- Page 1 and 2:

The Zicklin Tax Seminar Series Tax

- Page 3 and 4:

E. MARTIN DAVIDOFF & ASSOCIATES CER

- Page 5 and 6:

5

- Page 7 and 8:

• Payments of more than 24 months

- Page 9 and 10:

Reduced Offers Examples: One of the

- Page 11 and 12:

2 If you have any questions, please

- Page 13 and 14:

FACTS OFFER IN COMPROMISE CASE STUD

- Page 15 and 16:

Form 433-A (OIC) (Rev. May 2012) Us

- Page 17 and 18:

Section 3 (Continued) Cash value of

- Page 19 and 20:

Section 5 Business Income and Expen

- Page 21 and 22:

Section 8 Other Information Page 7

- Page 23 and 24:

L:\EMD\433Case11:B Personal Liabili

- Page 25 and 26:

433CASE12.123 John & Jane Doe 08/17

- Page 27 and 28:

Form 656 (Rev. May 2012) Department

- Page 29 and 30:

Section 6 Designation of Down Payme

- Page 31 and 32:

Form 656 (Rev. May 2012) Department

- Page 33 and 34:

Jim and Kelly Smith SS#: 123-45-678

- Page 35 and 36:

Offer In Compromise Package Logisti

- Page 37 and 38:

New Jersey - Local Standards: Housi

- Page 39 and 40:

One Car Two Cars Houston $312 $624

- Page 41 and 42:

Print Email Reports Export Reports

- Page 43 and 44:

Internal Revenue Manual - 5.8.5 Fin

- Page 45 and 46:

Internal Revenue Manual - 5.8.5 Fin

- Page 47 and 48:

E. Martin Davidoff - Offer in Compr

- Page 49 and 50:

Form 656 Booklet Offer in Compromis

- Page 51 and 52:

an offer unless the trust fund port

- Page 53 and 54:

Step 2 - Fill out the Form 433-A (O

- Page 55 and 56:

Section 2 Business Asset Informatio

- Page 57 and 58:

Page 4 of 6 Section 3 Business Inco

- Page 59 and 60:

Section 7 Signatures Page 6 of 6 Un

- Page 61 and 62:

Rules of Engagement in Dealing With

- Page 63 and 64:

Rules of Engagement: Dealing With I

- Page 65 and 66:

IRS Rules of Engagement: Under Prom

- Page 67 and 68:

Dealing with the IRS Regarding Coll

- Page 69 and 70:

I R S R E P R E S E N T A T I o N A

- Page 71 and 72:

R.C.P. OLD NEW Monthly Excess $361

- Page 73 and 74:

R.C.P. - Example #1 OLD NEW Monthly

- Page 75 and 76:

May 21, 2012 OIC Rules • There wi

- Page 77 and 78:

May 21, 2012 OIC Rules • State an

- Page 79 and 80:

May 21, 2012 OIC Rules Substantial

- Page 81 and 82:

E. MARTIN DAVIDOFF & ASSOCIATES CER

- Page 83 and 84:

Steps in a Controversy 1. Initial c

- Page 85 and 86:

Alternatives in a Collection Matter

- Page 87 and 88:

E. MARTIN DAVIDOFF ATTORNEY AT LAW

- Page 89 and 90:

Mr. & Mrs. Mickey Mantle January 5,

- Page 91 and 92:

E. MARTIN DAVIDOFF & ASSOCIATES CER

- Page 93 and 94:

Form 2848 (Rev. 3-2012) Page 2 6 Re

- Page 95 and 96:

Excerpts from the Internal Revenue

- Page 97 and 98:

97

- Page 99 and 100:

Sample Status Sheet GOALS of Johnny

- Page 101 and 102:

E. MARTIN DAVIDOFF ATTORNEY AT LAW

- Page 103 and 104:

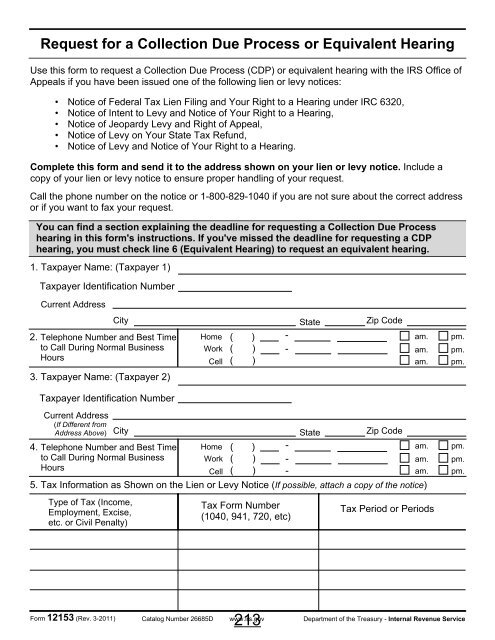

6. Request for a Collection Due Pro

- Page 105 and 106:

Information You Need To Know When R

- Page 107 and 108:

Collection Appeal Request 1. Taxpay

- Page 109 and 110:

John J. and Jane Doe Form 9423 Coll

- Page 111 and 112:

experience is that we secure better

- Page 113 and 114:

E. MARTIN DAVIDOFF ATTORNEY AT LAW

- Page 115 and 116:

Department of the Treasury - Intern

- Page 117 and 118:

117

- Page 119 and 120:

E. MARTIN DAVIDOFF ATTORNEY AT LAW

- Page 121 and 122:

Mr. William Skowron December 12, 20

- Page 123 and 124:

Form 9465-FS (12-2011) Page 2 Part

- Page 125 and 126:

INSTRUCTIONS TO TAXPAYER If not alr

- Page 127 and 128:

Mr. Yogi Berry September 19, 2011 P

- Page 129 and 130:

Mr. Jeffrey Austin January 5, 2011

- Page 131 and 132:

131

- Page 133 and 134:

Texas Iowa, Kansas, Louisiana, Miss

- Page 135 and 136:

4. Filing of Tax Court Petition In

- Page 137 and 138:

137

- Page 139 and 140:

139

- Page 141 and 142:

Yogi Berra Estimated 2011 - 2012 Ca

- Page 143 and 144:

BY HAND IN OUR OFFICE Mr. and Mrs.

