BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

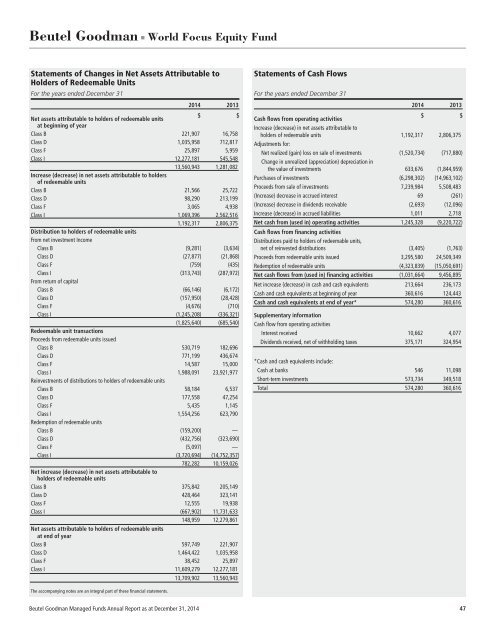

Beutel Goodman ■ World Focus Equity Fund<br />

Statements of Changes in Net Assets Attributable to<br />

Holders of Redeemable Units<br />

For the years ended December 31<br />

2014 2013<br />

Net assets attributable to holders of redeemable units<br />

$ $<br />

at beginning of year<br />

Class B 221,907 16,758<br />

Class D 1,035,958 712,817<br />

Class F 25,897 5,959<br />

Class I 12,277,181 545,548<br />

13,560,943 1,281,082<br />

Increase (decrease) in net assets attributable to holders<br />

of redeemable units<br />

Class B 21,566 25,722<br />

Class D 98,290 213,199<br />

Class F 3,065 4,938<br />

Class I 1,069,396 2,562,516<br />

1,192,317 2,806,375<br />

Distribution to holders of redeemable units<br />

From net investment Income<br />

Class B (9,281) (3,634)<br />

Class D (27,877) (21,868)<br />

Class F (759) (435)<br />

Class I (313,743) (287,972)<br />

From return of capital<br />

Class B (66,146) (6,172)<br />

Class D (157,950) (28,428)<br />

Class F (4,676) (710)<br />

Class I (1,245,208) (336,321)<br />

(1,825,640) (685,540)<br />

Redeemable unit transactions<br />

Proceeds from redeemable units issued<br />

Class B 530,719 182,696<br />

Class D 771,199 436,674<br />

Class F 14,587 15,000<br />

Class I 1,988,091 23,921,977<br />

Reinvestments of distributions to holders of redeemable units<br />

Class B 58,184 6,537<br />

Class D 177,558 47,254<br />

Class F 5,435 1,145<br />

Class I 1,554,256 623,790<br />

Redemption of redeemable units<br />

Class B (159,200) —<br />

Class D (432,756) (323,690)<br />

Class F (5,097) —<br />

Class I (3,720,694) (14,752,357)<br />

782,282 10,159,026<br />

Net increase (decrease) in net assets attributable to<br />

holders of redeemable units<br />

Class B 375,842 205,149<br />

Class D 428,464 323,141<br />

Class F 12,555 19,938<br />

Class I (667,902) 11,731,633<br />

148,959 12,279,861<br />

Net assets attributable to holders of redeemable units<br />

at end of year<br />

Class B 597,749 221,907<br />

Class D 1,464,422 1,035,958<br />

Class F 38,452 25,897<br />

Class I 11,609,279 12,277,181<br />

13,709,902 13,560,943<br />

Statements of Cash Flows<br />

For the years ended December 31<br />

2014 2013<br />

Cash flows from operating activities<br />

$ $<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units 1,192,317 2,806,375<br />

Adjustments for:<br />

Net realized (gain) loss on sale of investments (1,520,734) (717,880)<br />

Change in unrealized (appreciation) depreciation in<br />

the value of investments 633,676 (1,844,959)<br />

Purchases of investments (6,298,302) (14,963,102)<br />

Proceeds from sale of investments 7,239,984 5,508,483<br />

(Increase) decrease in accrued interest 69 (261)<br />

(Increase) decrease in dividends receivable (2,693) (12,096)<br />

Increase (decrease) in accrued liabilities 1,011 2,718<br />

Net cash from (used in) operating activities 1,245,328 (9,220,722)<br />

Cash flows from financing activities<br />

Distributions paid to holders of redeemable units,<br />

net of reinvested distributions (3,405) (1,763)<br />

Proceeds from redeemable units issued 3,295,580 24,509,349<br />

Redemption of redeemable units (4,323,839) (15,050,691)<br />

Net cash flows from (used in) financing activities (1,031,664) 9,456,895<br />

Net increase (decrease) in cash and cash equivalents 213,664 236,173<br />

Cash and cash equivalents at beginning of year 360,616 124,443<br />

Cash and cash equivalents at end of year* 574,280 360,616<br />

Supplementary information<br />

Cash flow from operating activities<br />

Interest received 10,662 4,077<br />

Dividends received, net of withholding taxes 375,171 324,954<br />

*Cash and cash equivalents include:<br />

Cash at banks 546 11,098<br />

Short-term investments 573,734 349,518<br />

Total 574,280 360,616<br />

The accompanying notes are an integral part of these financial statements.<br />

Beutel Goodman Managed Funds Annual Report as at December 31, 2014 47