Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

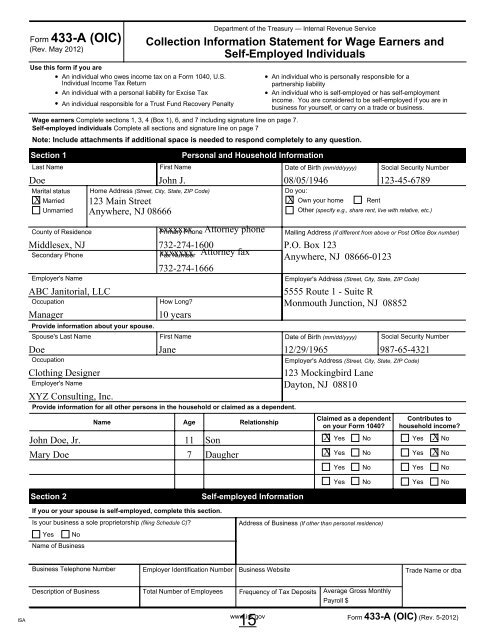

Form 433-A (OIC)<br />

(Rev. May <strong>2012</strong>)<br />

Use this form if you are<br />

An individual who owes income tax on a Form 1040, U.S.<br />

Individual Income <strong>Tax</strong> Return<br />

An individual with a personal liability for Excise <strong>Tax</strong><br />

An individual responsible for a Trust Fund Recovery Penalty<br />

Department of the Treasury — Internal Revenue Service<br />

Collection Information Statement for Wage Earners and<br />

Self-Employed Individuals<br />

An individual who is personally responsible for a<br />

partnership liability<br />

An individual who is self-employed or has self-employment<br />

income. You are considered to be self-employed if you are in<br />

business for yourself, or carry on a trade or business.<br />

Wage earners Complete sections 1, 3, 4 (Box 1), 6, and 7 including signature line on page 7.<br />

Self-employed individuals Complete all sections and signature line on page 7<br />

Note: Include attachments if additional space is needed to respond completely to any question.<br />

Section 1<br />

Personal and Household Information<br />

Last Name First Name Date of Birth (mm/dd/yyyy) Social Security Number<br />

Doe John J. 08/05/1946 123-45-6789<br />

Marital status Home Address (Street, City, State, ZIP Code)<br />

Do you:<br />

X Married 123 Main Street<br />

X Own your home Rent<br />

Unmarried Anywhere, NJ 08666<br />

Other (specify e.g., share rent, live with relative, etc.)<br />

County of Residence<br />

Employer's Name<br />

Occupation<br />

Primary Phone<br />

Middlesex, NJ 732-274-1600<br />

Secondary Phone<br />

xxxxxxx<br />

Fax Number Attorney fax<br />

732-274-1666<br />

ABC Janitorial, LLC<br />

Manager<br />

How Long?<br />

Mailing Address (if different from above or Post Office Box number)<br />

Employer's Address (Street, City, State, ZIP Code)<br />

Provide information about your spouse.<br />

Spouse's Last Name First Name Date of Birth (mm/dd/yyyy) Social Security Number<br />

Occupation<br />

Employer's Name<br />

10 years<br />

Provide information for all other persons in the household or claimed as a dependent.<br />

Name Age Relationship<br />

P.O. Box 123<br />

Anywhere, NJ 08666-0123<br />

5555 Route 1 - Suite R<br />

Monmouth Junction, NJ 08852<br />

Doe Jane 12/29/1965 987-65-4321<br />

Clothing Designer<br />

XYZ Consulting, Inc.<br />

xxxxxxx<br />

Attorney phone<br />

Employer's Address (Street, City, State, ZIP Code)<br />

123 Mockingbird Lane<br />

Dayton, NJ 08810<br />

Claimed as a dependent<br />

on your Form 1040?<br />

Contributes to<br />

household income?<br />

John Doe, Jr. 11 Son X X<br />

Mary Doe 7 Daugher X X<br />

Yes No Yes No<br />

Yes No Yes No<br />

Yes No Yes No<br />

Yes No Yes No<br />

Section 2<br />

Self-employed Information<br />

If you or your spouse is self-employed, complete this section.<br />

Is your business a sole proprietorship (filing Schedule C)?<br />

Yes No<br />

Name of Business<br />

Address of Business (If other than personal residence)<br />

Business Telephone Number<br />

Employer Identification Number Business Website<br />

Trade Name or dba<br />

ISA<br />

Description of Business Total Number of Employees Frequency of <strong>Tax</strong> Deposits Average Gross Monthly<br />

Payroll $<br />

15<br />

www.irs.gov Form 433-A (OIC) (Rev. 5-<strong>2012</strong>)