You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

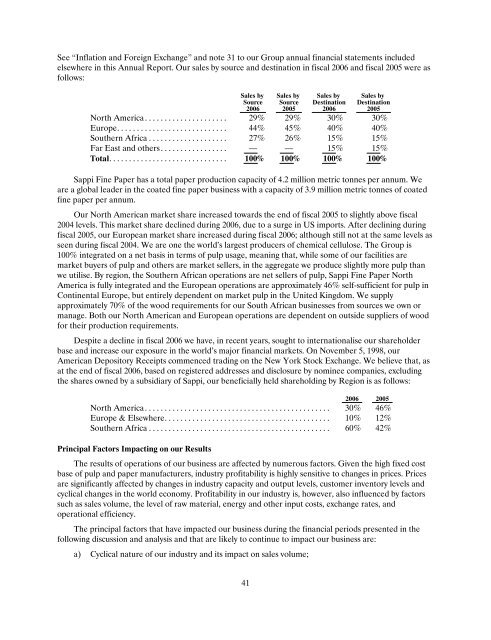

See “Inflation and Foreign Exchange” and note 31 to our Group annual financial statements included<br />

elsewhere in this Annual Report. Our sales by source and destination in fiscal <strong><strong>20</strong>06</strong> and fiscal <strong>20</strong>05 were as<br />

follows:<br />

Sales by<br />

Source<br />

<strong><strong>20</strong>06</strong><br />

41<br />

Sales by<br />

Source<br />

<strong>20</strong>05<br />

Sales by<br />

Destination<br />

<strong><strong>20</strong>06</strong><br />

Sales by<br />

Destination<br />

<strong>20</strong>05<br />

North America..................... 29% 29% 30% 30 %<br />

Europe............................ 44% 45% 40% 40 %<br />

Southern Africa.................... 27% 26% 15% 15 %<br />

Far East and others................. — — 15% 15 %<br />

Total.............................. 100% 100% 100% 100 %<br />

<strong>Sappi</strong> Fine Paper has a total paper production capacity of 4.2 million metric tonnes per annum. We<br />

are a global leader in the coated fine paper business with a capacity of 3.9 million metric tonnes of coated<br />

fine paper per annum.<br />

Our North American market share increased towards the end of fiscal <strong>20</strong>05 to slightly above fiscal<br />

<strong>20</strong>04 levels. This market share declined during <strong><strong>20</strong>06</strong>, due to a surge in US imports. After declining during<br />

fiscal <strong>20</strong>05, our European market share increased during fiscal <strong><strong>20</strong>06</strong>; although still not at the same levels as<br />

seen during fiscal <strong>20</strong>04. We are one the world’s largest producers of chemical cellulose. The Group is<br />

100% integrated on a net basis in terms of pulp usage, meaning that, while some of our facilities are<br />

market buyers of pulp and others are market sellers, in the aggregate we produce slightly more pulp than<br />

we utilise. By region, the Southern African operations are net sellers of pulp, <strong>Sappi</strong> Fine Paper North<br />

America is fully integrated and the European operations are approximately 46% self-sufficient for pulp in<br />

Continental Europe, but entirely dependent on market pulp in the United Kingdom. We supply<br />

approximately 70% of the wood requirements for our South African businesses from sources we own or<br />

manage. Both our North American and European operations are dependent on outside suppliers of wood<br />

for their production requirements.<br />

Despite a decline in fiscal <strong><strong>20</strong>06</strong> we have, in recent years, sought to internationalise our shareholder<br />

base and increase our exposure in the world’s major financial markets. On November 5, 1998, our<br />

American Depository Receipts commenced trading on the New York Stock Exchange. We believe that, as<br />

at the end of fiscal <strong><strong>20</strong>06</strong>, based on registered addresses and disclosure by nominee companies, excluding<br />

the shares owned by a subsidiary of <strong>Sappi</strong>, our beneficially held shareholding by Region is as follows:<br />

North America............................................... 30%<br />

Europe & Elsewhere.......................................... 10%<br />

Southern Africa.............................................. 60%<br />

Principal Factors Impacting on our Results<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

46 %<br />

12 %<br />

42 %<br />

The results of operations of our business are affected by numerous factors. Given the high fixed cost<br />

base of pulp and paper manufacturers, industry profitability is highly sensitive to changes in prices. Prices<br />

are significantly affected by changes in industry capacity and output levels, customer inventory levels and<br />

cyclical changes in the world economy. Profitability in our industry is, however, also influenced by factors<br />

such as sales volume, the level of raw material, energy and other input costs, exchange rates, and<br />

operational efficiency.<br />

The principal factors that have impacted our business during the financial periods presented in the<br />

following discussion and analysis and that are likely to continue to impact our business are:<br />

a) Cyclical nature of our industry and its impact on sales volume;