You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

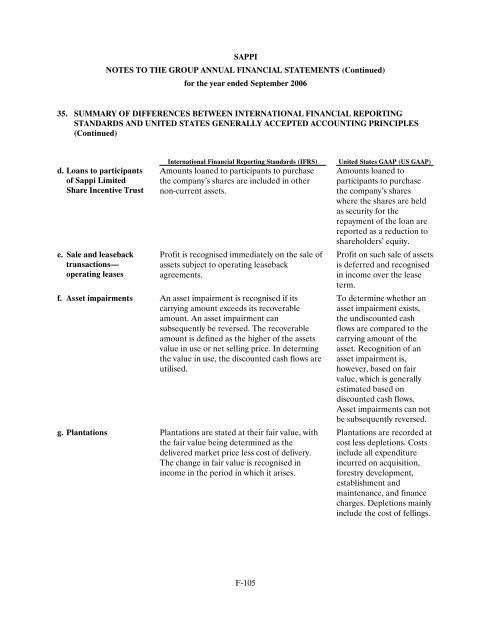

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

35. SUMMARY OF DIFFERENCES BETWEEN INTERNATIONAL FINANCIAL REPORTING<br />

STANDARDS AND UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES<br />

(Continued)<br />

d. Loans to participants<br />

of <strong>Sappi</strong> Limited<br />

Share Incentive Trust<br />

e. Sale and leaseback<br />

transactions—<br />

operating leases<br />

International Financial Reporting Standards (IFRS) United States GAAP (US GAAP)<br />

Amounts loaned to participants to purchase<br />

the company’s shares are included in other<br />

non-current assets.<br />

Profit is recognised immediately on the sale of<br />

assets subject to operating leaseback<br />

agreements.<br />

f. Asset impairments An asset impairment is recognised if its<br />

carrying amount exceeds its recoverable<br />

amount. An asset impairment can<br />

subsequently be reversed. The recoverable<br />

amount is defined as the higher of the assets<br />

value in use or net selling price. In determing<br />

the value in use, the discounted cash flows are<br />

utilised.<br />

g. Plantations Plantations are stated at their fair value, with<br />

the fair value being determined as the<br />

delivered market price less cost of delivery.<br />

The change in fair value is recognised in<br />

income in the period in which it arises.<br />

F-105<br />

Amounts loaned to<br />

participants to purchase<br />

the company’s shares<br />

where the shares are held<br />

as security for the<br />

repayment of the loan are<br />

reported as a reduction to<br />

shareholders’ equity.<br />

Profit on such sale of assets<br />

is deferred and recognised<br />

in income over the lease<br />

term.<br />

To determine whether an<br />

asset impairment exists,<br />

the undiscounted cash<br />

flows are compared to the<br />

carrying amount of the<br />

asset. Recognition of an<br />

asset impairment is,<br />

however, based on fair<br />

value, which is generally<br />

estimated based on<br />

discounted cash flows.<br />

Asset impairments can not<br />

be subsequently reversed.<br />

Plantations are recorded at<br />

cost less depletions. Costs<br />

include all expenditure<br />

incurred on acquisition,<br />

forestry development,<br />

establishment and<br />

maintenance, and finance<br />

charges. Depletions mainly<br />

include the cost of fellings.