BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Beutel Goodman ■ Notes to Financial Statements<br />

Class B Units: for retail investors investing a minimum of $5,000 in a Fund<br />

through authorized third-party dealers;<br />

Class D Units: for retail investors investing a minimum of $5,000 in a Fund;<br />

Class F Units: for investors investing a minimum of $5,000 in a Fund, who<br />

are enrolled in a dealer-sponsored fee-for-service or wrap program (where<br />

various mutual funds are bundled together) who are subject to a periodic<br />

asset-based fee, rather than commissions on each transaction and whose<br />

dealer has signed a Class F agreement, or any other investors for whom we do<br />

not incur distribution costs, such as our employees (or affiliated corporations);<br />

Class I Units: for investors who have invested a minimum of $500,000 in a<br />

Fund and who have entered into an investment management agreement with<br />

us. At our discretion, we may waive the investment minimum.<br />

The different classes of units of a Fund represent an interest in the same<br />

portfolio investments of the Fund.<br />

The Fund Specific Notes to the Financial Statements disclose capital<br />

movements in each Fund’s capital during the years.<br />

Short-Term Trading Penalty<br />

To discourage excessive trading, the BG Funds may, at the Manager’s sole<br />

discretion, charge a short-term trading penalty of up to 2% of the amount<br />

switched or redeemed if held in the Fund for less than 30 days. This penalty is<br />

paid directly to the BG Funds.<br />

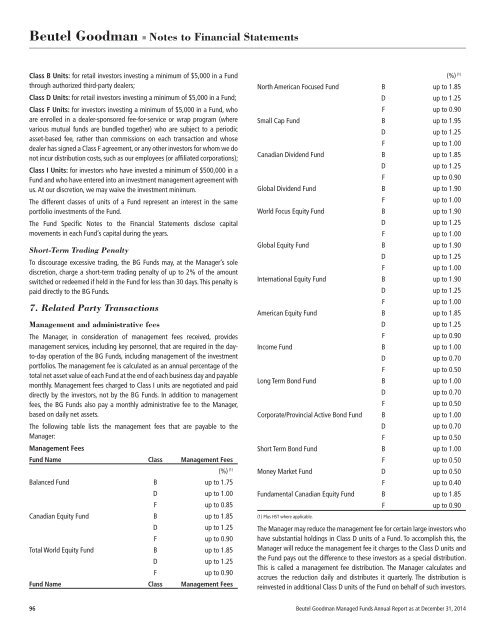

7. Related Party Transactions<br />

Management and administrative fees<br />

The Manager, in consideration of management fees received, provides<br />

management services, including key personnel, that are required in the dayto-day<br />

operation of the BG Funds, including management of the investment<br />

portfolios. The management fee is calculated as an annual percentage of the<br />

total net asset value of each Fund at the end of each business day and payable<br />

monthly. Management fees charged to Class I units are negotiated and paid<br />

directly by the investors, not by the BG Funds. In addition to management<br />

fees, the BG Funds also pay a monthly administrative fee to the Manager,<br />

based on daily net assets.<br />

The following table lists the management fees that are payable to the<br />

Manager:<br />

Management Fees<br />

Fund Name Class Management Fees<br />

(%) (1)<br />

Balanced Fund B up to 1.75<br />

D up to 1.00<br />

F up to 0.85<br />

Canadian Equity Fund B up to 1.85<br />

D up to 1.25<br />

F up to 0.90<br />

Total World Equity Fund B up to 1.85<br />

D up to 1.25<br />

F up to 0.90<br />

Fund Name Class Management Fees<br />

(%) (1)<br />

North American Focused Fund B up to 1.85<br />

D up to 1.25<br />

F up to 0.90<br />

Small Cap Fund B up to 1.95<br />

D up to 1.25<br />

F up to 1.00<br />

Canadian Dividend Fund B up to 1.85<br />

D up to 1.25<br />

F up to 0.90<br />

Global Dividend Fund B up to 1.90<br />

F up to 1.00<br />

World Focus Equity Fund B up to 1.90<br />

D up to 1.25<br />

F up to 1.00<br />

Global Equity Fund B up to 1.90<br />

D up to 1.25<br />

F up to 1.00<br />

International Equity Fund B up to 1.90<br />

D up to 1.25<br />

F up to 1.00<br />

American Equity Fund B up to 1.85<br />

D up to 1.25<br />

F up to 0.90<br />

Income Fund B up to 1.00<br />

D up to 0.70<br />

F up to 0.50<br />

Long Term Bond Fund B up to 1.00<br />

D up to 0.70<br />

F up to 0.50<br />

Corporate/Provincial Active Bond Fund B up to 1.00<br />

D up to 0.70<br />

F up to 0.50<br />

Short Term Bond Fund B up to 1.00<br />

F up to 0.50<br />

Money Market Fund D up to 0.50<br />

F up to 0.40<br />

Fundamental Canadian Equity Fund B up to 1.85<br />

F up to 0.90<br />

(1) Plus HST where applicable.<br />

The Manager may reduce the management fee for certain large investors who<br />

have substantial holdings in Class D units of a Fund. To accomplish this, the<br />

Manager will reduce the management fee it charges to the Class D units and<br />

the Fund pays out the difference to these investors as a special distribution.<br />

This is called a management fee distribution. The Manager calculates and<br />

accrues the reduction daily and distributes it quarterly. The distribution is<br />

reinvested in additional Class D units of the Fund on behalf of such investors.<br />

96 Beutel Goodman Managed Funds Annual Report as at December 31, 2014