Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

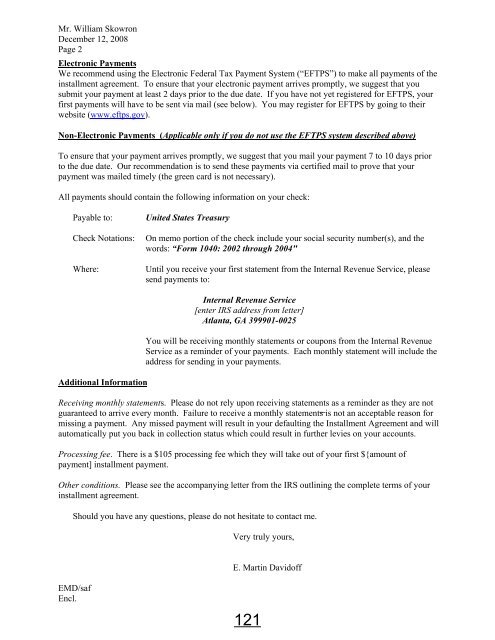

Mr. William Skowron<br />

<strong>December</strong> 12, 2008<br />

Page 2<br />

Electronic Payments<br />

We recommend using the Electronic Federal <strong>Tax</strong> Payment System (“EFTPS”) to make all payments of the<br />

installment agreement. To ensure that your electronic payment arrives promptly, we suggest that you<br />

submit your payment at least 2 days prior to the due date. If you have not yet registered for EFTPS, your<br />

first payments will have to be sent via mail (see below). You may register for EFTPS by going to their<br />

website (www.eftps.gov).<br />

Non-Electronic Payments (Applicable only if you do not use the EFTPS system described above)<br />

To ensure that your payment arrives promptly, we suggest that you mail your payment 7 to 10 days prior<br />

to the due date. Our recommendation is to send these payments via certified mail to prove that your<br />

payment was mailed timely (the green card is not necessary).<br />

All payments should contain the following information on your check:<br />

Payable to:<br />

Check Notations:<br />

Where:<br />

United States Treasury<br />

On memo portion of the check include your social security number(s), and the<br />

words: “Form 1040: 2002 through 2004"<br />

Until you receive your first statement from the Internal Revenue Service, please<br />

send payments to:<br />

Additional Information<br />

Internal Revenue Service<br />

[enter IRS address from letter]<br />

Atlanta, GA 399901-0025<br />

You will be receiving monthly statements or coupons from the Internal Revenue<br />

Service as a reminder of your payments. Each monthly statement will include the<br />

address for sending in your payments.<br />

Receiving monthly statements. Please do not rely upon receiving statements as a reminder as they are not<br />

guaranteed to arrive every month. Failure to receive a monthly statements is not an acceptable reason for<br />

missing a payment. Any missed payment will result in your defaulting the Installment Agreement and will<br />

automatically put you back in collection status which could result in further levies on your accounts.<br />

Processing fee. There is a $105 processing fee which they will take out of your first ${amount of<br />

payment] installment payment.<br />

Other conditions. Please see the accompanying letter from the IRS outlining the complete terms of your<br />

installment agreement.<br />

Should you have any questions, please do not hesitate to contact me.<br />

Very truly yours,<br />

E. Martin Davidoff<br />

EMD/saf<br />

Encl.<br />

121