You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

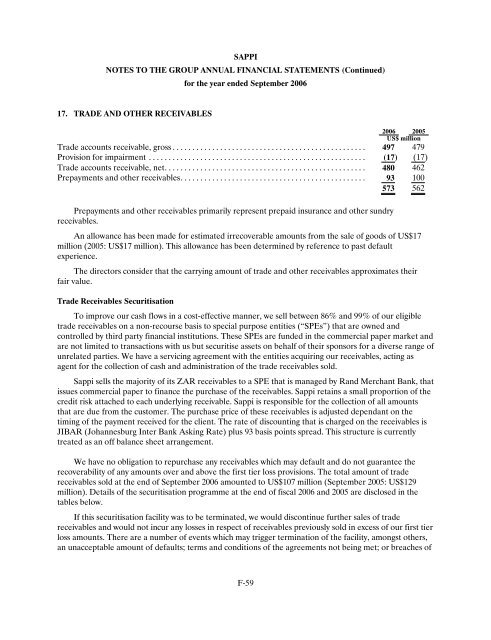

17. TRADE AND OTHER RECEIVABLES<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

Trade accounts receivable, gross................................................. 497 479<br />

Provision for impairment....................................................... (17 ) (17)<br />

Trade accounts receivable, net................................................... 480 462<br />

Prepayments and other receivables............................................... 93 100<br />

573 562<br />

Prepayments and other receivables primarily represent prepaid insurance and other sundry<br />

receivables.<br />

An allowance has been made for estimated irrecoverable amounts from the sale of goods of US$17<br />

million (<strong>20</strong>05: US$17 million). This allowance has been determined by reference to past default<br />

experience.<br />

The directors consider that the carrying amount of trade and other receivables approximates their<br />

fair value.<br />

Trade Receivables Securitisation<br />

To improve our cash flows in a cost-effective manner, we sell between 86% and 99% of our eligible<br />

trade receivables on a non-recourse basis to special purpose entities (“SPEs”) that are owned and<br />

controlled by third party financial institutions. These SPEs are funded in the commercial paper market and<br />

are not limited to transactions with us but securitise assets on behalf of their sponsors for a diverse range of<br />

unrelated parties. We have a servicing agreement with the entities acquiring our receivables, acting as<br />

agent for the collection of cash and administration of the trade receivables sold.<br />

<strong>Sappi</strong> sells the majority of its ZAR receivables to a SPE that is managed by Rand Merchant Bank, that<br />

issues commercial paper to finance the purchase of the receivables. <strong>Sappi</strong> retains a small proportion of the<br />

credit risk attached to each underlying receivable. <strong>Sappi</strong> is responsible for the collection of all amounts<br />

that are due from the customer. The purchase price of these receivables is adjusted dependant on the<br />

timing of the payment received for the client. The rate of discounting that is charged on the receivables is<br />

JIBAR (Johannesburg Inter Bank Asking Rate) plus 93 basis points spread. This structure is currently<br />

treated as an off balance sheet arrangement.<br />

We have no obligation to repurchase any receivables which may default and do not guarantee the<br />

recoverability of any amounts over and above the first tier loss provisions. The total amount of trade<br />

receivables sold at the end of September <strong><strong>20</strong>06</strong> amounted to US$107 million (September <strong>20</strong>05: US$129<br />

million). Details of the securitisation programme at the end of fiscal <strong><strong>20</strong>06</strong> and <strong>20</strong>05 are disclosed in the<br />

tables below.<br />

If this securitisation facility was to be terminated, we would discontinue further sales of trade<br />

receivables and would not incur any losses in respect of receivables previously sold in excess of our first tier<br />

loss amounts. There are a number of events which may trigger termination of the facility, amongst others,<br />

an unacceptable amount of defaults; terms and conditions of the agreements not being met; or breaches of<br />

F-59