Worldwide transfer pricing reference guide 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

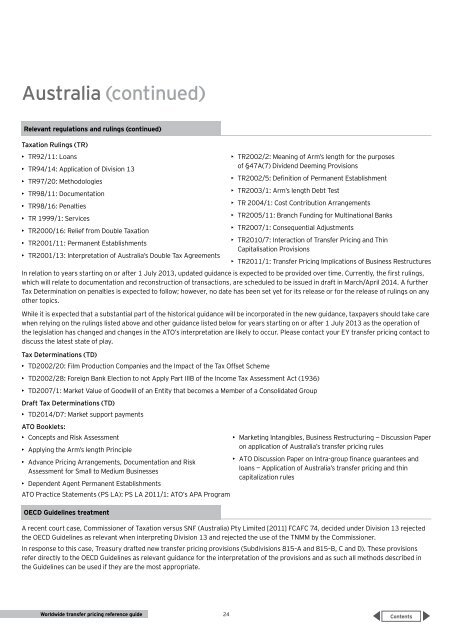

Australia (continued)<br />

Relevant regulations and rulings (continued)<br />

Taxation Rulings (TR)<br />

• TR92/11: Loans<br />

• TR94/14: Application of Division 13<br />

• TR97/20: Methodologies<br />

• TR98/11: Documentation<br />

• TR98/16: Penalties<br />

• TR 1999/1: Services<br />

• TR2000/16: Relief from Double Taxation<br />

• TR2001/11: Permanent Establishments<br />

• TR2001/13: Interpretation of Australia’s Double Tax Agreements<br />

• TR2002/2: Meaning of Arm’s length for the purposes<br />

of §47A(7) Dividend Deeming Provisions<br />

• TR2002/5: Definition of Permanent Establishment<br />

• TR2003/1: Arm’s length Debt Test<br />

• TR 2004/1: Cost Contribution Arrangements<br />

• TR2005/11: Branch Funding for Multinational Banks<br />

• TR2007/1: Consequential Adjustments<br />

• TR2010/7: Interaction of Transfer Pricing and Thin<br />

Capitalisation Provisions<br />

• TR2011/1: Transfer Pricing Implications of Business Restructures<br />

In relation to years starting on or after 1 July 2013, updated guidance is expected to be provided over time. Currently, the first rulings,<br />

which will relate to documentation and reconstruction of transactions, are scheduled to be issued in draft in March/April <strong>2014</strong>. A further<br />

Tax Determination on penalties is expected to follow; however, no date has been set yet for its release or for the release of rulings on any<br />

other topics.<br />

While it is expected that a substantial part of the historical guidance will be incorporated in the new guidance, taxpayers should take care<br />

when relying on the rulings listed above and other guidance listed below for years starting on or after 1 July 2013 as the operation of<br />

the legislation has changed and changes in the ATO’s interpretation are likely to occur. Please contact your EY <strong>transfer</strong> <strong>pricing</strong> contact to<br />

discuss the latest state of play.<br />

Tax Determinations (TD)<br />

• TD2002/20: Film Production Companies and the Impact of the Tax Offset Scheme<br />

• TD2002/28: Foreign Bank Election to not Apply Part IIIB of the Income Tax Assessment Act (1936)<br />

• TD2007/1: Market Value of Goodwill of an Entity that becomes a Member of a Consolidated Group<br />

Draft Tax Determinations (TD)<br />

• TD<strong>2014</strong>/D7: Market support payments<br />

ATO Booklets:<br />

• Concepts and Risk Assessment<br />

• Marketing Intangibles, Business Restructuring — Discussion Paper<br />

• Applying the Arm’s length Principle<br />

on application of Australia’s <strong>transfer</strong> <strong>pricing</strong> rules<br />

• Advance Pricing Arrangements, Documentation and Risk<br />

• ATO Discussion Paper on Intra-group finance guarantees and<br />

Assessment for Small to Medium Businesses<br />

loans — Application of Australia’s <strong>transfer</strong> <strong>pricing</strong> and thin<br />

capitalization rules<br />

• Dependent Agent Permanent Establishments<br />

ATO Practice Statements (PS LA): PS LA 2011/1: ATO’s APA Program<br />

OECD Guidelines treatment<br />

A recent court case, Commissioner of Taxation versus SNF (Australia) Pty Limited [2011] FCAFC 74, decided under Division 13 rejected<br />

the OECD Guidelines as relevant when interpreting Division 13 and rejected the use of the TNMM by the Commissioner.<br />

In response to this case, Treasury drafted new <strong>transfer</strong> <strong>pricing</strong> provisions (Subdivisions 815–A and 815–B, C and D). These provisions<br />

refer directly to the OECD Guidelines as relevant guidance for the interpretation of the provisions and as such all methods described in<br />

the Guidelines can be used if they are the most appropriate.<br />

<strong>Worldwide</strong> <strong>transfer</strong> <strong>pricing</strong> <strong>reference</strong> <strong>guide</strong><br />

24