Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

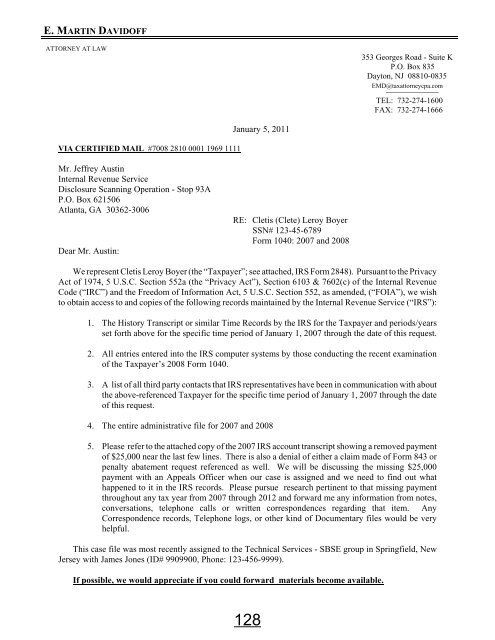

E. MARTIN DAVIDOFF<br />

ATTORNEY AT LAW<br />

353 Georges Road - Suite K<br />

P.O. Box 835<br />

Dayton, NJ 08810-0835<br />

EMD@taxattorneycpa.com<br />

_____________<br />

TEL: 732-274-1600<br />

FAX: 732-274-1666<br />

VIA CERTIFIED MAIL #7008 2810 0001 1969 1111<br />

January 5, 2011<br />

Mr. Jeffrey Austin<br />

Internal Revenue Service<br />

Disclosure Scanning Operation - Stop 93A<br />

P.O. Box 621506<br />

Atlanta, GA 30362-3006<br />

Dear Mr. Austin:<br />

RE: Cletis (Clete) Leroy Boyer<br />

SSN# 123-45-6789<br />

Form 1040: 2007 and 2008<br />

We represent Cletis Leroy Boyer (the “<strong>Tax</strong>payer”; see attached, IRS Form 2848). Pursuant to the Privacy<br />

Act of 1974, 5 U.S.C. Section 552a (the “Privacy Act”), Section 6103 & 7602(c) of the Internal Revenue<br />

Code (“IRC”) and the Freedom of Information Act, 5 U.S.C. Section 552, as amended, (“FOIA”), we wish<br />

to obtain access to and copies of the following records maintained by the Internal Revenue Service (“IRS”):<br />

1. The History Transcript or similar Time Records by the IRS for the <strong>Tax</strong>payer and periods/years<br />

set forth above for the specific time period of January 1, 2007 through the date of this request.<br />

2. All entries entered into the IRS computer systems by those conducting the recent examination<br />

of the <strong>Tax</strong>payer’s 2008 Form 1040.<br />

3. A list of all third party contacts that IRS representatives have been in communication with about<br />

the above-referenced <strong>Tax</strong>payer for the specific time period of January 1, 2007 through the date<br />

of this request.<br />

4. The entire administrative file for 2007 and 2008<br />

5. Please refer to the attached copy of the 2007 IRS account transcript showing a removed payment<br />

of $25,000 near the last few lines. There is also a denial of either a claim made of Form 843 or<br />

penalty abatement request referenced as well. We will be discussing the missing $25,000<br />

payment with an Appeals Officer when our case is assigned and we need to find out what<br />

happened to it in the IRS records. Please pursue research pertinent to that missing payment<br />

throughout any tax year from 2007 through <strong>2012</strong> and forward me any information from notes,<br />

conversations, telephone calls or written correspondences regarding that item. Any<br />

Correspondence records, Telephone logs, or other kind of Documentary files would be very<br />

helpful.<br />

This case file was most recently assigned to the Technical Services - SBSE group in Springfield, New<br />

Jersey with James Jones (ID# 9909900, Phone: 123-456-9999).<br />

If possible, we would appreciate if you could forward materials become available.<br />

128