BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

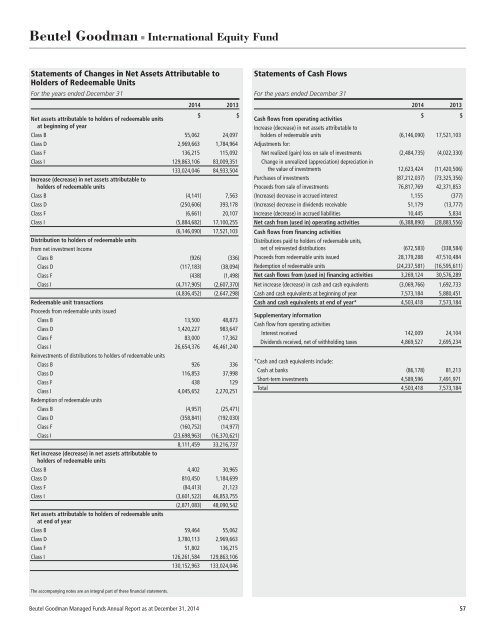

Beutel Goodman ■ International Equity Fund<br />

Statements of Changes in Net Assets Attributable to<br />

Holders of Redeemable Units<br />

For the years ended December 31<br />

2014 2013<br />

Net assets attributable to holders of redeemable units<br />

$ $<br />

at beginning of year<br />

Class B 55,062 24,097<br />

Class D 2,969,663 1,784,964<br />

Class F 136,215 115,092<br />

Class I 129,863,106 83,009,351<br />

133,024,046 84,933,504<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units<br />

Class B (4,141) 7,563<br />

Class D (250,606) 393,178<br />

Class F (6,661) 20,107<br />

Class I (5,884,682) 17,100,255<br />

(6,146,090) 17,521,103<br />

Distribution to holders of redeemable units<br />

From net investment Income<br />

Class B (926) (336)<br />

Class D (117,183) (38,094)<br />

Class F (438) (1,498)<br />

Class I (4,717,905) (2,607,370)<br />

(4,836,452) (2,647,298)<br />

Redeemable unit transactions<br />

Proceeds from redeemable units issued<br />

Class B 13,500 48,873<br />

Class D 1,420,227 983,647<br />

Class F 83,000 17,362<br />

Class I 26,654,376 46,461,240<br />

Reinvestments of distributions to holders of redeemable units<br />

Class B 926 336<br />

Class D 116,853 37,998<br />

Class F 438 129<br />

Class I 4,045,652 2,270,251<br />

Redemption of redeemable units<br />

Class B (4,957) (25,471)<br />

Class D (358,841) (192,030)<br />

Class F (160,752) (14,977)<br />

Class I (23,698,963) (16,370,621)<br />

8,111,459 33,216,737<br />

Net increase (decrease) in net assets attributable to<br />

holders of redeemable units<br />

Class B 4,402 30,965<br />

Class D 810,450 1,184,699<br />

Class F (84,413) 21,123<br />

Class I (3,601,522) 46,853,755<br />

(2,871,083) 48,090,542<br />

Net assets attributable to holders of redeemable units<br />

at end of year<br />

Class B 59,464 55,062<br />

Class D 3,780,113 2,969,663<br />

Class F 51,802 136,215<br />

Class I 126,261,584 129,863,106<br />

130,152,963 133,024,046<br />

Statements of Cash Flows<br />

For the years ended December 31<br />

2014 2013<br />

Cash flows from operating activities<br />

$ $<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units (6,146,090) 17,521,103<br />

Adjustments for:<br />

Net realized (gain) loss on sale of investments (2,484,735) (4,022,330)<br />

Change in unrealized (appreciation) depreciation in<br />

the value of investments 12,623,424 (11,420,506)<br />

Purchases of investments (87,212,037) (73,325,356)<br />

Proceeds from sale of investments 76,817,769 42,371,853<br />

(Increase) decrease in accrued interest 1,155 (377)<br />

(Increase) decrease in dividends receivable 51,179 (13,777)<br />

Increase (decrease) in accrued liabilities 10,445 5,834<br />

Net cash from (used in) operating activities (6,388,890) (28,883,556)<br />

Cash flows from financing activities<br />

Distributions paid to holders of redeemable units,<br />

net of reinvested distributions (672,583) (338,584)<br />

Proceeds from redeemable units issued 28,179,288 47,510,484<br />

Redemption of redeemable units (24,237,581) (16,595,611)<br />

Net cash flows from (used in) financing activities 3,269,124 30,576,289<br />

Net increase (decrease) in cash and cash equivalents (3,069,766) 1,692,733<br />

Cash and cash equivalents at beginning of year 7,573,184 5,880,451<br />

Cash and cash equivalents at end of year* 4,503,418 7,573,184<br />

Supplementary information<br />

Cash flow from operating activities<br />

Interest received 142,009 24,104<br />

Dividends received, net of withholding taxes 4,869,527 2,695,234<br />

*Cash and cash equivalents include:<br />

Cash at banks (86,178) 81,213<br />

Short-term investments 4,589,596 7,491,971<br />

Total 4,503,418 7,573,184<br />

The accompanying notes are an integral part of these financial statements.<br />

Beutel Goodman Managed Funds Annual Report as at December 31, 2014 57