You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

11. PLANTATIONS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

<strong>Sappi</strong> manages the establishment, maintenance and harvesting of its plantations on a<br />

compartmentalised basis. These comprise pulpwood and sawlogs and are managed in such a way so as to<br />

ensure that the optimum fibre balance is supplied to its paper and pulping operations in southern Africa.<br />

<strong>Sappi</strong> owns approximately 372,000 (<strong>20</strong>05: 373,000) hectares of plantation and directly and indirectly<br />

manages a further 174,000 (<strong>20</strong>05: 168,000) hectares. 398,000 (<strong>20</strong>05: 395,000) hectares of this land is<br />

forested with approximately 38,247,563 (<strong>20</strong>05: 38,885,000) standing tons of timber.<br />

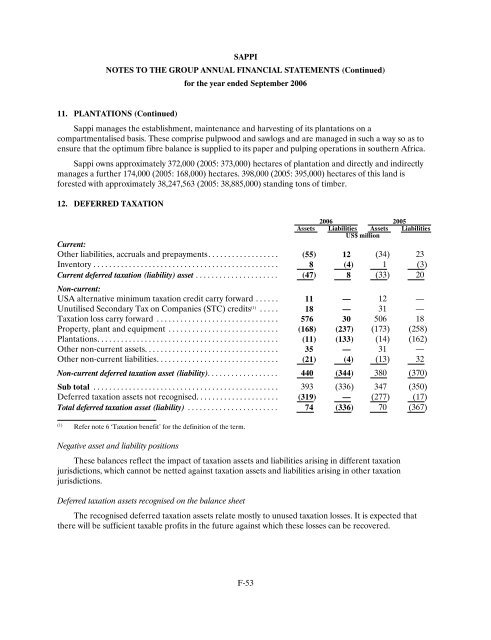

12. DEFERRED TAXATION<br />

F-53<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

Assets Liabilities Assets Liabilities<br />

US$ million<br />

Current:<br />

Other liabilities, accruals and prepayments.................. (55) 12 (34 ) 23<br />

Inventory............................................... 8 (4) 1 (3)<br />

Current deferred taxation (liability) asset ..................... (47) 8 (33 ) <strong>20</strong><br />

Non-current:<br />

USA alternative minimum taxation credit carry forward . . . . . . 11 — 12 —<br />

Unutilised Secondary Tax on Companies (STC) credits (1) ..... 18 — 31 —<br />

Taxation loss carry forward ............................... 576 30 506 18<br />

Property, plant and equipment ............................ (168) (237) (173 ) (258)<br />

Plantations.............................................. (11) (133) (14 ) (162)<br />

Other non-current assets.................................. 35 — 31 —<br />

Other non-current liabilities............................... (21) (4) (13 ) 32<br />

Non-current deferred taxation asset (liability).................. 440 (344) 380 (370)<br />

Sub total ............................................... 393 (336) 347 (350)<br />

Deferred taxation assets not recognised..................... (319) — (277 ) (17)<br />

Total deferred taxation asset (liability) ....................... 74 (336) 70 (367)<br />

(1) Refer note 6 ‘Taxation benefit’ for the definition of the term.<br />

Negative asset and liability positions<br />

These balances reflect the impact of taxation assets and liabilities arising in different taxation<br />

jurisdictions, which cannot be netted against taxation assets and liabilities arising in other taxation<br />

jurisdictions.<br />

Deferred taxation assets recognised on the balance sheet<br />

The recognised deferred taxation assets relate mostly to unused taxation losses. It is expected that<br />

there will be sufficient taxable profits in the future against which these losses can be recovered.