Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

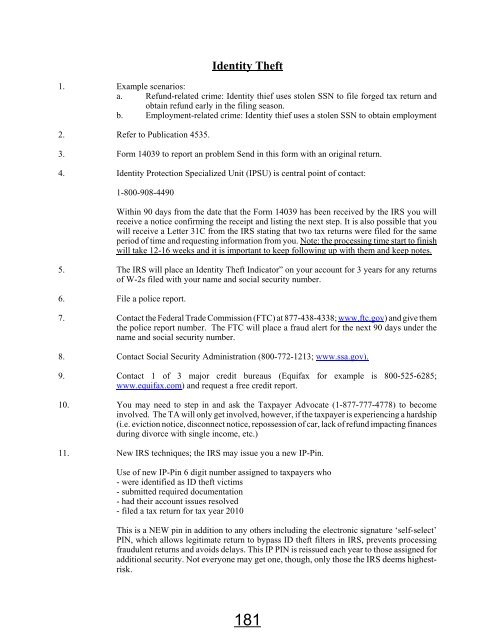

Identity Theft<br />

1. Example scenarios:<br />

a. Refund-related crime: Identity thief uses stolen SSN to file forged tax return and<br />

obtain refund early in the filing season.<br />

b. Employment-related crime: Identity thief uses a stolen SSN to obtain employment<br />

2. Refer to Publication 4535.<br />

3. Form 14039 to report an problem Send in this form with an original return.<br />

4. Identity Protection Specialized Unit (IPSU) is central point of contact:<br />

1-800-908-4490<br />

Within 90 days from the date that the Form 14039 has been received by the IRS you will<br />

receive a notice confirming the receipt and listing the next step. It is also possible that you<br />

will receive a Letter 31C from the IRS stating that two tax returns were filed for the same<br />

period of time and requesting information from you. Note: the processing time start to finish<br />

will take 12-16 weeks and it is important to keep following up with them and keep notes.<br />

5. The IRS will place an Identity Theft Indicator” on your account for 3 years for any returns<br />

of W-2s filed with your name and social security number.<br />

6. File a police report.<br />

7. Contact the Federal Trade Commission (FTC) at 877-438-4338; www.ftc.gov) and give them<br />

the police report number. The FTC will place a fraud alert for the next 90 days under the<br />

name and social security number.<br />

8. Contact Social Security Administration (800-772-1213; www.ssa.gov).<br />

9. Contact 1 of 3 major credit bureaus (Equifax for example is 800-525-6285;<br />

www.equifax.com) and request a free credit report.<br />

10. You may need to step in and ask the <strong>Tax</strong>payer Advocate (1-877-777-4778) to become<br />

involved. The TA will only get involved, however, if the taxpayer is experiencing a hardship<br />

(i.e. eviction notice, disconnect notice, repossession of car, lack of refund impacting finances<br />

during divorce with single income, etc.)<br />

11. New IRS techniques; the IRS may issue you a new IP-Pin.<br />

Use of new IP-Pin 6 digit number assigned to taxpayers who<br />

- were identified as ID theft victims<br />

- submitted required documentation<br />

- had their account issues resolved<br />

- filed a tax return for tax year 2010<br />

This is a NEW pin in addition to any others including the electronic signature ‘self-select’<br />

PIN, which allows legitimate return to bypass ID theft filters in IRS, prevents processing<br />

fraudulent returns and avoids delays. This IP PIN is reissued each year to those assigned for<br />

additional security. Not everyone may get one, though, only those the IRS deems highestrisk.<br />

181