Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

28. POST-EMPLOYMENT BENEFITS—PENSIONS (Continued)<br />

rate by 1% would increase the projected benefit obligation by US$256 million and US$46 million<br />

respectively.<br />

F-80<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

US$ million<br />

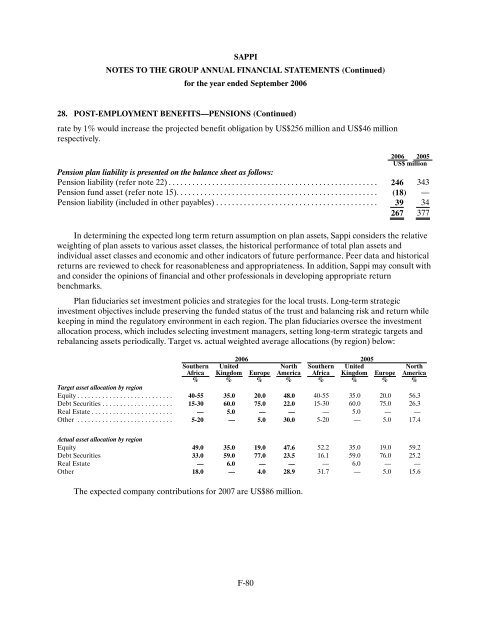

Pension plan liability is presented on the balance sheet as follows:<br />

Pension liability (refer note 22)..................................................... 246 343<br />

Pension fund asset (refer note 15)................................................... (18 ) —<br />

Pension liability (included in other payables)......................................... 39 34<br />

267 377<br />

In determining the expected long term return assumption on plan assets, <strong>Sappi</strong> considers the relative<br />

weighting of plan assets to various asset classes, the historical performance of total plan assets and<br />

individual asset classes and economic and other indicators of future performance. Peer data and historical<br />

returns are reviewed to check for reasonableness and appropriateness. In addition, <strong>Sappi</strong> may consult with<br />

and consider the opinions of financial and other professionals in developing appropriate return<br />

benchmarks.<br />

Plan fiduciaries set investment policies and strategies for the local trusts. Long-term strategic<br />

investment objectives include preserving the funded status of the trust and balancing risk and return while<br />

keeping in mind the regulatory environment in each region. The plan fiduciaries oversee the investment<br />

allocation process, which includes selecting investment managers, setting long-term strategic targets and<br />

rebalancing assets periodically. Target vs. actual weighted average allocations (by region) below:<br />

<strong><strong>20</strong>06</strong> <strong>20</strong>05<br />

Southern United<br />

North Southern United<br />

North<br />

Africa Kingdom Europe America Africa Kingdom Europe America<br />

% % % % % % % %<br />

Target asset allocation by region<br />

Equity........................... 40-55 35.0 <strong>20</strong>.0 48.0 40-55 35.0 <strong>20</strong>.0 56.3<br />

Debt Securities.................... 15-30 60.0 75.0 22.0 15-30 60.0 75.0 26.3<br />

Real Estate....................... — 5.0 — — — 5.0 — —<br />

Other ........................... 5-<strong>20</strong> — 5.0 30.0 5-<strong>20</strong> — 5.0 17.4<br />

Actual asset allocation by region<br />

Equity 49.0 35.0 19.0 47.6 52.2 35.0 19.0 59.2<br />

Debt Securities 33.0 59.0 77.0 23.5 16.1 59.0 76.0 25.2<br />

Real Estate — 6.0 — — — 6.0 — —<br />

Other 18.0 — 4.0 28.9 31.7 — 5.0 15.6<br />

The expected company contributions for <strong>20</strong>07 are US$86 million.