Tax Seminar #3 – December 3 2012

Workbook - Zicklin School of Business

Workbook - Zicklin School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

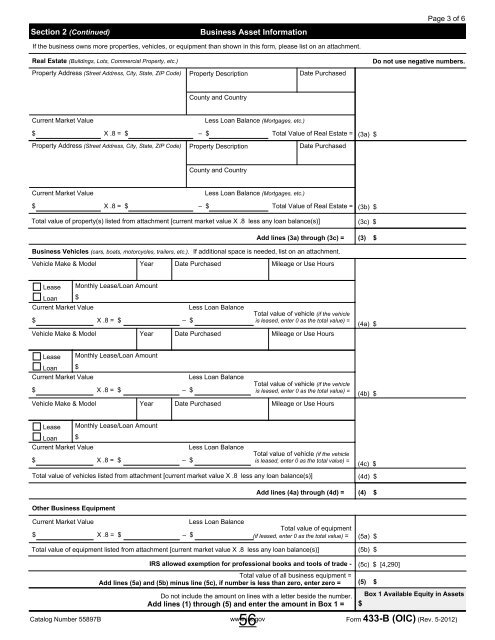

Section 2 (Continued)<br />

Business Asset Information<br />

Page 3 of 6<br />

If the business owns more properties, vehicles, or equipment than shown in this form, please list on an attachment.<br />

Real Estate (Buildings, Lots, Commercial Property, etc.)<br />

Property Address (Street Address, City, State, ZIP Code) Property Description Date Purchased<br />

Do not use negative numbers.<br />

County and Country<br />

Current Market Value<br />

Less Loan Balance (Mortgages, etc.)<br />

$ X .8 = $<br />

<strong>–</strong> $ Total Value of Real Estate = (3a) $<br />

Property Address (Street Address, City, State, ZIP Code) Property Description Date Purchased<br />

County and Country<br />

Current Market Value<br />

$ X .8 = $<br />

Less Loan Balance (Mortgages, etc.)<br />

<strong>–</strong> $ Total Value of Real Estate = (3b) $<br />

Total value of property(s) listed from attachment [current market value X .8 less any loan balance(s)] (3c) $<br />

Add lines (3a) through (3c) = (3) $<br />

Business Vehicles (cars, boats, motorcycles, trailers, etc.). If additional space is needed, list on an attachment.<br />

Vehicle Make & Model Year Date Purchased Mileage or Use Hours<br />

Lease Monthly Lease/Loan Amount<br />

Loan $<br />

Current Market Value<br />

$ X .8 = $<br />

<strong>–</strong> $<br />

Less Loan Balance<br />

Total value of vehicle (if the vehicle<br />

is leased, enter 0 as the total value) =<br />

Vehicle Make & Model Year Date Purchased Mileage or Use Hours<br />

(4a) $<br />

Lease Monthly Lease/Loan Amount<br />

Loan $<br />

Current Market Value<br />

$ X .8 = $<br />

<strong>–</strong> $<br />

Less Loan Balance<br />

Total value of vehicle (if the vehicle<br />

is leased, enter 0 as the total value) =<br />

Vehicle Make & Model Year Date Purchased Mileage or Use Hours<br />

(4b) $<br />

Lease Monthly Lease/Loan Amount<br />

Loan $<br />

Current Market Value<br />

Less Loan Balance<br />

Total value of vehicle (if the vehicle<br />

is leased, enter 0 as the total value) =<br />

$ X .8 = $<br />

<strong>–</strong> $<br />

(4c) $<br />

Total value of vehicles listed from attachment [current market value X .8 less any loan balance(s)] (4d) $<br />

Other Business Equipment<br />

Add lines (4a) through (4d) = (4) $<br />

Current Market Value<br />

$ X .8 = $<br />

<strong>–</strong> $<br />

Less Loan Balance<br />

Total value of equipment<br />

(if leased, enter 0 as the total value) = (5a) $<br />

Total value of equipment listed from attachment [current market value X .8 less any loan balance(s)] (5b) $<br />

IRS allowed exemption for professional books and tools of trade - (5c) $ [4,290]<br />

Total value of all business equipment =<br />

Add lines (5a) and (5b) minus line (5c), if number is less than zero, enter zero = (5) $<br />

Do not include the amount on lines with a letter beside the number.<br />

Add lines (1) through (5) and enter the amount in Box 1 =<br />

Box 1 Available Equity in Assets<br />

$<br />

56<br />

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 5-<strong>2012</strong>)