- Page 145 and 146:

Representing Clients Before the IRS

- Page 147 and 148:

Rules of Engagement in Dealing With

- Page 149 and 150:

Rules of Engagement: Dealing With I

- Page 151 and 152:

IRS Rules of Engagement: Under Prom

- Page 153 and 154:

Dealing with the IRS Regarding Coll

- Page 155 and 156:

IRS Announces New Effort to Help St

- Page 157 and 158:

Under New Rules, the IRS Will Now R

- Page 159 and 160:

Adjustments to IRS Lien Policies 15

- Page 161 and 162: DIRECT DEBIT INSTALLMENT AGREEMENT

- Page 163 and 164: LIEN HAS BEEN RELEASED 163

- Page 165 and 166: 165

- Page 167 and 168: 617-316-2608 617-316-2606

- Page 169 and 170: Online Payment Agreement Applicatio

- Page 171 and 172: OUTDATED 171

- Page 173 and 174: 173

- Page 175 and 176: October 2011 Your Access to Free Cr

- Page 177 and 178: FTC Facts For Consumers 3 access it

- Page 179 and 180: FTC Facts For Consumers 5 or an unp

- Page 181 and 182: Identity Theft 1. Example scenarios

- Page 183 and 184: The Zicklin Tax Seminar Series IRS

- Page 185 and 186: Notice and Demand of Tax Due • Th

- Page 187 and 188: Unfiled Lien v. Filed Lien A filed

- Page 189 and 190: Collection Appeal Rights Process

- Page 191 and 192: IRS Appeals Can Also Help After the

- Page 193 and 194: To Stop an IRS Levy • Resolve the

- Page 195 and 196: How to File a CDP Request • Compl

- Page 197 and 198: I. How Does A Tax Debt Arise? AGOST

- Page 199 and 200: d G. 3 Notice - “Immediate Action

- Page 201 and 202: 3. If case is not assigned to the l

- Page 203 and 204: payments. The only other asset is t

- Page 205 and 206: (2) The Trust fund portion of the t

- Page 207 and 208: Department of the Treasury - Intern

- Page 209 and 210: Instructions for completing Form 91

- Page 211: Collection Appeal Request (Instruct

- Page 215 and 216: Information You Need To Know When R

- Page 217 and 218: The Zicklin Tax Seminar Series IRS

- Page 219 and 220: IRS Tax Collections: Liens and Levi

- Page 221 and 222: IRS Tax Collections: Liens and Levi

- Page 223 and 224: IRS Tax Collections: Liens and Levi

- Page 225 and 226: IRS Tax Collections: Liens and Levi

- Page 227 and 228: 227

- Page 229 and 230: 229

- Page 231 and 232: 231

- Page 233 and 234: 233

- Page 235 and 236: 235

- Page 237 and 238: 237

- Page 239 and 240: 239

- Page 241 and 242: 241

- Page 243 and 244: 243

- Page 245 and 246: 245

- Page 247 and 248: 247

- Page 249 and 250: 249

- Page 251 and 252: 251

- Page 253 and 254: 253

- Page 255 and 256: 255

- Page 257 and 258: 257

- Page 259 and 260: 259

- Page 261 and 262: 261

- Page 263 and 264:

263

- Page 265 and 266:

Treasury Department Circular No. 23

- Page 267 and 268:

Table of Contents Paragraph 1. . .

- Page 269 and 270:

Paragraph 1. The authority citation

- Page 271 and 272:

of section 404(a) (2)), 404 (relati

- Page 273 and 274:

(1) The former employee applies for

- Page 275 and 276:

This notification must include the

- Page 277 and 278:

software, taxation, or ethics); and

- Page 279 and 280:

the matter within 60 days of the da

- Page 281 and 282:

otherwise prescribed in forms, inst

- Page 283 and 284:

Subpart B — Duties and Restrictio

- Page 285 and 286:

a rule with respect to that particu

- Page 287 and 288:

in writing by each affected client,

- Page 289 and 290:

(ii) Advise a client to take a posi

- Page 291 and 292:

(5) Marketed opinion — (i) Writte

- Page 293 and 294:

under paragraph (e) of this section

- Page 295 and 296:

their practice with the firm, that

- Page 297 and 298:

paragraph (a) of this section. (ii)

- Page 299 and 300:

§ 10.53 Receipt of information con

- Page 301 and 302:

as determined under section 6212 of

- Page 303 and 304:

and law in support. (2) Summary adj

- Page 305 and 306:

specifically provided for in this s

- Page 307 and 308:

§ 10.73 Evidence. § 10.74 Transcr

- Page 309 and 310:

the Secretary of the Treasury, or d

- Page 311 and 312:

to a conference and may be suspende