Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

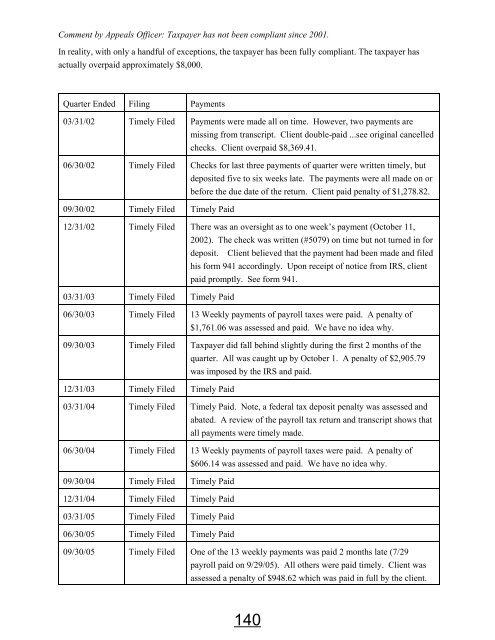

Comment by Appeals Officer: <strong>Tax</strong>payer has not been compliant since 2001.<br />

In reality, with only a handful of exceptions, the taxpayer has been fully compliant. The taxpayer has<br />

actually overpaid approximately $8,000.<br />

Quarter Ended Filing Payments<br />

03/31/02 Timely Filed Payments were made all on time. However, two payments are<br />

missing from transcript. Client double-paid ...see original cancelled<br />

checks. Client overpaid $8,369.41.<br />

06/30/02 Timely Filed Checks for last three payments of quarter were written timely, but<br />

deposited five to six weeks late. The payments were all made on or<br />

before the due date of the return. Client paid penalty of $1,278.82.<br />

09/30/02 Timely Filed Timely Paid<br />

12/31/02 Timely Filed There was an oversight as to one week’s payment (October 11,<br />

2002). The check was written (#5079) on time but not turned in for<br />

deposit. Client believed that the payment had been made and filed<br />

his form 941 accordingly. Upon receipt of notice from IRS, client<br />

paid promptly. See form 941.<br />

03/31/03 Timely Filed Timely Paid<br />

06/30/03 Timely Filed 13 Weekly payments of payroll taxes were paid. A penalty of<br />

$1,761.06 was assessed and paid. We have no idea why.<br />

09/30/03 Timely Filed <strong>Tax</strong>payer did fall behind slightly during the first 2 months of the<br />

quarter. All was caught up by October 1. A penalty of $2,905.79<br />

was imposed by the IRS and paid.<br />

12/31/03 Timely Filed Timely Paid<br />

03/31/04 Timely Filed Timely Paid. Note, a federal tax deposit penalty was assessed and<br />

abated. A review of the payroll tax return and transcript shows that<br />

all payments were timely made.<br />

06/30/04 Timely Filed 13 Weekly payments of payroll taxes were paid. A penalty of<br />

$606.14 was assessed and paid. We have no idea why.<br />

09/30/04 Timely Filed Timely Paid<br />

12/31/04 Timely Filed Timely Paid<br />

03/31/05 Timely Filed Timely Paid<br />

06/30/05 Timely Filed Timely Paid<br />

09/30/05 Timely Filed One of the 13 weekly payments was paid 2 months late (7/29<br />

payroll paid on 9/29/05). All others were paid timely. Client was<br />

assessed a penalty of $948.62 which was paid in full by the client.<br />

140