BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

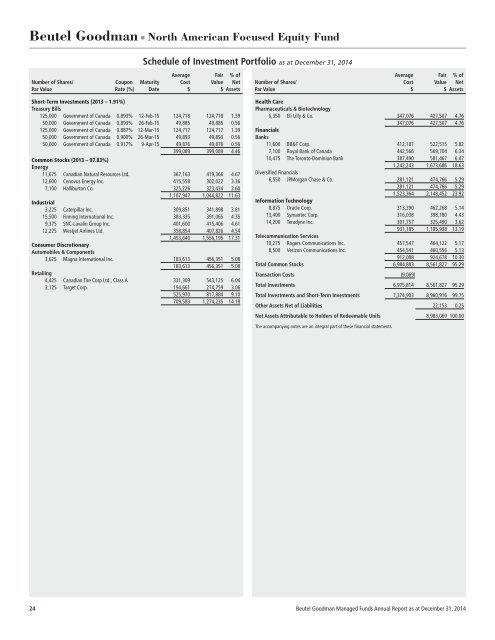

Beutel Goodman ■ North American Focused Equity Fund<br />

Schedule of Investment Portfolio as at December 31, 2014<br />

Average Fair % of<br />

Number of Shares/ Coupon Maturity Cost Value Net<br />

Par Value Rate (%) Date $ $ Assets<br />

Short-Term Investments (2013 – 1.91%)<br />

Treasury Bills<br />

125,000 Government of Canada 0.893% 12-Feb-15 124,718 124,718 1.39<br />

50,000 Government of Canada 0.893% 26-Feb-15 49,885 49,885 0.56<br />

125,000 Government of Canada 0.887% 12-Mar-15 124,717 124,717 1.39<br />

50,000 Government of Canada 0.900% 26-Mar-15 49,893 49,893 0.56<br />

50,000 Government of Canada 0.917% 9-Apr-15 49,876 49,876 0.56<br />

399,089 399,089 4.46<br />

Common Stocks (2013 – 97.83%)<br />

Energy<br />

11,675 Canadian Natural Resources Ltd. 367,163 419,366 4.67<br />

12,600 Cenovus Energy Inc. 415,558 302,022 3.36<br />

7,100 Halliburton Co. 325,226 323,434 3.60<br />

1,107,947 1,044,822 11.63<br />

Industrial<br />

3,225 Caterpillar Inc. 309,851 341,898 3.81<br />

15,500 Finning International Inc. 383,335 391,065 4.35<br />

9,375 SNC-Lavalin Group Inc. 401,600 415,406 4.61<br />

12,225 Westjet Airlines Ltd. 358,854 407,826 4.54<br />

1,453,640 1,556,195 17.31<br />

Consumer Discretionary<br />

Automobiles & Components<br />

3,625 Magna International Inc. 183,613 456,351 5.08<br />

183,613 456,351 5.08<br />

Retailing<br />

4,425 Canadian Tire Corp Ltd., Class A 331,309 543,125 6.04<br />

3,125 Target Corp. 194,661 274,759 3.06<br />

525,970 817,884 9.10<br />

709,583 1,274,235 14.18<br />

Average Fair % of<br />

Number of Shares/ Cost Value Net<br />

Par Value $ $ Assets<br />

Health Care<br />

Pharmaceuticals & Biotechnology<br />

5,350 Eli Lilly & Co. 347,076 427,507 4.76<br />

347,076 427,507 4.76<br />

Financials<br />

Banks<br />

11,600 BB&T Corp. 412,187 522,515 5.82<br />

7,100 Royal Bank of Canada 442,566 569,704 6.34<br />

10,475 The Toronto-Dominion Bank 387,490 581,467 6.47<br />

1,242,243 1,673,686 18.63<br />

Diversified Financials<br />

6,550 JPMorgan Chase & Co. 281,121 474,766 5.29<br />

281,121 474,766 5.29<br />

1,523,364 2,148,452 23.92<br />

Information Technology<br />

8,875 Oracle Corp. 313,390 462,268 5.14<br />

13,400 Symantec Corp. 316,038 398,180 4.43<br />

14,200 Teradyne Inc. 301,757 325,490 3.62<br />

931,185 1,185,938 13.19<br />

Telecommunication Services<br />

10,275 Rogers Communications Inc. 457,547 464,122 5.17<br />

8,500 Verizon Communications Inc. 454,541 460,556 5.13<br />

912,088 924,678 10.30<br />

Total Common Stocks 6,984,883 8,561,827 95.29<br />

Transaction Costs (9,069)<br />

Total Investments 6,975,814 8,561,827 95.29<br />

Total Investments and Short-Term Investments 7,374,903 8,960,916 99.75<br />

Other Assets Net of Liabilities 22,153 0.25<br />

Net Assets Attributable to Holders of Redeemable Units 8,983,069 100.00<br />

The accompanying notes are an integral part of these financial statements.<br />

24 Beutel Goodman Managed Funds Annual Report as at December 31, 2014