Worldwide transfer pricing reference guide 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

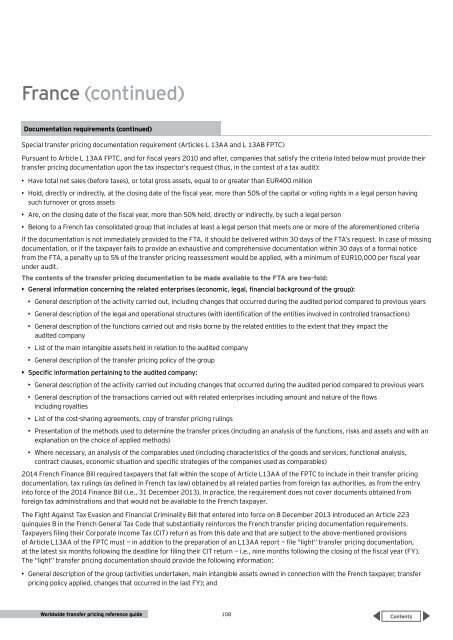

France (continued)<br />

Documentation requirements (continued)<br />

Special <strong>transfer</strong> <strong>pricing</strong> documentation requirement (Articles L 13AA and L 13AB FPTC)<br />

Pursuant to Article L 13AA FPTC, and for fiscal years 2010 and after, companies that satisfy the criteria listed below must provide their<br />

<strong>transfer</strong> <strong>pricing</strong> documentation upon the tax inspector’s request (thus, in the context of a tax audit):<br />

• Have total net sales (before taxes), or total gross assets, equal to or greater than EUR400 million<br />

• Hold, directly or indirectly, at the closing date of the fiscal year, more than 50% of the capital or voting rights in a legal person having<br />

such turnover or gross assets<br />

• Are, on the closing date of the fiscal year, more than 50% held, directly or indirectly, by such a legal person<br />

• Belong to a French tax consolidated group that includes at least a legal person that meets one or more of the aforementioned criteria<br />

If the documentation is not immediately provided to the FTA, it should be delivered within 30 days of the FTA’s request. In case of missing<br />

documentation, or if the taxpayer fails to provide an exhaustive and comprehensive documentation within 30 days of a formal notice<br />

from the FTA, a penalty up to 5% of the <strong>transfer</strong> <strong>pricing</strong> reassessment would be applied, with a minimum of EUR10,000 per fiscal year<br />

under audit.<br />

The contents of the <strong>transfer</strong> <strong>pricing</strong> documentation to be made available to the FTA are two-fold:<br />

• General information concerning the related enterprises (economic, legal, financial background of the group):<br />

• General description of the activity carried out, including changes that occurred during the audited period compared to previous years<br />

• General description of the legal and operational structures (with identification of the entities involved in controlled transactions)<br />

• General description of the functions carried out and risks borne by the related entities to the extent that they impact the<br />

audited company<br />

• List of the main intangible assets held in relation to the audited company<br />

• General description of the <strong>transfer</strong> <strong>pricing</strong> policy of the group<br />

• Specific information pertaining to the audited company:<br />

• General description of the activity carried out including changes that occurred during the audited period compared to previous years<br />

• General description of the transactions carried out with related enterprises including amount and nature of the flows<br />

including royalties<br />

• List of the cost-sharing agreements, copy of <strong>transfer</strong> <strong>pricing</strong> rulings<br />

• Presentation of the methods used to determine the <strong>transfer</strong> prices (including an analysis of the functions, risks and assets and with an<br />

explanation on the choice of applied methods)<br />

• Where necessary, an analysis of the comparables used (including characteristics of the goods and services, functional analysis,<br />

contract clauses, economic situation and specific strategies of the companies used as comparables)<br />

<strong>2014</strong> French Finance Bill required taxpayers that fall within the scope of Article L13AA of the FPTC to include in their <strong>transfer</strong> <strong>pricing</strong><br />

documentation, tax rulings (as defined in French tax law) obtained by all related parties from foreign tax authorities, as from the entry<br />

into force of the <strong>2014</strong> Finance Bill (i.e., 31 December 2013). In practice, the requirement does not cover documents obtained from<br />

foreign tax administrations and that would not be available to the French taxpayer.<br />

The Fight Against Tax Evasion and Financial Criminality Bill that entered into force on 8 December 2013 introduced an Article 223<br />

quinquies B in the French General Tax Code that substantially reinforces the French <strong>transfer</strong> <strong>pricing</strong> documentation requirements.<br />

Taxpayers filing their Corporate Income Tax (CIT) return as from this date and that are subject to the above-mentioned provisions<br />

of Article L13AA of the FPTC must — in addition to the preparation of an L13AA report — file “light” <strong>transfer</strong> <strong>pricing</strong> documentation,<br />

at the latest six months following the deadline for filing their CIT return — i.e., nine months following the closing of the fiscal year (FY).<br />

The “light” <strong>transfer</strong> <strong>pricing</strong> documentation should provide the following information:<br />

• General description of the group (activities undertaken, main intangible assets owned in connection with the French taxpayer, <strong>transfer</strong><br />

<strong>pricing</strong> policy applied, changes that occurred in the last FY); and<br />

<strong>Worldwide</strong> <strong>transfer</strong> <strong>pricing</strong> <strong>reference</strong> <strong>guide</strong><br />

108