Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

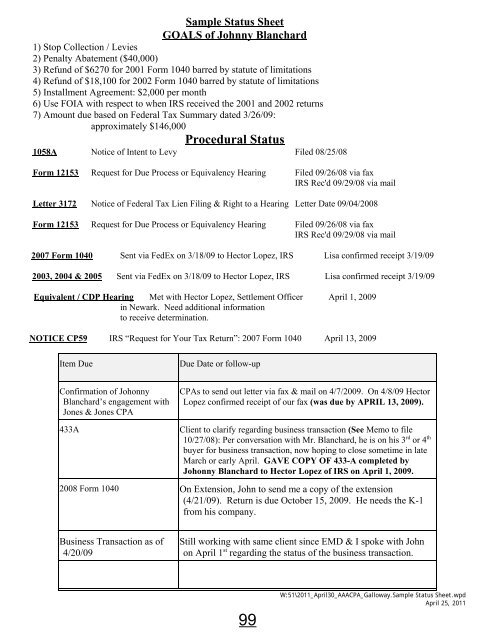

Sample Status Sheet<br />

GOALS of Johnny Blanchard<br />

1) Stop Collection / Levies<br />

2) Penalty Abatement ($40,000)<br />

3) Refund of $6270 for 2001 Form 1040 barred by statute of limitations<br />

4) Refund of $18,100 for 2002 Form 1040 barred by statute of limitations<br />

5) Installment Agreement: $2,000 per month<br />

6) Use FOIA with respect to when IRS received the 2001 and 2002 returns<br />

7) Amount due based on Federal <strong>Tax</strong> Summary dated 3/26/09:<br />

approximately $146,000<br />

Procedural Status<br />

1058A Notice of Intent to Levy Filed 08/25/08<br />

Form 12153 Request for Due Process or Equivalency Hearing Filed 09/26/08 via fax<br />

IRS Rec'd 09/29/08 via mail<br />

Letter 3172 Notice of Federal <strong>Tax</strong> Lien Filing & Right to a Hearing Letter Date 09/04/2008<br />

Form 12153 Request for Due Process or Equivalency Hearing Filed 09/26/08 via fax<br />

IRS Rec'd 09/29/08 via mail<br />

2007 Form 1040 Sent via FedEx on 3/18/09 to Hector Lopez, IRS Lisa confirmed receipt 3/19/09<br />

2003, 2004 & 2005 Sent via FedEx on 3/18/09 to Hector Lopez, IRS Lisa confirmed receipt 3/19/09<br />

Equivalent / CDP Hearing Met with Hector Lopez, Settlement Officer April 1, 2009<br />

in Newark. Need additional information<br />

to receive determination.<br />

NOTICE CP59 IRS “Request for Your <strong>Tax</strong> Return”: 2007 Form 1040 April 13, 2009<br />

Item Due<br />

Due Date or follow-up<br />

Confirmation of Johonny<br />

Blanchard’s engagement with<br />

Jones & Jones CPA<br />

433A<br />

CPAs to send out letter via fax & mail on 4/7/2009. On 4/8/09 Hector<br />

Lopez confirmed receipt of our fax (was due by APRIL 13, 2009).<br />

Client to clarify regarding business transaction (See Memo to file<br />

10/27/08): Per conversation with Mr. Blanchard, he is on his 3 rd or 4 th<br />

buyer for business transaction, now hoping to close sometime in late<br />

March or early April. GAVE COPY OF 433-A completed by<br />

Johonny Blanchard to Hector Lopez of IRS on April 1, 2009.<br />

2008 Form 1040 On Extension, John to send me a copy of the extension<br />

(4/21/09). Return is due October 15, 2009. He needs the K-1<br />

from his company.<br />

Business Transaction as of<br />

4/20/09<br />

Still working with same client since EMD & I spoke with John<br />

on April 1 st regarding the status of the business transaction.<br />

99<br />

W:51\2011_April30_AAACPA_Galloway.Sample Status Sheet.wpd<br />

April 25, 2011