BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

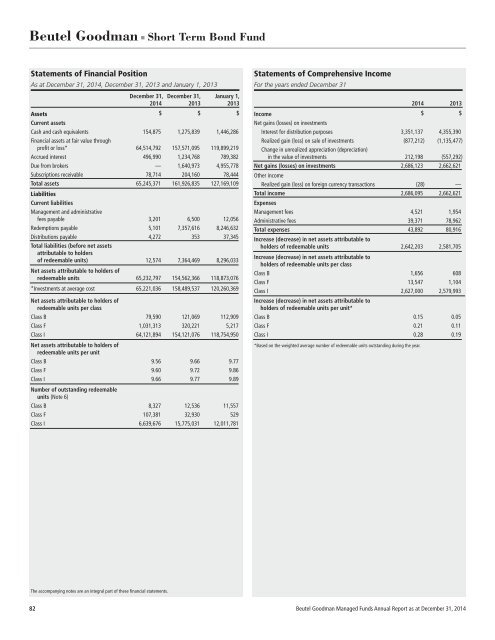

Beutel Goodman ■ Short Term Bond Fund<br />

Statements of Financial Position<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

December 31, December 31, January 1,<br />

2014 2013 2013<br />

Assets<br />

$ $ $<br />

Current assets<br />

Cash and cash equivalents 154,875 1,275,839 1,446,286<br />

Financial assets at fair value through<br />

profit or loss* 64,514,792 157,571,095 119,899,219<br />

Accrued interest 496,990 1,234,768 789,382<br />

Due from brokers — 1,640,973 4,955,778<br />

Subscriptions receivable 78,714 204,160 78,444<br />

Total assets 65,245,371 161,926,835 127,169,109<br />

Liabilities<br />

Current liabilities<br />

Management and administrative<br />

fees payable 3,201 6,500 12,056<br />

Redemptions payable 5,101 7,357,616 8,246,632<br />

Distributions payable 4,272 353 37,345<br />

Total liabilities (before net assets<br />

attributable to holders<br />

of redeemable units) 12,574 7,364,469 8,296,033<br />

Net assets attributable to holders of<br />

redeemable units 65,232,797 154,562,366 118,873,076<br />

*Investments at average cost 65,221,036 158,489,537 120,260,369<br />

Net assets attributable to holders of<br />

redeemable units per class<br />

Class B 79,590 121,069 112,909<br />

Class F 1,031,313 320,221 5,217<br />

Class I 64,121,894 154,121,076 118,754,950<br />

Net assets attributable to holders of<br />

redeemable units per unit<br />

Class B 9.56 9.66 9.77<br />

Class F 9.60 9.72 9.86<br />

Class I 9.66 9.77 9.89<br />

Number of outstanding redeemable<br />

units (Note 6)<br />

Class B 8,327 12,536 11,557<br />

Class F 107,381 32,930 529<br />

Class I 6,639,676 15,775,031 12,011,781<br />

Statements of Comprehensive Income<br />

For the years ended December 31<br />

Income<br />

Net gains (losses) on investments<br />

2014 2013<br />

$ $<br />

Interest for distribution purposes 3,351,137 4,355,390<br />

Realized gain (loss) on sale of investments (877,212) (1,135,477)<br />

Change in unrealized appreciation (depreciation)<br />

in the value of investments 212,198 (557,292)<br />

Net gains (losses) on investments 2,686,123 2,662,621<br />

Other income<br />

Realized gain (loss) on foreign currency transactions (28) —<br />

Total income 2,686,095 2,662,621<br />

Expenses<br />

Management fees 4,521 1,954<br />

Administrative fees 39,371 78,962<br />

Total expenses 43,892 80,916<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units 2,642,203 2,581,705<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per class<br />

Class B 1,656 608<br />

Class F 13,547 1,104<br />

Class I 2,627,000 2,579,993<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per unit*<br />

Class B 0.15 0.05<br />

Class F 0.21 0.11<br />

Class I 0.28 0.19<br />

*Based on the weighted average number of redeemable units outstanding during the year.<br />

The accompanying notes are an integral part of these financial statements.<br />

82 Beutel Goodman Managed Funds Annual Report as at December 31, 2014