Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

39. DIRECTORS’ PARTICIPATION IN THE SAPPI LIMITED SHARE INCENTIVE TRUST AND PERFORMANCE SHARE INCENTIVE<br />

PLAN<br />

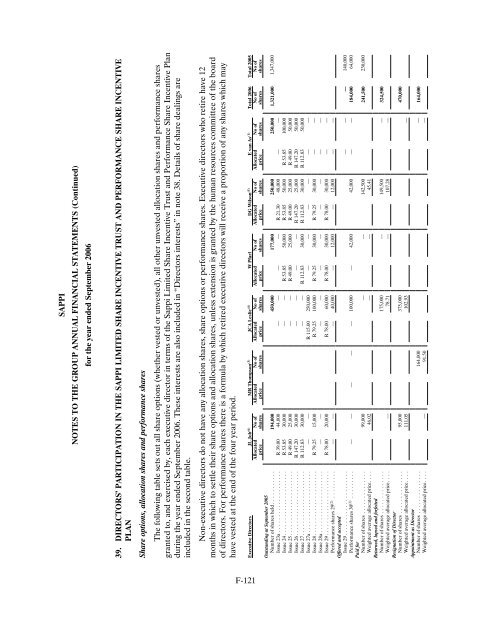

Share options, allocation shares and performance shares<br />

The following table sets out all share options (whether vested or unvested), all other unvested allocation shares and performance shares<br />

granted to, and exercised by, each executive director in terms of the <strong>Sappi</strong> Limited Share Incentive Trust and Performance Share Incentive Plan<br />

during the year ended September <strong><strong>20</strong>06</strong>. These interests are also included in “Directors interests” in note 38. Details of share dealings are<br />

included in the second table.<br />

Non-executive directors do not have any allocation shares, share options or performance shares. Executive directors who retire have 12<br />

months in which to settle their share options and allocation shares, unless extension is granted by the human resources committee of the board<br />

of directors. For performance shares there is a formula by which retired executive directors will receive a proportion of any shares which may<br />

have vested at the end of the four year period.<br />

Executive Directors JL Job (6) MR Thompson (3) JCA Leslie (4) W Pfarl DG Wilson (5) E van As (1) Total <strong><strong>20</strong>06</strong> Total <strong>20</strong>05<br />

Allocated No of Allocated No of Allocated No of Allocated No of Allocated No of Allocated No of No of No of<br />

price shares price shares price shares price shares price shares price shares shares shares<br />

Outstanding at September <strong>20</strong>05<br />

Number of shares held........... 194,000 450,000 177,000 250,000 250,000 1,321,000 1,347,000<br />

Issue 23a.................... R 39.00 44,000 — — — — R 21.30 48,000 — —<br />

Issue 24..................... R 53.85 30,000 — — R 53.85 50,000 R 53.85 50,000 R 53.85 100,000<br />

Issue 25..................... R 49.00 25,000 — — R 49.00 25,000 R 49.00 25,000 R 49.00 50,000<br />

Issue 26..................... R 147.<strong>20</strong> 30,000 — — — — R 147.<strong>20</strong> 25,000 R 147.<strong>20</strong> 50,000<br />

Issue 27..................... R 112.83 30,000 — — R 112.83 30,000 R 112.83 30,000 R 112.83 50,000<br />

Issue 27a.................... — — R 115.00 250,000 — — — — — —<br />

Issue 28..................... R 79.25 15,000 R 79.25 100,000 R 79.25 30,000 R 79.25 30,000 — —<br />

Issue 28a.................... — — — — — — — — — —<br />

Issue 29..................... R 78.00 <strong>20</strong>,000 R 78.00 60,000 R 78.00 30,000 R 78.00 30,000 — —<br />

Performance shares 29 (2) ......... — — — 40,000 — 12,000 — 12,000 — —<br />

Offered and accepted<br />

Issue 29..................... — — — 140,000<br />

Performance shares 30 (2) ......... — — — — — 100,000 — 42,000 42,000 — — 184,000 64,000<br />

Paid for<br />

Number of shares.............. 99,000 — — 142,500 241,500 230,000<br />

Weighted average allocated price.... 46.02 — — 45.41<br />

Returned, lapsed and forfeited<br />

Number of shares.............. 175,000 — 149,500 — 324,500<br />

Weighted average allocated price.... — 78.71 — 107.28 —<br />

Resignation of Director<br />

Number of shares.............. 95,000 375,000 470,000<br />

Weighted average allocated price.... 111.05 102.93 —<br />

Appointment as Director<br />

Number of shares.............. 164,000 — 164,000<br />

Weighted average allocated price.... — 91.50 —<br />

F-121