BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Beutel Goodman ■ Fundamental Canadian Equity Fund<br />

Fund Specific Notes to the Financial Statements<br />

As at December 31, 2014<br />

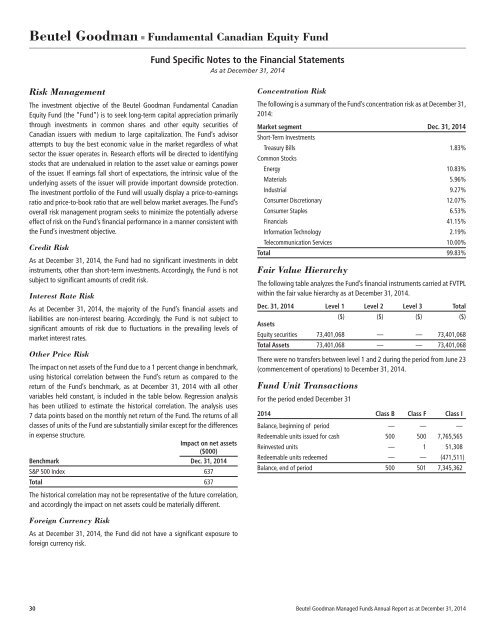

Risk Management<br />

The investment objective of the Beutel Goodman Fundamental Canadian<br />

Equity Fund (the “Fund”) is to seek long-term capital appreciation primarily<br />

through investments in common shares and other equity securities of<br />

Canadian issuers with medium to large capitalization. The Fund’s advisor<br />

attempts to buy the best economic value in the market regardless of what<br />

sector the issuer operates in. Research efforts will be directed to identifying<br />

stocks that are undervalued in relation to the asset value or earnings power<br />

of the issuer. If earnings fall short of expectations, the intrinsic value of the<br />

underlying assets of the issuer will provide important downside protection.<br />

The investment portfolio of the Fund will usually display a price-to-earnings<br />

ratio and price-to-book ratio that are well below market averages. The Fund’s<br />

overall risk management program seeks to minimize the potentially adverse<br />

effect of risk on the Fund’s financial performance in a manner consistent with<br />

the Fund’s investment objective.<br />

Credit Risk<br />

As at December 31, 2014, the Fund had no significant investments in debt<br />

instruments, other than short-term investments. Accordingly, the Fund is not<br />

subject to significant amounts of credit risk.<br />

Interest Rate Risk<br />

As at December 31, 2014, the majority of the Fund’s financial assets and<br />

liabilities are non-interest bearing. Accordingly, the Fund is not subject to<br />

significant amounts of risk due to fluctuations in the prevailing levels of<br />

market interest rates.<br />

Other Price Risk<br />

The impact on net assets of the Fund due to a 1 percent change in benchmark,<br />

using historical correlation between the Fund’s return as compared to the<br />

return of the Fund’s benchmark, as at December 31, 2014 with all other<br />

variables held constant, is included in the table below. Regression analysis<br />

has been utilized to estimate the historical correlation. The analysis uses<br />

7 data points based on the monthly net return of the Fund. The returns of all<br />

classes of units of the Fund are substantially similar except for the differences<br />

in expense structure.<br />

Impact on net assets<br />

($000)<br />

Benchmark Dec. 31, 2014<br />

S&P 500 Index 637<br />

Total 637<br />

The historical correlation may not be representative of the future correlation,<br />

and accordingly the impact on net assets could be materially different.<br />

Concentration Risk<br />

The following is a summary of the Fund’s concentration risk as at December 31,<br />

2014:<br />

Market segment Dec. 31, 2014<br />

Short-Term Investments<br />

Treasury Bills 1.83%<br />

Common Stocks<br />

Energy 10.83%<br />

Materials 5.96%<br />

Industrial 9.27%<br />

Consumer Discretionary 12.07%<br />

Consumer Staples 6.53%<br />

Financials 41.15%<br />

Information Technology 2.19%<br />

Telecommunication Services 10.00%<br />

Total 99.83%<br />

Fair Value Hierarchy<br />

The following table analyzes the Fund’s financial instruments carried at FVTPL<br />

within the fair value hierarchy as at December 31, 2014.<br />

Dec. 31, 2014 Level 1 Level 2 Level 3 Total<br />

($) ($) ($) ($)<br />

Assets<br />

Equity securities 73,401,068 — — 73,401,068<br />

Total Assets 73,401,068 — — 73,401,068<br />

There were no transfers between level 1 and 2 during the period from June 23<br />

(commencement of operations) to December 31, 2014.<br />

Fund Unit Transactions<br />

For the period ended December 31<br />

2014 Class B Class F Class I<br />

Balance, beginning of period — — —<br />

Redeemable units issued for cash 500 500 7,765,565<br />

Reinvested units — 1 51,308<br />

Redeemable units redeemed — — (471,511)<br />

Balance, end of period 500 501 7,345,362<br />

Foreign Currency Risk<br />

As at December 31, 2014, the Fund did not have a significant exposure to<br />

foreign currency risk.<br />

30 Beutel Goodman Managed Funds Annual Report as at December 31, 2014