CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUPERVISION AND OVERSIGHT<br />

2015 Regulatory Capital Ratio<br />

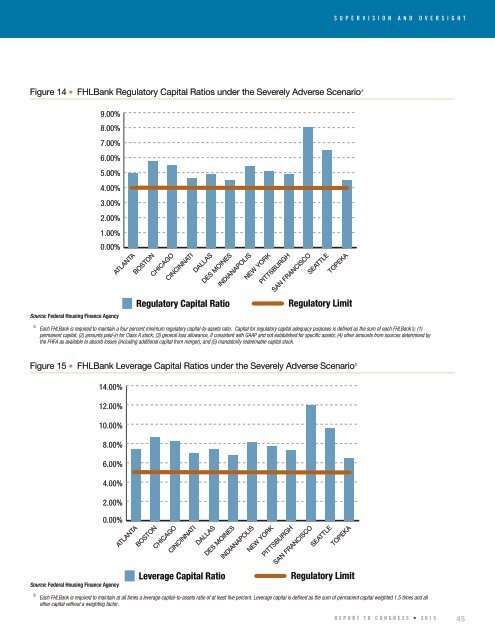

Figure 14 • FHLBank Regulatory Capital Ratios under the Severely Adverse Scenario a<br />

9.00%<br />

8.00%<br />

7.00%<br />

6.00%<br />

5.00%<br />

4.00%<br />

3.00%<br />

2.00%<br />

1.00%<br />

0.00%<br />

Source: Federal Housing Finance Agency<br />

ATLANTA<br />

BOSTON<br />

CHICAGO<br />

CINCINNATI<br />

DALLAS<br />

DES MOINES<br />

INDIANAPOLIS<br />

NEW YORK<br />

PITTSBURGH<br />

SAN FRANCISCO<br />

SEATTLE<br />

TOPEKA<br />

Regulatory Capital Ratio<br />

Regulatory Limit<br />

2015 Leverage Capital Ratio<br />

a<br />

Each FHLBank is required to maintain a four percent minimum regulatory capital-to-assets ratio. Capital for regulatory capital adequacy purposes is defined as the sum of each FHLBank’s: (1)<br />

permanent capital; (2) amounts paid-in for Class A stock; (3) general loss allowance, if consistent with GAAP and not established for specific assets; (4) other amounts from sources determined by<br />

the FHFA as available to absorb losses (including additional capital from merger); and (5) mandatorily redeemable capital stock.<br />

Figure 15 • FHLBank Leverage Capital Ratios under the Severely Adverse Scenario b<br />

14.00%<br />

12.00%<br />

10.00%<br />

8.00%<br />

6.00%<br />

4.00%<br />

2.00%<br />

0.00%<br />

Source: Federal Housing Finance Agency<br />

ATLANTA<br />

BOSTON<br />

CHICAGO<br />

CINCINNATI<br />

Leverage Capital Ratio<br />

DALLAS<br />

DES MOINES<br />

INDIANAPOLIS<br />

NEW YORK<br />

PITTSBURGH<br />

SAN FRANCISCO<br />

SEATTLE<br />

TOPEKA<br />

Regulatory Limit<br />

b<br />

Each FHLBank is required to maintain at all times a leverage capital-to-assets ratio of at least five percent. Leverage capital is defined as the sum of permanent capital weighted 1.5 times and all<br />

other capital without a weighting factor.<br />

REPORT TO <strong>CONGRESS</strong> • 2015<br />

45