CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

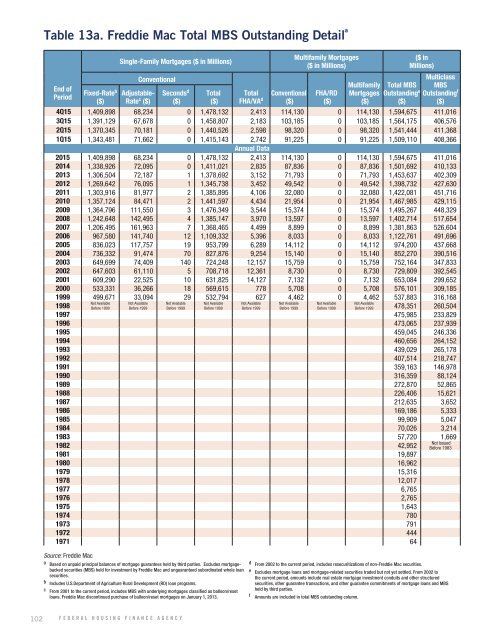

Table 13a. Freddie Mac Total MBS Outstanding Detail a<br />

End of<br />

Period<br />

Fixed-Rate b<br />

($)<br />

Single-Family Mortgages ($ in Millions)<br />

Adjustable-<br />

Rate c ($)<br />

Conventional<br />

Seconds d<br />

($)<br />

Total<br />

($)<br />

Total<br />

FHA/VA d<br />

Conventional<br />

($)<br />

Multifamily Mortgages<br />

($ in Millions)<br />

FHA/RD<br />

($)<br />

Multifamily<br />

Mortgages<br />

($)<br />

($ in<br />

Millions)<br />

Total MBS<br />

Outstanding e<br />

($)<br />

Multiclass<br />

MBS<br />

Outstanding f<br />

($)<br />

4Q15 1,409,898 68,234 0 1,478,132 2,413 114,130 0 114,130 1,594,675 411,016<br />

3Q15 1,391,129 67,678 0 1,458,807 2,183 103,185 0 103,185 1,564,175 406,576<br />

2Q15 1,370,345 70,181 0 1,440,526 2,598 98,320 0 98,320 1,541,444 411,368<br />

1Q15 1,343,481 71,662 0 1,415,143 2,742 91,225 0 91,225 1,509,110 408,366<br />

Annual Data<br />

2015 1,409,898 68,234 0 1,478,132 2,413 114,130 0 114,130 1,594,675 411,016<br />

2014 1,338,926 72,095 0 1,411,021 2,835 87,836 0 87,836 1,501,692 410,133<br />

2013 1,306,504 72,187 1 1,378,692 3,152 71,793 0 71,793 1,453,637 402,309<br />

2012 1,269,642 76,095 1 1,345,738 3,452 49,542 0 49,542 1,398,732 427,630<br />

2011 1,303,916 81,977 2 1,385,895 4,106 32,080 0 32,080 1,422,081 451,716<br />

2010 1,357,124 84,471 2 1,441,597 4,434 21,954 0 21,954 1,467,985 429,115<br />

2009 1,364,796 111,550 3 1,476,349 3,544 15,374 0 15,374 1,495,267 448,329<br />

2008 1,242,648 142,495 4 1,385,147 3,970 13,597 0 13,597 1,402,714 517,654<br />

2007 1,206,495 161,963 7 1,368,465 4,499 8,899 0 8,899 1,381,863 526,604<br />

2006 967,580 141,740 12 1,109,332 5,396 8,033 0 8,033 1,122,761 491,696<br />

2005 836,023 117,757 19 953,799 6,289 14,112 0 14,112 974,200 437,668<br />

2004 736,332 91,474 70 827,876 9,254 15,140 0 15,140 852,270 390,516<br />

2003 649,699 74,409 140 724,248 12,157 15,759 0 15,759 752,164 347,833<br />

2002 647,603 61,110 5 708,718 12,361 8,730 0 8,730 729,809 392,545<br />

2001 609,290 22,525 10 631,825 14,127 7,132 0 7,132 653,084 299,652<br />

2000 533,331 36,266 18 569,615 778 5,708 0 5,708 576,101 309,185<br />

1999 499,671 33,094 29 532,794 627 4,462 0 4,462 537,883 316,168<br />

Not Available Not Available Not Available Not Available Not Available Not Available Not Available Not Available<br />

1998<br />

Before 1999 Before 1999 Before 1999 Before 1999 Before 1999 Before 1999 Before 1999 Before 1999 478,351 260,504<br />

1997 475,985 233,829<br />

1996 473,065 237,939<br />

1995 459,045 246,336<br />

1994 460,656 264,152<br />

1993 439,029 265,178<br />

1992 407,514 218,747<br />

1991 359,163 146,978<br />

1990 316,359 88,124<br />

1989 272,870 52,865<br />

1988 226,406 15,621<br />

1987 212,635 3,652<br />

1986 169,186 5,333<br />

1985 99,909 5,047<br />

1984 70,026 3,214<br />

1983 57,720 1,669<br />

1982 42,952<br />

Not Issued<br />

Before 1983<br />

1981 19,897<br />

1980 16,962<br />

1979 15,316<br />

1978 12,017<br />

1977 6,765<br />

1976 2,765<br />

1975 1,643<br />

1974 780<br />

1973 791<br />

1972 444<br />

1971 64<br />

Source: Freddie Mac<br />

a Based on unpaid principal balances of mortgage guarantees held by third parties. Excludes mortgagebacked<br />

securities (MBS) held for investment by Freddie Mac and unguaranteed subordinated whole loan<br />

securities.<br />

b Includes U.S.Department of Agriculture Rural Development (RD) loan programs.<br />

c From 2001 to the current period, includes MBS with underlying mortgages classified as balloon/reset<br />

loans. Freddie Mac discontinued purchase of balloon/reset mortgages on January 1, 2013.<br />

d From 2002 to the current period, includes resecuritizations of non-Freddie Mac securities.<br />

e Excludes mortgage loans and mortgage-related securities traded but not yet settled. From 2002 to<br />

the current period, amounts include real estate mortgage investment conduits and other structured<br />

securities, other guarantee transactions, and other guarantee commitments of mortgage loans and MBS<br />

held by third parties.<br />

f Amounts are included in total MBS outstanding column.<br />

102 FEDERAL HOUSING FINANCE AGENCY