You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

impact on liquidity varies according to the terms of the agreement; generally however, future trade<br />

receivables would be recorded on balance sheet until a replacement agreement was entered into.<br />

An impairment of accounts receivable has been recorded for any receivables which may be uncollectable.<br />

The determination of this allowance is restricted to the 15% risk retained by <strong>Sappi</strong>.<br />

Equity Accounted Investment. In 1998, our interests in timberlands located in Maine and certain<br />

equipment and machinery were sold to a third party timber company, Plum Creek Timberlands LLP, in<br />

exchange for cash of US$3 million and three promissory notes receivable in the aggregate amount of<br />

US$171 million. In 1999, the Company contributed these promissory notes to a special purpose entity<br />

(“SPE”). The promissory notes were pledged as collateral for the SPE to issue bonds to investors in the<br />

amount of US$156 million. In <strong>20</strong>01, the Company contributed its interest in the SPE to a limited liability<br />

company in exchange for 90% of the outstanding limited liability membership interest. All voting control<br />

of the limited liability company is controlled by an unrelated investor that has significant capital at risk and<br />

therefore has not been consolidated by the Company in its financial statements. The SPE is not<br />

consolidated in our financial statements because we have taken the position that it is controlled by an<br />

unrelated investor which has sufficient equity capital at risk to support such a position. The Company’s<br />

investment in the SPE is US$19 million as of October 1, <strong><strong>20</strong>06</strong>.<br />

The SPE may not be liquidated prior to repayment of the bonds it issued, which mature in three<br />

tranches on February 11, <strong>20</strong>07, February 11, <strong>20</strong>09, and February 11, <strong>20</strong>11. The Company may not redeem<br />

its investment in the SPE (via its ownership interest in the limited liability company) prior to complete<br />

repayment of the bonds issued by the SPE and our investment has a subordinate interest to the payment of<br />

the outstanding bonds. We have not guaranteed the obligations of the SPE and the holders of the notes<br />

payable issued by the SPE have no recourse to us.<br />

The SPE is bankruptcy remote and serves to protect the investors in the notes from any credit risk<br />

relating to <strong>Sappi</strong> Limited by isolating cash flows from the Plum Creek notes receivable. The structure was<br />

set up to raise funding using the promissory notes as collateral in a manner that would not result in either<br />

debt or the Plum Creek Timberlands LLP notes being reflected on balance sheet. This would not be the<br />

case if we monetised the promissory notes through an issuance of secured notes directly or by an entity that<br />

was required to be consolidated in our financial statements under the applicable accounting principles.<br />

Capital Expenditures<br />

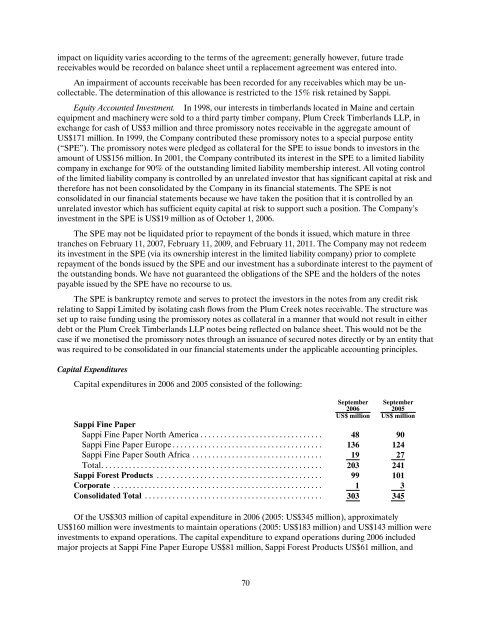

Capital expenditures in <strong><strong>20</strong>06</strong> and <strong>20</strong>05 consisted of the following:<br />

70<br />

September<br />

<strong><strong>20</strong>06</strong> September<br />

<strong>20</strong>05<br />

US$ million US$ million<br />

<strong>Sappi</strong> Fine Paper<br />

<strong>Sappi</strong> Fine Paper North America............................... 48 90<br />

<strong>Sappi</strong> Fine Paper Europe...................................... 136 124<br />

<strong>Sappi</strong> Fine Paper South Africa................................. 19 27<br />

Total........................................................ <strong>20</strong>3 241<br />

<strong>Sappi</strong> Forest Products .......................................... 99 101<br />

Corporate ..................................................... 1 3<br />

Consolidated Total ............................................. 303 345<br />

Of the US$303 million of capital expenditure in <strong><strong>20</strong>06</strong> (<strong>20</strong>05: US$345 million), approximately<br />

US$160 million were investments to maintain operations (<strong>20</strong>05: US$183 million) and US$143 million were<br />

investments to expand operations. The capital expenditure to expand operations during <strong><strong>20</strong>06</strong> included<br />

major projects at <strong>Sappi</strong> Fine Paper Europe US$81 million, <strong>Sappi</strong> Forest Products US$61 million, and