BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

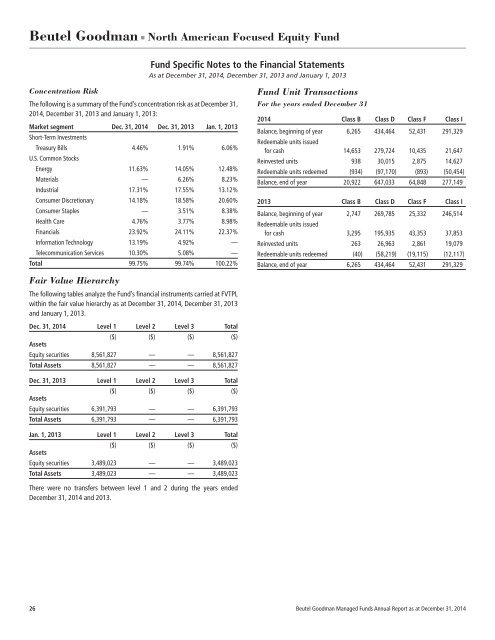

Beutel Goodman ■ North American Focused Equity Fund<br />

Fund Specific Notes to the Financial Statements<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

Concentration Risk<br />

The following is a summary of the Fund’s concentration risk as at December 31,<br />

2014, December 31, 2013 and January 1, 2013:<br />

Market segment Dec. 31, 2014 Dec. 31, 2013 Jan. 1, 2013<br />

Short-Term Investments<br />

Treasury Bills 4.46% 1.91% 6.06%<br />

U.S. Common Stocks<br />

Energy 11.63% 14.05% 12.48%<br />

Materials — 6.26% 8.23%<br />

Industrial 17.31% 17.55% 13.12%<br />

Consumer Discretionary 14.18% 18.58% 20.60%<br />

Consumer Staples — 3.51% 8.38%<br />

Health Care 4.76% 3.77% 8.98%<br />

Financials 23.92% 24.11% 22.37%<br />

Information Technology 13.19% 4.92% —<br />

Telecommunication Services 10.30% 5.08% —<br />

Total 99.75% 99.74% 100.22%<br />

Fund Unit Transactions<br />

For the years ended December 31<br />

2014 Class B Class D Class F Class I<br />

Balance, beginning of year 6,265 434,464 52,431 291,329<br />

Redeemable units issued<br />

for cash 14,653 279,724 10,435 21,647<br />

Reinvested units 938 30,015 2,875 14,627<br />

Redeemable units redeemed (934) (97,170) (893) (50,454)<br />

Balance, end of year 20,922 647,033 64,848 277,149<br />

2013 Class B Class D Class F Class I<br />

Balance, beginning of year 2,747 269,785 25,332 246,514<br />

Redeemable units issued<br />

for cash 3,295 195,935 43,353 37,853<br />

Reinvested units 263 26,963 2,861 19,079<br />

Redeemable units redeemed (40) (58,219) (19,115) (12,117)<br />

Balance, end of year 6,265 434,464 52,431 291,329<br />

Fair Value Hierarchy<br />

The following tables analyze the Fund’s financial instruments carried at FVTPL<br />

within the fair value hierarchy as at December 31, 2014, December 31, 2013<br />

and January 1, 2013.<br />

Dec. 31, 2014 Level 1 Level 2 Level 3 Total<br />

($) ($) ($) ($)<br />

Assets<br />

Equity securities 8,561,827 — — 8,561,827<br />

Total Assets 8,561,827 — — 8,561,827<br />

Dec. 31, 2013 Level 1 Level 2 Level 3 Total<br />

($) ($) ($) ($)<br />

Assets<br />

Equity securities 6,391,793 — — 6,391,793<br />

Total Assets 6,391,793 — — 6,391,793<br />

Jan. 1, 2013 Level 1 Level 2 Level 3 Total<br />

($) ($) ($) ($)<br />

Assets<br />

Equity securities 3,489,023 — — 3,489,023<br />

Total Assets 3,489,023 — — 3,489,023<br />

There were no transfers between level 1 and 2 during the years ended<br />

December 31, 2014 and 2013.<br />

26 Beutel Goodman Managed Funds Annual Report as at December 31, 2014