Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

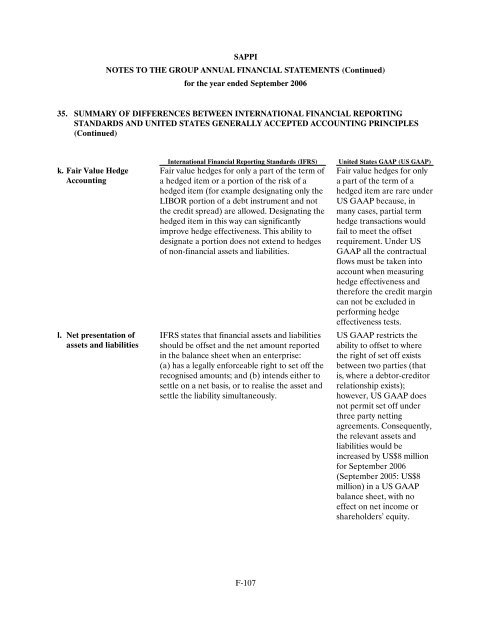

35. SUMMARY OF DIFFERENCES BETWEEN INTERNATIONAL FINANCIAL REPORTING<br />

STANDARDS AND UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES<br />

(Continued)<br />

k. Fair Value Hedge<br />

Accounting<br />

l. Net presentation of<br />

assets and liabilities<br />

International Financial Reporting Standards (IFRS) United States GAAP (US GAAP)<br />

Fair value hedges for only a part of the term of<br />

a hedged item or a portion of the risk of a<br />

hedged item (for example designating only the<br />

LIBOR portion of a debt instrument and not<br />

the credit spread) are allowed. Designating the<br />

hedged item in this way can significantly<br />

improve hedge effectiveness. This ability to<br />

designate a portion does not extend to hedges<br />

of non-financial assets and liabilities.<br />

IFRS states that financial assets and liabilities<br />

should be offset and the net amount reported<br />

in the balance sheet when an enterprise:<br />

(a) has a legally enforceable right to set off the<br />

recognised amounts; and (b) intends either to<br />

settle on a net basis, or to realise the asset and<br />

settle the liability simultaneously.<br />

F-107<br />

Fair value hedges for only<br />

a part of the term of a<br />

hedged item are rare under<br />

US GAAP because, in<br />

many cases, partial term<br />

hedge transactions would<br />

fail to meet the offset<br />

requirement. Under US<br />

GAAP all the contractual<br />

flows must be taken into<br />

account when measuring<br />

hedge effectiveness and<br />

therefore the credit margin<br />

can not be excluded in<br />

performing hedge<br />

effectiveness tests.<br />

US GAAP restricts the<br />

ability to offset to where<br />

the right of set off exists<br />

between two parties (that<br />

is, where a debtor-creditor<br />

relationship exists);<br />

however, US GAAP does<br />

not permit set off under<br />

three party netting<br />

agreements. Consequently,<br />

the relevant assets and<br />

liabilities would be<br />

increased by US$8 million<br />

for September <strong><strong>20</strong>06</strong><br />

(September <strong>20</strong>05: US$8<br />

million) in a US GAAP<br />

balance sheet, with no<br />

effect on net income or<br />

shareholders’ equity.