Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

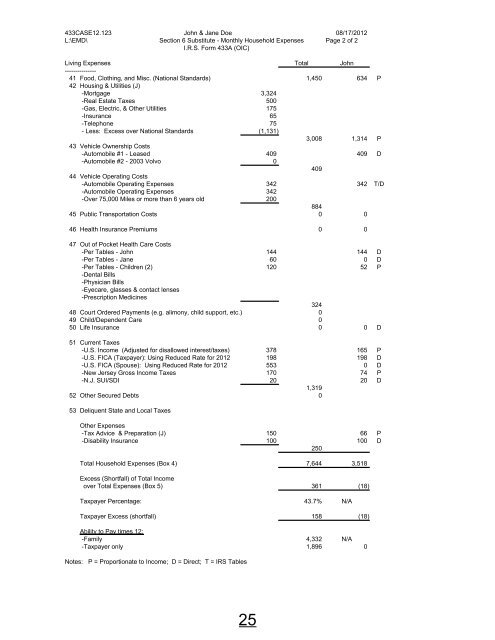

433CASE12.123 John & Jane Doe 08/17/<strong>2012</strong><br />

L:\EMD\ Section 6 Substitute - Monthly Household Expenses Page 2 of 2<br />

I.R.S. Form 433A (OIC)<br />

Living Expenses Total John<br />

---------------<br />

41 Food, Clothing, and Misc. (National Standards) 1,450 634 P<br />

42 Housing & Utilities (J)<br />

-Mortgage 3,324<br />

-Real Estate <strong>Tax</strong>es 500<br />

-Gas, Electric, & Other Utilities 175<br />

-Insurance 65<br />

-Telephone 75<br />

- Less: Excess over National Standards (1,131)<br />

3,008 1,314 P<br />

43 Vehicle Ownership Costs<br />

-Automobile #1 - Leased 409 409 D<br />

-Automobile #2 - 2003 Volvo 0<br />

409<br />

44 Vehicle Operating Costs<br />

-Automobile Operating Expenses 342 342 T/D<br />

-Automobile Operating Expenses 342<br />

-Over 75,000 Miles or more than 6 years old 200<br />

884<br />

45 Public Transportation Costs 0 0<br />

46 Health Insurance Premiums 0 0<br />

47 Out of Pocket Health Care Costs<br />

-Per Tables - John 144 144 D<br />

-Per Tables - Jane 60 0 D<br />

-Per Tables - Children (2) 120 52 P<br />

-Dental Bills<br />

-Physician Bills<br />

-Eyecare, glasses & contact lenses<br />

-Prescription Medicines<br />

324<br />

48 Court Ordered Payments (e.g. alimony, child support, etc.) 0<br />

49 Child/Dependent Care 0<br />

50 Life Insurance 0 0 D<br />

51 Current <strong>Tax</strong>es<br />

-U.S. Income (Adjusted for disallowed interest/taxes) 378 165 P<br />

-U.S. FICA (<strong>Tax</strong>payer): Using Reduced Rate for <strong>2012</strong> 198 198 D<br />

-U.S. FICA (Spouse): Using Reduced Rate for <strong>2012</strong> 553 0 D<br />

-New Jersey Gross Income <strong>Tax</strong>es 170 74 P<br />

-N.J. SUI/SDI 20 20 D<br />

1,319<br />

52 Other Secured Debts 0<br />

53 Deliquent State and Local <strong>Tax</strong>es<br />

Other Expenses<br />

-<strong>Tax</strong> Advice & Preparation (J) 150 66 P<br />

-Disability Insurance 100 100 D<br />

250<br />

Total Household Expenses (Box 4) 7,644 3,518<br />

Excess (Shortfall) of Total Income<br />

over Total Expenses (Box 5) 361 (18)<br />

<strong>Tax</strong>payer Percentage: 43.7% N/A<br />

<strong>Tax</strong>payer Excess (shortfall) 158 (18)<br />

Ability to Pay times 12:<br />

-Family 4,332 N/A<br />

-<strong>Tax</strong>payer only 1,896 0<br />

Notes: P = Proportionate to Income; D = Direct; T = IRS Tables<br />

25