BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

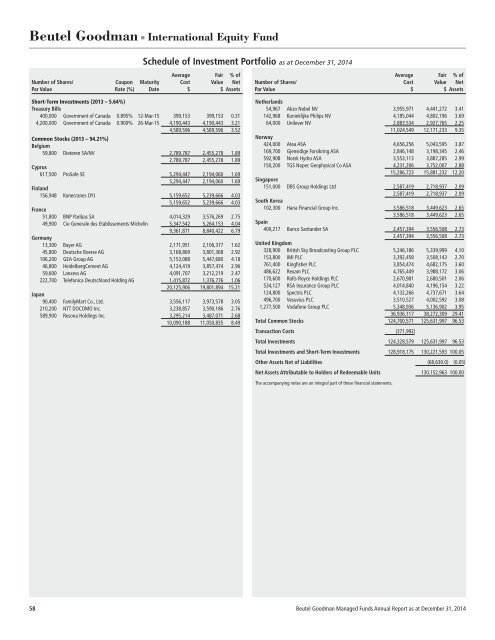

Beutel Goodman ■ International Equity Fund<br />

Schedule of Investment Portfolio as at December 31, 2014<br />

Average Fair % of<br />

Number of Shares/ Coupon Maturity Cost Value Net<br />

Par Value Rate (%) Date $ $ Assets<br />

Short-Term Investments (2013 – 5.64%)<br />

Treasury Bills<br />

400,000 Government of Canada 0.895% 12-Mar-15 399,153 399,153 0.31<br />

4,200,000 Government of Canada 0.900% 26-Mar-15 4,190,443 4,190,443 3.21<br />

4,589,596 4,589,596 3.52<br />

Common Stocks (2013 – 94.21%)<br />

Belgium<br />

59,800 Dieteren SA/NV 2,789,787 2,455,278 1.89<br />

2,789,787 2,455,278 1.89<br />

Cyprus<br />

617,500 ProSafe SE 5,294,447 2,194,060 1.69<br />

5,294,447 2,194,060 1.69<br />

Finland<br />

156,948 Konecranes OYJ 5,159,652 5,239,666 4.03<br />

5,159,652 5,239,666 4.03<br />

France<br />

51,800 BNP Paribas SA 4,014,329 3,576,269 2.75<br />

49,900 Cie Generale des Etablissements Michelin 5,347,542 5,264,153 4.04<br />

9,361,871 8,840,422 6.79<br />

Germany<br />

13,300 Bayer AG 2,171,951 2,106,377 1.62<br />

45,800 Deutsche Boerse AG 3,168,869 3,801,368 2.92<br />

106,200 GEA Group AG 5,153,088 5,447,680 4.18<br />

46,800 HeidelbergCement AG 4,124,419 3,857,474 2.96<br />

59,600 Lanxess AG 4,091,707 3,212,219 2.47<br />

222,700 Telefonica Deutschland Holding AG 1,415,872 1,376,776 1.06<br />

20,125,906 19,801,894 15.21<br />

Japan<br />

90,400 FamilyMart Co., Ltd. 3,556,117 3,973,578 3.05<br />

210,200 NTT DOCOMO Inc. 3,238,857 3,590,186 2.76<br />

589,900 Resona Holdings Inc. 3,295,214 3,487,071 2.68<br />

10,090,188 11,050,835 8.49<br />

Average Fair % of<br />

Number of Shares/ Cost Value Net<br />

Par Value $ $ Assets<br />

Netherlands<br />

54,967 Akzo Nobel NV 3,955,971 4,441,272 3.41<br />

142,968 Koninklijke Philips NV 4,185,044 4,802,196 3.69<br />

64,000 Unilever NV 2,883,534 2,927,765 2.25<br />

11,024,549 12,171,233 9.35<br />

Norway<br />

424,000 Atea ASA 4,656,256 5,043,595 3.87<br />

169,700 Gjensidige Forsikring ASA 2,846,148 3,198,345 2.46<br />

592,908 Norsk Hydro ASA 3,553,113 3,887,285 2.99<br />

150,200 TGS Nopec Geophysical Co ASA 4,231,206 3,752,007 2.88<br />

15,286,723 15,881,232 12.20<br />

Singapore<br />

151,000 DBS Group Holdings Ltd 2,587,419 2,718,937 2.09<br />

2,587,419 2,718,937 2.09<br />

South Korea<br />

102,300 Hana Financial Group Inc. 3,586,518 3,449,623 2.65<br />

3,586,518 3,449,623 2.65<br />

Spain<br />

400,217 Banco Santander SA 2,457,394 3,556,508 2.73<br />

2,457,394 3,556,508 2.73<br />

United Kingdom<br />

328,900 British Sky Broadcasting Group PLC 5,246,186 5,339,999 4.10<br />

153,800 IMI PLC 3,392,458 3,508,143 2.70<br />

761,400 Kingfisher PLC 3,854,474 4,682,175 3.60<br />

486,622 Rexam PLC 4,765,449 3,988,172 3.06<br />

170,600 Rolls-Royce Holdings PLC 2,670,981 2,680,501 2.06<br />

534,127 RSA Insurance Group PLC 4,014,840 4,196,154 3.22<br />

124,800 Spectris PLC 4,132,266 4,737,671 3.64<br />

496,700 Vesuvius PLC 3,510,527 4,002,592 3.08<br />

1,277,500 Vodafone Group PLC 5,348,936 5,136,902 3.95<br />

36,936,117 38,272,309 29.41<br />

Total Common Stocks 124,700,571 125,631,997 96.53<br />

Transaction Costs (371,992)<br />

Total Investments 124,328,579 125,631,997 96.53<br />

Total Investments and Short-Term Investments 128,918,175 130,221,593 100.05<br />

Other Assets Net of Liabilities (68,630.0) (0.05)<br />

Net Assets Attributable to Holders of Redeemable Units 130,152,963 100.00<br />

The accompanying notes are an integral part of these financial statements.<br />

58 Beutel Goodman Managed Funds Annual Report as at December 31, 2014