BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

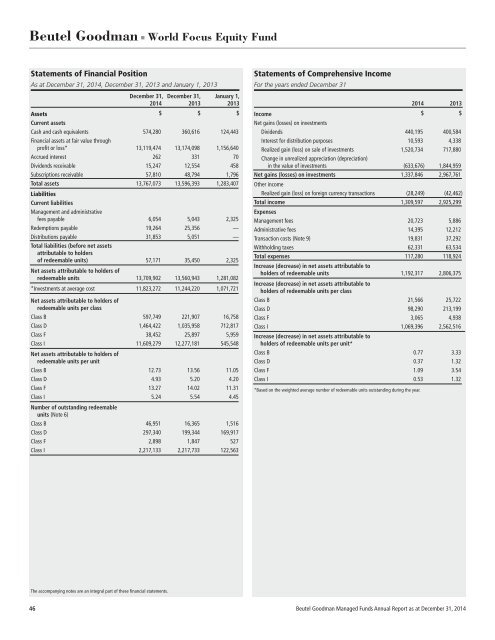

Beutel Goodman ■ World Focus Equity Fund<br />

Statements of Financial Position<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

December 31, December 31, January 1,<br />

2014 2013 2013<br />

Assets<br />

$ $ $<br />

Current assets<br />

Cash and cash equivalents 574,280 360,616 124,443<br />

Financial assets at fair value through<br />

profit or loss* 13,119,474 13,174,098 1,156,640<br />

Accrued interest 262 331 70<br />

Dividends receivable 15,247 12,554 458<br />

Subscriptions receivable 57,810 48,794 1,796<br />

Total assets 13,767,073 13,596,393 1,283,407<br />

Liabilities<br />

Current liabilities<br />

Management and administrative<br />

fees payable 6,054 5,043 2,325<br />

Redemptions payable 19,264 25,356 —<br />

Distributions payable 31,853 5,051 —<br />

Total liabilities (before net assets<br />

attributable to holders<br />

of redeemable units) 57,171 35,450 2,325<br />

Net assets attributable to holders of<br />

redeemable units 13,709,902 13,560,943 1,281,082<br />

*Investments at average cost 11,823,272 11,244,220 1,071,721<br />

Net assets attributable to holders of<br />

redeemable units per class<br />

Class B 597,749 221,907 16,758<br />

Class D 1,464,422 1,035,958 712,817<br />

Class F 38,452 25,897 5,959<br />

Class I 11,609,279 12,277,181 545,548<br />

Net assets attributable to holders of<br />

redeemable units per unit<br />

Class B 12.73 13.56 11.05<br />

Class D 4.93 5.20 4.20<br />

Class F 13.27 14.02 11.31<br />

Class I 5.24 5.54 4.45<br />

Number of outstanding redeemable<br />

units (Note 6)<br />

Class B 46,951 16,365 1,516<br />

Class D 297,340 199,344 169,917<br />

Class F 2,898 1,847 527<br />

Class I 2,217,133 2,217,733 122,563<br />

Statements of Comprehensive Income<br />

For the years ended December 31<br />

Income<br />

Net gains (losses) on investments<br />

2014 2013<br />

$ $<br />

Dividends 440,195 400,584<br />

Interest for distribution purposes 10,593 4,338<br />

Realized gain (loss) on sale of investments 1,520,734 717,880<br />

Change in unrealized appreciation (depreciation)<br />

in the value of investments (633,676) 1,844,959<br />

Net gains (losses) on investments 1,337,846 2,967,761<br />

Other income<br />

Realized gain (loss) on foreign currency transactions (28,249) (42,462)<br />

Total income 1,309,597 2,925,299<br />

Expenses<br />

Management fees 20,723 5,886<br />

Administrative fees 14,395 12,212<br />

Transaction costs (Note 9) 19,831 37,292<br />

Withholding taxes 62,331 63,534<br />

Total expenses 117,280 118,924<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units 1,192,317 2,806,375<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per class<br />

Class B 21,566 25,722<br />

Class D 98,290 213,199<br />

Class F 3,065 4,938<br />

Class I 1,069,396 2,562,516<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per unit*<br />

Class B 0.77 3.33<br />

Class D 0.37 1.32<br />

Class F 1.09 3.54<br />

Class I 0.53 1.32<br />

*Based on the weighted average number of redeemable units outstanding during the year.<br />

The accompanying notes are an integral part of these financial statements.<br />

46 Beutel Goodman Managed Funds Annual Report as at December 31, 2014