Table of Contents

Research Journal of Social Science & Management - RJSSM - The ...

Research Journal of Social Science & Management - RJSSM - The ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

[4] R. Ball and P. Brown. "An empirical evaluation <strong>of</strong><br />

accounting income numbers", Journal <strong>of</strong> Accounting<br />

Research, Vol.6, No.2, pp.159-178, 1968.<br />

[5] V.L. Bernard and J. Thomas. "Evidence that stock<br />

prices do not fully reflect the implications <strong>of</strong> current<br />

earnings for future earnings", Journal <strong>of</strong> Accounting and<br />

Economics, Vol.13, No.4, pp. 305-340, 1990.<br />

[6] J.A. Ohlson. Financial ratios and the probabilistic<br />

prediction <strong>of</strong> bankruptcy. Journal <strong>of</strong> Accounting Research,<br />

Vol.18, No.1, pp.109-131, Spring-1980.<br />

[8] B. Lev and R.Thigarajan. Fundamental information<br />

analysis. Journal <strong>of</strong> Accounting Research, Vol.31, No.2,<br />

pp.190-215, Autumn 1993.<br />

[9] H. Manao and D. Nur. Asosiasi rasio keuangan<br />

dengan return saham: pertimbangan ukuran perusahaan serta<br />

pengaruh krisis ekonomi di indonesia. Simposium Nasional<br />

Akuntansi, No.4, 2001.<br />

[10] S.Sparta and F. Februwaty. Pengaruh ROE, EPS,<br />

OCF terhadap harga saham industri manufacturing di bursa<br />

efek jakarta. Jurnal Akuntansi, Vol.9, No.1, January 2005.<br />

[7] N. Daniati and D.Suhairi. Pengaruh kandungan<br />

informasi komponen laporan arus kas, laba kotor, dan size<br />

perusahaan terhadap expected return saham (survey pada<br />

industri textile dan automotive yang terdaftar di BEJ).<br />

Padang: Simposium Nasional Akuntansi, No.9, pp.23-25,<br />

2006.<br />

[11] R.G. Mais. Pengaruh rasio-rasio keuangan utama<br />

perusahaan terhadap harga saham perusahaan yang terdaftar<br />

di jakarta islamic index tahun 2004. Jurnal Ekonomi STEI,<br />

Vol.14, No.3, p.30, July-September, 2005.<br />

Annexure<br />

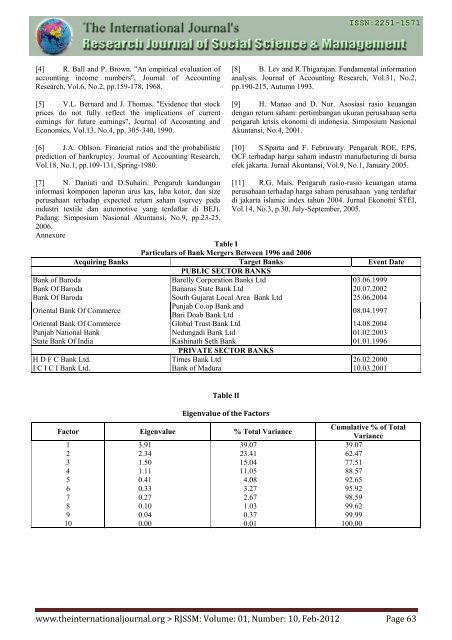

<strong>Table</strong> I<br />

Particulars <strong>of</strong> Bank Mergers Between 1996 and 2006<br />

Acquiring Banks Target Banks Event Date<br />

PUBLIC SECTOR BANKS<br />

Bank <strong>of</strong> Baroda Barelly Corporation Banks Ltd 03.06.1999<br />

Bank Of Baroda Banaras State Bank Ltd 20.07.2002<br />

Bank Of Baroda South Gujarat Local Area Bank Ltd 25.06.2004<br />

Oriental Bank Of Commerce<br />

Punjab Co.op Bank and<br />

Bari Doab Bank Ltd<br />

08.04.1997<br />

Oriental Bank Of Commerce Global Trust Bank Ltd 14.08.2004<br />

Punjab National Bank Nedungadi Bank Ltd 01.02.2003<br />

State Bank Of India Kashinath Seth Bank 01.01.1996<br />

PRIVATE SECTOR BANKS<br />

H D F C Bank Ltd. Times Bank Ltd 26.02.2000<br />

I C I C I Bank Ltd. Bank <strong>of</strong> Madura 10.03.2001<br />

<strong>Table</strong> II<br />

Eigenvalue <strong>of</strong> the Factors<br />

Factor Eigenvalue % Total Variance<br />

Cumulative % <strong>of</strong> Total<br />

Variance<br />

1 3.91 39.07 39.07<br />

2 2.34 23.41 62.47<br />

3 1.50 15.04 77.51<br />

4 1.11 11.05 88.57<br />

5 0.41 4.08 92.65<br />

6 0.33 3.27 95.92<br />

7 0.27 2.67 98.59<br />

8 0.10 1.03 99.62<br />

9 0.04 0.37 99.99<br />

10 0.00 0.01 100.00<br />

www.theinternationaljournal.org > RJSSM: Volume: 01, Number: 10, Feb-2012 Page 63