Table of Contents

Research Journal of Social Science & Management - RJSSM - The ...

Research Journal of Social Science & Management - RJSSM - The ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In phase 6, the validation will be conducted to<br />

assess the efficiency, the practicality and reliability <strong>of</strong> the<br />

program and identify areas for further improvement.<br />

FRAUD DETERRENCE MODEL<br />

Identification <strong>of</strong> the risk factors causing fraudulent<br />

activities in the organization in Thailand was carried out<br />

using a quantitative research which represented the attitude<br />

<strong>of</strong> the participants in the survey. However, it cannot be<br />

concluded that a person displaying such characteristics will<br />

commit fraud. Hence, the association rule is more<br />

appropriate to be used to find out the important rules for<br />

fraud potential to occur in association with each fraud risk<br />

factor [19] [20] [28] [30] [32].<br />

POTENTIAL FRAUD RISK BEHAVIORS<br />

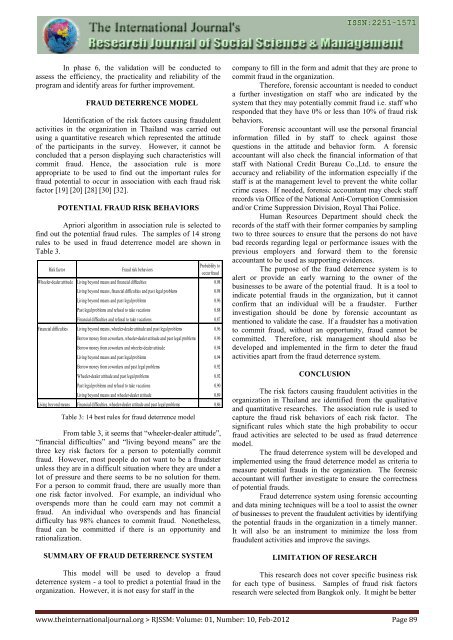

Apriori algorithm in association rule is selected to<br />

find out the potential fraud rules. The samples <strong>of</strong> 14 strong<br />

rules to be used in fraud deterrence model are shown in<br />

<strong>Table</strong> 3.<br />

Risk factor<br />

Fraud risk behaviors<br />

<strong>Table</strong> 3: 14 best rules for fraud deterrence model<br />

Probability to<br />

occur fraud<br />

Wheeler-dealer attitude Living beyond means and financial difficulties 0.98<br />

Living beyond means, financial difficulties and past legal problems 0.98<br />

Living beyond means and past legal problems 0.96<br />

Past legal problems and refusal to take vacations 0.88<br />

Financial difficulties and refusal to take vacations 0.87<br />

Financial difficulties Living beyond means, wheeler-dealer attitude and past legal problems 0.96<br />

Borrow money from coworkers, wheeler-dealer attitude and past legal problems 0.96<br />

Borrow money from coworkers and wheeler-dealer attitude 0.94<br />

Living beyond means and past legal problems 0.94<br />

Borrow money from coworkers and past legal problems 0.92<br />

Wheeler-dealer attitude and past legal problems 0.92<br />

Past legal problems and refusal to take vacations 0.90<br />

Living beyond means and wheeler-dealer attitude 0.89<br />

Living beyond means Financial difficulties, wheeler-dealer attitude and past legal problems 0.86<br />

From table 3, it seems that “wheeler-dealer attitude”,<br />

“financial difficulties” and “living beyond means” are the<br />

three key risk factors for a person to potentially commit<br />

fraud. However, most people do not want to be a fraudster<br />

unless they are in a difficult situation where they are under a<br />

lot <strong>of</strong> pressure and there seems to be no solution for them.<br />

For a person to commit fraud, there are usually more than<br />

one risk factor involved. For example, an individual who<br />

overspends more than he could earn may not commit a<br />

fraud. An individual who overspends and has financial<br />

difficulty has 98% chances to commit fraud. Nonetheless,<br />

fraud can be committed if there is an opportunity and<br />

rationalization.<br />

SUMMARY OF FRAUD DETERRENCE SYSTEM<br />

This model will be used to develop a fraud<br />

deterrence system - a tool to predict a potential fraud in the<br />

organization. However, it is not easy for staff in the<br />

company to fill in the form and admit that they are prone to<br />

commit fraud in the organization.<br />

Therefore, forensic accountant is needed to conduct<br />

a further investigation on staff who are indicated by the<br />

system that they may potentially commit fraud i.e. staff who<br />

responded that they have 0% or less than 10% <strong>of</strong> fraud risk<br />

behaviors.<br />

Forensic accountant will use the personal financial<br />

information filled in by staff to check against those<br />

questions in the attitude and behavior form. A forensic<br />

accountant will also check the financial information <strong>of</strong> that<br />

staff with National Credit Bureau Co.,Ltd. to ensure the<br />

accuracy and reliability <strong>of</strong> the information especially if the<br />

staff is at the management level to prevent the white collar<br />

crime cases. If needed, forensic accountant may check staff<br />

records via Office <strong>of</strong> the National Anti-Corruption Commission<br />

and/or Crime Suppression Division, Royal Thai Police.<br />

Human Resources Department should check the<br />

records <strong>of</strong> the staff with their former companies by sampling<br />

two to three sources to ensure that the persons do not have<br />

bad records regarding legal or performance issues with the<br />

previous employers and forward them to the forensic<br />

accountant to be used as supporting evidences.<br />

The purpose <strong>of</strong> the fraud deterrence system is to<br />

alert or provide an early warning to the owner <strong>of</strong> the<br />

businesses to be aware <strong>of</strong> the potential fraud. It is a tool to<br />

indicate potential frauds in the organization, but it cannot<br />

confirm that an individual will be a fraudster. Further<br />

investigation should be done by forensic accountant as<br />

mentioned to validate the case. If a fraudster has a motivation<br />

to commit fraud, without an opportunity, fraud cannot be<br />

committed. Therefore, risk management should also be<br />

developed and implemented in the firm to deter the fraud<br />

activities apart from the fraud deterrence system.<br />

CONCLUSION<br />

The risk factors causing fraudulent activities in the<br />

organization in Thailand are identified from the qualitative<br />

and quantitative researches. The association rule is used to<br />

capture the fraud risk behaviors <strong>of</strong> each risk factor. The<br />

significant rules which state the high probability to occur<br />

fraud activities are selected to be used as fraud deterrence<br />

model.<br />

The fraud deterrence system will be developed and<br />

implemented using the fraud deterrence model as criteria to<br />

measure potential frauds in the organization. The forensic<br />

accountant will further investigate to ensure the correctness<br />

<strong>of</strong> potential frauds.<br />

Fraud deterrence system using forensic accounting<br />

and data mining techniques will be a tool to assist the owner<br />

<strong>of</strong> businesses to prevent the fraudulent activities by identifying<br />

the potential frauds in the organization in a timely manner.<br />

It will also be an instrument to minimize the loss from<br />

fraudulent activities and improve the savings.<br />

LIMITATION OF RESEARCH<br />

This research does not cover specific business risk<br />

for each type <strong>of</strong> business. Samples <strong>of</strong> fraud risk factors<br />

research were selected from Bangkok only. It might be better<br />

www.theinternationaljournal.org > RJSSM: Volume: 01, Number: 10, Feb-2012 Page 89