BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Beutel Goodman ■ American Equity Fund<br />

Fund Specific Notes to the Financial Statements<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

Risk Management<br />

The investment objective of Beutel Goodman American Equity Fund (the<br />

“Fund”) is to seek long-term enhancement of capital primarily through<br />

investments in common stocks and other equity securities of American<br />

issuers. The investment strategy for this Fund focuses on stock selection which<br />

the Fund’s advisor believes is the primary catalyst for superior portfolio return.<br />

The selection process is sourced from a universe of potential candidates<br />

whose management have consistently demonstrated a commitment to<br />

create shareholder value without undue financial leverage. A value approach<br />

is applied to purchase stocks at a reasonable price by analyzing relative<br />

valuation measures such as the issuer’s price/earnings, price/cash flow<br />

and price/book value relative to its own history, the overall market and to<br />

its sustainable earnings growth rate. The Fund’s overall risk management<br />

program seeks to minimize the potentially adverse effect of risk on the Fund’s<br />

financial performance in a manner consistent with the Fund’s investment<br />

objective.<br />

Credit Risk<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013, the Fund<br />

had no significant investments in debt instruments, other than short-term<br />

investments. Accordingly, the Fund is not subject to significant amounts of<br />

credit risk.<br />

Interest Rate Risk<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013, the<br />

majority of the Fund’s financial assets and liabilities are non-interest bearing.<br />

Accordingly, the Fund is not subject to significant amounts of risk due to<br />

fluctuations in the prevailing levels of market interest rates.<br />

Other Price Risk<br />

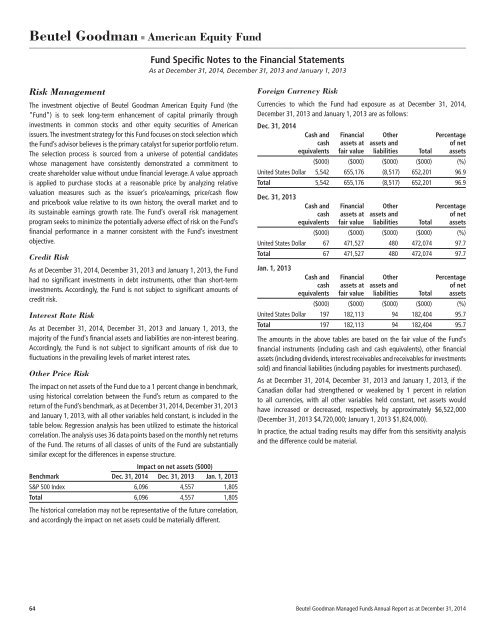

The impact on net assets of the Fund due to a 1 percent change in benchmark,<br />

using historical correlation between the Fund’s return as compared to the<br />

return of the Fund’s benchmark, as at December 31, 2014, December 31, 2013<br />

and January 1, 2013, with all other variables held constant, is included in the<br />

table below. Regression analysis has been utilized to estimate the historical<br />

correlation. The analysis uses 36 data points based on the monthly net returns<br />

of the Fund. The returns of all classes of units of the Fund are substantially<br />

similar except for the differences in expense structure.<br />

Impact on net assets ($000)<br />

Benchmark Dec. 31, 2014 Dec. 31, 2013 Jan. 1, 2013<br />

S&P 500 Index 6,096 4,557 1,805<br />

Total 6,096 4,557 1,805<br />

The historical correlation may not be representative of the future correlation,<br />

and accordingly the impact on net assets could be materially different.<br />

Foreign Currency Risk<br />

Currencies to which the Fund had exposure as at December 31, 2014,<br />

December 31, 2013 and January 1, 2013 are as follows:<br />

Dec. 31, 2014<br />

Cash and Financial Other Percentage<br />

cash assets at assets and of net<br />

equivalents fair value liabilities Total assets<br />

($000) ($000) ($000) ($000) (%)<br />

United States Dollar 5,542 655,176 (8,517) 652,201 96.9<br />

Total 5,542 655,176 (8,517) 652,201 96.9<br />

Dec. 31, 2013<br />

Cash and Financial Other Percentage<br />

cash assets at assets and of net<br />

equivalents fair value liabilities Total assets<br />

($000) ($000) ($000) ($000) (%)<br />

United States Dollar 67 471,527 480 472,074 97.7<br />

Total 67 471,527 480 472,074 97.7<br />

Jan. 1, 2013<br />

Cash and Financial Other Percentage<br />

cash assets at assets and of net<br />

equivalents fair value liabilities Total assets<br />

($000) ($000) ($000) ($000) (%)<br />

United States Dollar 197 182,113 94 182,404 95.7<br />

Total 197 182,113 94 182,404 95.7<br />

The amounts in the above tables are based on the fair value of the Fund’s<br />

financial instruments (including cash and cash equivalents), other financial<br />

assets (including dividends, interest receivables and receivables for investments<br />

sold) and financial liabilities (including payables for investments purchased).<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013, if the<br />

Canadian dollar had strengthened or weakened by 1 percent in relation<br />

to all currencies, with all other variables held constant, net assets would<br />

have increased or decreased, respectively, by approximately $6,522,000<br />

(December 31, 2013 $4,720,000; January 1, 2013 $1,824,000).<br />

In practice, the actual trading results may differ from this sensitivity analysis<br />

and the difference could be material.<br />

64 Beutel Goodman Managed Funds Annual Report as at December 31, 2014