Worldwide transfer pricing reference guide 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Australia (continued)<br />

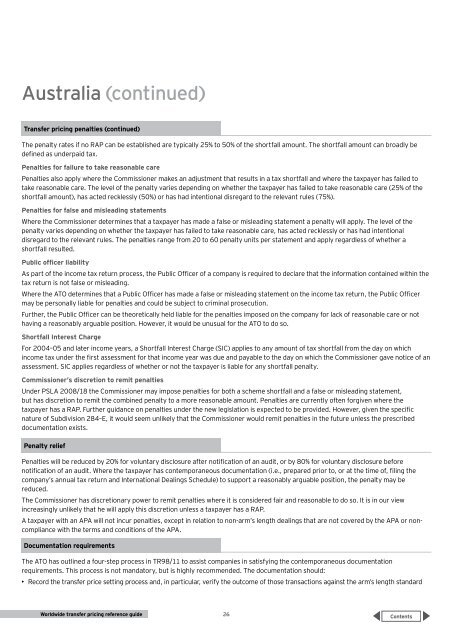

Transfer <strong>pricing</strong> penalties (continued)<br />

The penalty rates if no RAP can be established are typically 25% to 50% of the shortfall amount. The shortfall amount can broadly be<br />

defined as underpaid tax.<br />

Penalties for failure to take reasonable care<br />

Penalties also apply where the Commissioner makes an adjustment that results in a tax shortfall and where the taxpayer has failed to<br />

take reasonable care. The level of the penalty varies depending on whether the taxpayer has failed to take reasonable care (25% of the<br />

shortfall amount), has acted recklessly (50%) or has had intentional disregard to the relevant rules (75%).<br />

Penalties for false and misleading statements<br />

Where the Commissioner determines that a taxpayer has made a false or misleading statement a penalty will apply. The level of the<br />

penalty varies depending on whether the taxpayer has failed to take reasonable care, has acted recklessly or has had intentional<br />

disregard to the relevant rules. The penalties range from 20 to 60 penalty units per statement and apply regardless of whether a<br />

shortfall resulted.<br />

Public officer liability<br />

As part of the income tax return process, the Public Officer of a company is required to declare that the information contained within the<br />

tax return is not false or misleading.<br />

Where the ATO determines that a Public Officer has made a false or misleading statement on the income tax return, the Public Officer<br />

may be personally liable for penalties and could be subject to criminal prosecution.<br />

Further, the Public Officer can be theoretically held liable for the penalties imposed on the company for lack of reasonable care or not<br />

having a reasonably arguable position. However, it would be unusual for the ATO to do so.<br />

Shortfall Interest Charge<br />

For 2004–05 and later income years, a Shortfall Interest Charge (SIC) applies to any amount of tax shortfall from the day on which<br />

income tax under the first assessment for that income year was due and payable to the day on which the Commissioner gave notice of an<br />

assessment. SIC applies regardless of whether or not the taxpayer is liable for any shortfall penalty.<br />

Commissioner’s discretion to remit penalties<br />

Under PSLA 2008/18 the Commissioner may impose penalties for both a scheme shortfall and a false or misleading statement,<br />

but has discretion to remit the combined penalty to a more reasonable amount. Penalties are currently often forgiven where the<br />

taxpayer has a RAP. Further guidance on penalties under the new legislation is expected to be provided. However, given the specific<br />

nature of Subdivision 284–E, it would seem unlikely that the Commissioner would remit penalties in the future unless the prescribed<br />

documentation exists.<br />

Penalty relief<br />

Penalties will be reduced by 20% for voluntary disclosure after notification of an audit, or by 80% for voluntary disclosure before<br />

notification of an audit. Where the taxpayer has contemporaneous documentation (i.e., prepared prior to, or at the time of, filing the<br />

company’s annual tax return and International Dealings Schedule) to support a reasonably arguable position, the penalty may be<br />

reduced.<br />

The Commissioner has discretionary power to remit penalties where it is considered fair and reasonable to do so. It is in our view<br />

increasingly unlikely that he will apply this discretion unless a taxpayer has a RAP.<br />

A taxpayer with an APA will not incur penalties, except in relation to non-arm’s length dealings that are not covered by the APA or noncompliance<br />

with the terms and conditions of the APA.<br />

Documentation requirements<br />

The ATO has outlined a four-step process in TR98/11 to assist companies in satisfying the contemporaneous documentation<br />

requirements. This process is not mandatory, but is highly recommended. The documentation should:<br />

• Record the <strong>transfer</strong> price setting process and, in particular, verify the outcome of those transactions against the arm’s length standard<br />

<strong>Worldwide</strong> <strong>transfer</strong> <strong>pricing</strong> <strong>reference</strong> <strong>guide</strong><br />

26