You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

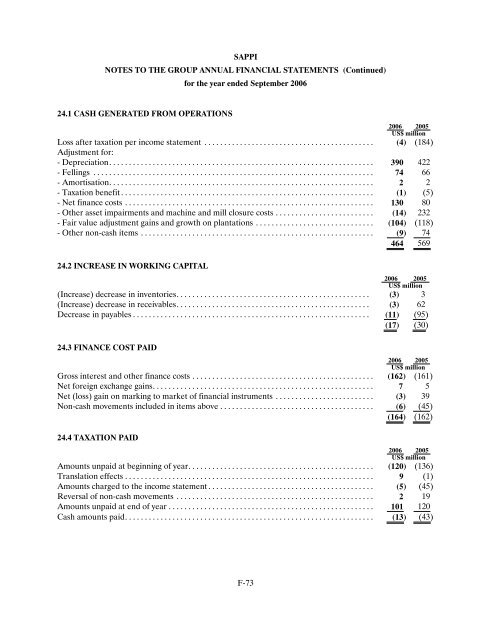

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

24.1 CASH GENERATED FROM OPERATIONS<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

Loss after taxation per income statement ........................................... (4 ) (184)<br />

Adjustment for:<br />

- Depreciation................................................................... 390 422<br />

- Fellings ....................................................................... 74 66<br />

- Amortisation................................................................... 2 2<br />

- Taxation benefit................................................................ (1 ) (5)<br />

- Net finance costs............................................................... 130 80<br />

- Other asset impairments and machine and mill closure costs......................... (14 ) 232<br />

- Fair value adjustment gains and growth on plantations .............................. (104 ) (118)<br />

- Other non-cash items ........................................................... (9 ) 74<br />

464 569<br />

24.2 INCREASE IN WORKING CAPITAL<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

(Increase) decrease in inventories................................................. (3 ) 3<br />

(Increase) decrease in receivables................................................. (3 ) 62<br />

Decrease in payables............................................................ (11 ) (95)<br />

(17 ) (30)<br />

24.3 FINANCE COST PAID<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

Gross interest and other finance costs.............................................. (162 ) (161)<br />

Net foreign exchange gains........................................................ 7 5<br />

Net (loss) gain on marking to market of financial instruments ......................... (3 ) 39<br />

Non-cash movements included in items above....................................... (6 ) (45)<br />

(164 ) (162)<br />

24.4 TAXATION PAID<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

Amounts unpaid at beginning of year............................................... (1<strong>20</strong> ) (136)<br />

Translation effects............................................................... 9 (1)<br />

Amounts charged to the income statement.......................................... (5 ) (45)<br />

Reversal of non-cash movements .................................................. 2 19<br />

Amounts unpaid at end of year.................................................... 101 1<strong>20</strong><br />

Cash amounts paid............................................................... (13 ) (43)<br />

F-73