Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

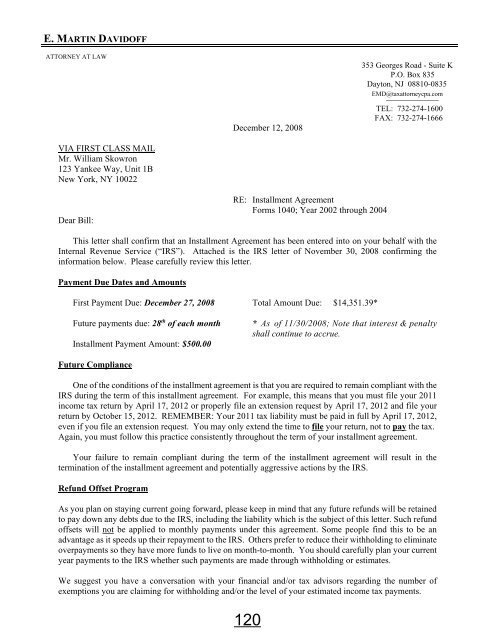

E. MARTIN DAVIDOFF<br />

ATTORNEY AT LAW<br />

<strong>December</strong> 12, 2008<br />

353 Georges Road - Suite K<br />

P.O. Box 835<br />

Dayton, NJ 08810-0835<br />

EMD@taxattorneycpa.com<br />

_____________<br />

TEL: 732-274-1600<br />

FAX: 732-274-1666<br />

VIA FIRST CLASS MAIL<br />

Mr. William Skowron<br />

123 Yankee Way, Unit 1B<br />

New York, NY 10022<br />

Dear Bill:<br />

RE: Installment Agreement<br />

Forms 1040; Year 2002 through 2004<br />

This letter shall confirm that an Installment Agreement has been entered into on your behalf with the<br />

Internal Revenue Service (“IRS”). Attached is the IRS letter of November 30, 2008 confirming the<br />

information below. Please carefully review this letter.<br />

Payment Due Dates and Amounts<br />

First Payment Due: <strong>December</strong> 27, 2008 Total Amount Due: $14,351.39*<br />

Future payments due: 28 th of each month<br />

Installment Payment Amount: $500.00<br />

* As of 11/30/2008; Note that interest & penalty<br />

shall continue to accrue.<br />

Future Compliance<br />

One of the conditions of the installment agreement is that you are required to remain compliant with the<br />

IRS during the term of this installment agreement. For example, this means that you must file your 2011<br />

income tax return by April 17, <strong>2012</strong> or properly file an extension request by April 17, <strong>2012</strong> and file your<br />

return by October 15, <strong>2012</strong>. REMEMBER: Your 2011 tax liability must be paid in full by April 17, <strong>2012</strong>,<br />

even if you file an extension request. You may only extend the time to file your return, not to pay the tax.<br />

Again, you must follow this practice consistently throughout the term of your installment agreement.<br />

Your failure to remain compliant during the term of the installment agreement will result in the<br />

termination of the installment agreement and potentially aggressive actions by the IRS.<br />

Refund Offset Program<br />

As you plan on staying current going forward, please keep in mind that any future refunds will be retained<br />

to pay down any debts due to the IRS, including the liability which is the subject of this letter. Such refund<br />

offsets will not be applied to monthly payments under this agreement. Some people find this to be an<br />

advantage as it speeds up their repayment to the IRS. Others prefer to reduce their withholding to eliminate<br />

overpayments so they have more funds to live on month-to-month. You should carefully plan your current<br />

year payments to the IRS whether such payments are made through withholding or estimates.<br />

We suggest you have a conversation with your financial and/or tax advisors regarding the number of<br />

exemptions you are claiming for withholding and/or the level of your estimated income tax payments.<br />

120