You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

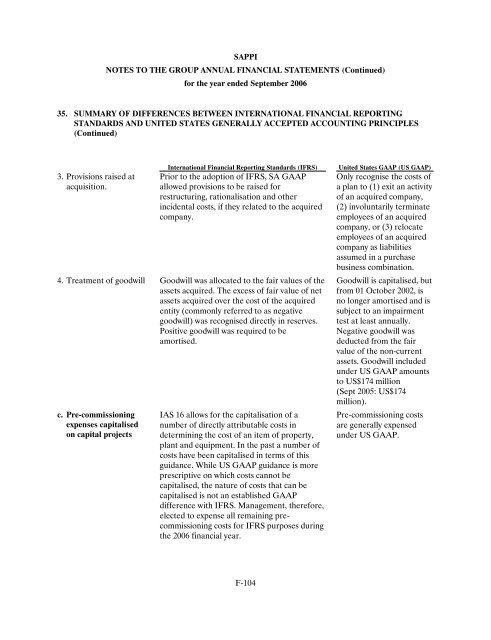

SAPPI<br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September <strong><strong>20</strong>06</strong><br />

35. SUMMARY OF DIFFERENCES BETWEEN INTERNATIONAL FINANCIAL REPORTING<br />

STANDARDS AND UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES<br />

(Continued)<br />

3. Provisions raised at<br />

acquisition.<br />

International Financial Reporting Standards (IFRS) United States GAAP (US GAAP)<br />

Prior to the adoption of IFRS, SA GAAP<br />

allowed provisions to be raised for<br />

restructuring, rationalisation and other<br />

incidental costs, if they related to the acquired<br />

company.<br />

4. Treatment of goodwill Goodwill was allocated to the fair values of the<br />

assets acquired. The excess of fair value of net<br />

assets acquired over the cost of the acquired<br />

entity (commonly referred to as negative<br />

goodwill) was recognised directly in reserves.<br />

Positive goodwill was required to be<br />

amortised.<br />

c. Pre-commissioning<br />

expenses capitalised<br />

on capital projects<br />

IAS 16 allows for the capitalisation of a<br />

number of directly attributable costs in<br />

determining the cost of an item of property,<br />

plant and equipment. In the past a number of<br />

costs have been capitalised in terms of this<br />

guidance. While US GAAP guidance is more<br />

prescriptive on which costs cannot be<br />

capitalised, the nature of costs that can be<br />

capitalised is not an established GAAP<br />

difference with IFRS. Management, therefore,<br />

elected to expense all remaining precommissioning<br />

costs for IFRS purposes during<br />

the <strong><strong>20</strong>06</strong> financial year.<br />

F-104<br />

Only recognise the costs of<br />

a plan to (1) exit an activity<br />

of an acquired company,<br />

(2) involuntarily terminate<br />

employees of an acquired<br />

company, or (3) relocate<br />

employees of an acquired<br />

company as liabilities<br />

assumed in a purchase<br />

business combination.<br />

Goodwill is capitalised, but<br />

from 01 October <strong>20</strong>02, is<br />

no longer amortised and is<br />

subject to an impairment<br />

test at least annually.<br />

Negative goodwill was<br />

deducted from the fair<br />

value of the non-current<br />

assets. Goodwill included<br />

under US GAAP amounts<br />

to US$174 million<br />

(Sept <strong>20</strong>05: US$174<br />

million).<br />

Pre-commissioning costs<br />

are generally expensed<br />

under US GAAP.