Worldwide transfer pricing reference guide 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

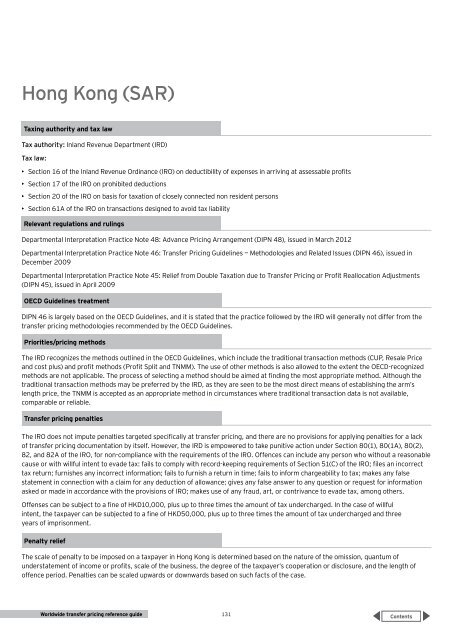

Hong Kong (SAR)<br />

Taxing authority and tax law<br />

Tax authority: Inland Revenue Department (IRD)<br />

Tax law:<br />

• Section 16 of the Inland Revenue Ordinance (IRO) on deductibility of expenses in arriving at assessable profits<br />

• Section 17 of the IRO on prohibited deductions<br />

• Section 20 of the IRO on basis for taxation of closely connected non resident persons<br />

• Section 61A of the IRO on transactions designed to avoid tax liability<br />

Relevant regulations and rulings<br />

Departmental Interpretation Practice Note 48: Advance Pricing Arrangement (DIPN 48), issued in March 2012<br />

Departmental Interpretation Practice Note 46: Transfer Pricing Guidelines — Methodologies and Related Issues (DIPN 46), issued in<br />

December 2009<br />

Departmental Interpretation Practice Note 45: Relief from Double Taxation due to Transfer Pricing or Profit Reallocation Adjustments<br />

(DIPN 45), issued in April 2009<br />

OECD Guidelines treatment<br />

DIPN 46 is largely based on the OECD Guidelines, and it is stated that the practice followed by the IRD will generally not differ from the<br />

<strong>transfer</strong> <strong>pricing</strong> methodologies recommended by the OECD Guidelines.<br />

Priorities/<strong>pricing</strong> methods<br />

The IRD recognizes the methods outlined in the OECD Guidelines, which include the traditional transaction methods (CUP, Resale Price<br />

and cost plus) and profit methods (Profit Split and TNMM). The use of other methods is also allowed to the extent the OECD-recognized<br />

methods are not applicable. The process of selecting a method should be aimed at finding the most appropriate method. Although the<br />

traditional transaction methods may be preferred by the IRD, as they are seen to be the most direct means of establishing the arm’s<br />

length price, the TNMM is accepted as an appropriate method in circumstances where traditional transaction data is not available,<br />

comparable or reliable.<br />

Transfer <strong>pricing</strong> penalties<br />

The IRO does not impute penalties targeted specifically at <strong>transfer</strong> <strong>pricing</strong>, and there are no provisions for applying penalties for a lack<br />

of <strong>transfer</strong> <strong>pricing</strong> documentation by itself. However, the IRD is empowered to take punitive action under Section 80(1), 80(1A), 80(2),<br />

82, and 82A of the IRO, for non-compliance with the requirements of the IRO. Offences can include any person who without a reasonable<br />

cause or with willful intent to evade tax: fails to comply with record-keeping requirements of Section 51(C) of the IRO; files an incorrect<br />

tax return; furnishes any incorrect information; fails to furnish a return in time; fails to inform chargeability to tax; makes any false<br />

statement in connection with a claim for any deduction of allowance; gives any false answer to any question or request for information<br />

asked or made in accordance with the provisions of IRO; makes use of any fraud, art, or contrivance to evade tax, among others.<br />

Offenses can be subject to a fine of HKD10,000, plus up to three times the amount of tax undercharged. In the case of willful<br />

intent, the taxpayer can be subjected to a fine of HKD50,000, plus up to three times the amount of tax undercharged and three<br />

years of imprisonment.<br />

Penalty relief<br />

The scale of penalty to be imposed on a taxpayer in Hong Kong is determined based on the nature of the omission, quantum of<br />

understatement of income or profits, scale of the business, the degree of the taxpayer’s cooperation or disclosure, and the length of<br />

offence period. Penalties can be scaled upwards or downwards based on such facts of the case.<br />

<strong>Worldwide</strong> <strong>transfer</strong> <strong>pricing</strong> <strong>reference</strong> <strong>guide</strong><br />

131