Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

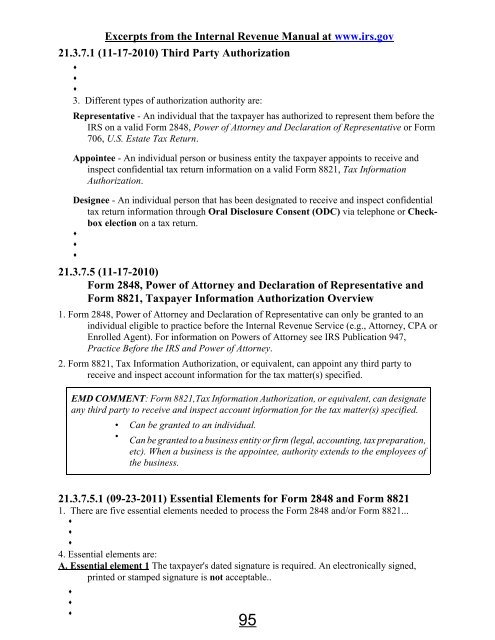

Excerpts from the Internal Revenue Manual at www.irs.gov<br />

21.3.7.1 (11-17-2010) Third Party Authorization<br />

<br />

<br />

<br />

3. Different types of authorization authority are:<br />

Representative - An individual that the taxpayer has authorized to represent them before the<br />

IRS on a valid Form 2848, Power of Attorney and Declaration of Representative or Form<br />

706, U.S. Estate <strong>Tax</strong> Return.<br />

Appointee - An individual person or business entity the taxpayer appoints to receive and<br />

inspect confidential tax return information on a valid Form 8821, <strong>Tax</strong> Information<br />

Authorization.<br />

Designee - An individual person that has been designated to receive and inspect confidential<br />

tax return information through Oral Disclosure Consent (ODC) via telephone or Checkbox<br />

election on a tax return.<br />

<br />

<br />

<br />

21.3.7.5 (11-17-2010)<br />

Form 2848, Power of Attorney and Declaration of Representative and<br />

Form 8821, <strong>Tax</strong>payer Information Authorization Overview<br />

1. Form 2848, Power of Attorney and Declaration of Representative can only be granted to an<br />

individual eligible to practice before the Internal Revenue Service (e.g., Attorney, CPA or<br />

Enrolled Agent). For information on Powers of Attorney see IRS Publication 947,<br />

Practice Before the IRS and Power of Attorney.<br />

2. Form 8821, <strong>Tax</strong> Information Authorization, or equivalent, can appoint any third party to<br />

receive and inspect account information for the tax matter(s) specified.<br />

EMD COMMENT: Form 8821,<strong>Tax</strong> Information Authorization, or equivalent, can designate<br />

any third party to receive and inspect account information for the tax matter(s) specified.<br />

• Can be granted to an individual.<br />

•<br />

Can be granted to a business entity or firm (legal, accounting, tax preparation,<br />

etc). When a business is the appointee, authority extends to the employees of<br />

the business.<br />

21.3.7.5.1 (09-23-2011) Essential Elements for Form 2848 and Form 8821<br />

1. There are five essential elements needed to process the Form 2848 and/or Form 8821...<br />

<br />

<br />

<br />

4. Essential elements are:<br />

A. Essential element 1 The taxpayer's dated signature is required. An electronically signed,<br />

printed or stamped signature is not acceptable..<br />

<br />

<br />

<br />

95