BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Beutel Goodman ■ Money Market Fund<br />

Fund Specific Notes to the Financial Statements<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

Risk Management<br />

The investment objective of the Beutel Goodman Money Market Fund (the<br />

“Fund”) is to seek to maintain a high level of liquidity by investing in high<br />

quality Canadian money market instruments such as treasury bills, shortterm<br />

government and corporate securities and deposit receipts of Canadian<br />

chartered banks and trust companies having a term to maturity not exceeding<br />

one year. The Fund will invest in a variety of money market instruments<br />

including Government of Canada treasury bills, short-term government<br />

bonds, commercial paper, short-term corporate bonds, chartered bank deposit<br />

receipts with a rating of A1 or R1 (low) depending on the rating agency, with<br />

a term to maturity of less than a year. The Fund is conservatively managed<br />

with an average term to maturity of less than 183 days. The Fund’s overall<br />

risk management program seeks to minimize the potentially adverse effect<br />

of risk on the Fund’s financial performance in a manner consistent with the<br />

Fund’s investment objective.<br />

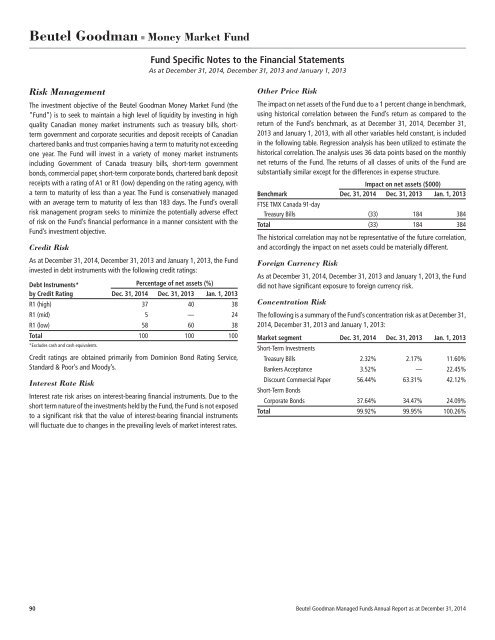

Credit Risk<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013, the Fund<br />

invested in debt instruments with the following credit ratings:<br />

Debt Instruments* Percentage of net assets (%)<br />

by Credit Rating Dec. 31, 2014 Dec. 31, 2013 Jan. 1, 2013<br />

R1 (high) 37 40 38<br />

R1 (mid) 5 — 24<br />

R1 (low) 58 60 38<br />

Total 100 100 100<br />

*Excludes cash and cash equivalents.<br />

Credit ratings are obtained primarily from Dominion Bond Rating Service,<br />

Standard & Poor’s and Moody’s.<br />

Interest Rate Risk<br />

Interest rate risk arises on interest-bearing financial instruments. Due to the<br />

short term nature of the investments held by the Fund, the Fund is not exposed<br />

to a significant risk that the value of interest-bearing financial instruments<br />

will fluctuate due to changes in the prevailing levels of market interest rates.<br />

Other Price Risk<br />

The impact on net assets of the Fund due to a 1 percent change in benchmark,<br />

using historical correlation between the Fund’s return as compared to the<br />

return of the Fund’s benchmark, as at December 31, 2014, December 31,<br />

2013 and January 1, 2013, with all other variables held constant, is included<br />

in the following table. Regression analysis has been utilized to estimate the<br />

historical correlation. The analysis uses 36 data points based on the monthly<br />

net returns of the Fund. The returns of all classes of units of the Fund are<br />

substantially similar except for the differences in expense structure.<br />

Impact on net assets ($000)<br />

Benchmark Dec. 31, 2014 Dec. 31, 2013 Jan. 1, 2013<br />

FTSE TMX Canada 91-day<br />

Treasury Bills (33) 184 384<br />

Total (33) 184 384<br />

The historical correlation may not be representative of the future correlation,<br />

and accordingly the impact on net assets could be materially different.<br />

Foreign Currency Risk<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013, the Fund<br />

did not have significant exposure to foreign currency risk.<br />

Concentration Risk<br />

The following is a summary of the Fund’s concentration risk as at December 31,<br />

2014, December 31, 2013 and January 1, 2013:<br />

Market segment Dec. 31, 2014 Dec. 31, 2013 Jan. 1, 2013<br />

Short-Term Investments<br />

Treasury Bills 2.32% 2.17% 11.60%<br />

Bankers Acceptance 3.52% — 22.45%<br />

Discount Commercial Paper 56.44% 63.31% 42.12%<br />

Short-Term Bonds<br />

Corporate Bonds 37.64% 34.47% 24.09%<br />

Total 99.92% 99.95% 100.26%<br />

90 Beutel Goodman Managed Funds Annual Report as at December 31, 2014