CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

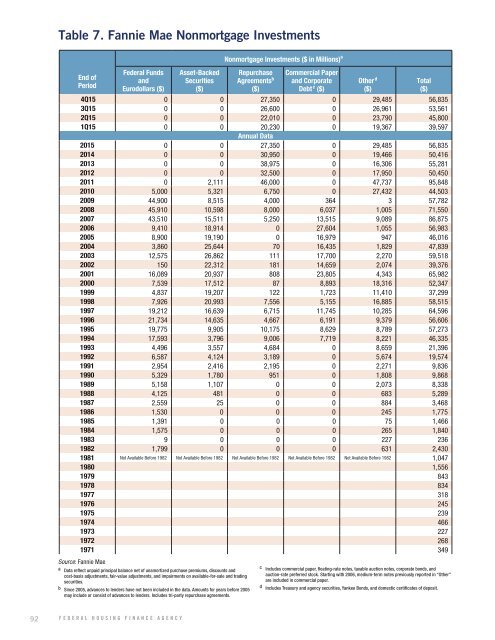

Table 7. Fannie Mae Nonmortgage Investments<br />

End of<br />

Period<br />

Federal Funds<br />

and<br />

Eurodollars ($)<br />

Asset-Backed<br />

Securities<br />

($)<br />

Nonmortgage Investments ($ in Millions) a<br />

Repurchase<br />

Agreements b<br />

($)<br />

Commercial Paper<br />

and Corporate<br />

Debt c ($)<br />

Other d<br />

($)<br />

4Q15 0 0 27,350 0 29,485 56,835<br />

3Q15 0 0 26,600 0 26,961 53,561<br />

2Q15 0 0 22,010 0 23,790 45,800<br />

1Q15 0 0 20,230 0 19,367 39,597<br />

Annual Data<br />

2015 0 0 27,350 0 29,485 56,835<br />

2014 0 0 30,950 0 19,466 50,416<br />

2013 0 0 38,975 0 16,306 55,281<br />

2012 0 0 32,500 0 17,950 50,450<br />

2011 0 2,111 46,000 0 47,737 95,848<br />

2010 5,000 5,321 6,750 0 27,432 44,503<br />

2009 44,900 8,515 4,000 364 3 57,782<br />

2008 45,910 10,598 8,000 6,037 1,005 71,550<br />

2007 43,510 15,511 5,250 13,515 9,089 86,875<br />

2006 9,410 18,914 0 27,604 1,055 56,983<br />

2005 8,900 19,190 0 16,979 947 46,016<br />

2004 3,860 25,644 70 16,435 1,829 47,839<br />

2003 12,575 26,862 111 17,700 2,270 59,518<br />

2002 150 22,312 181 14,659 2,074 39,376<br />

2001 16,089 20,937 808 23,805 4,343 65,982<br />

2000 7,539 17,512 87 8,893 18,316 52,347<br />

1999 4,837 19,207 122 1,723 11,410 37,299<br />

1998 7,926 20,993 7,556 5,155 16,885 58,515<br />

1997 19,212 16,639 6,715 11,745 10,285 64,596<br />

1996 21,734 14,635 4,667 6,191 9,379 56,606<br />

1995 19,775 9,905 10,175 8,629 8,789 57,273<br />

1994 17,593 3,796 9,006 7,719 8,221 46,335<br />

1993 4,496 3,557 4,684 0 8,659 21,396<br />

1992 6,587 4,124 3,189 0 5,674 19,574<br />

1991 2,954 2,416 2,195 0 2,271 9,836<br />

1990 5,329 1,780 951 0 1,808 9,868<br />

1989 5,158 1,107 0 0 2,073 8,338<br />

1988 4,125 481 0 0 683 5,289<br />

1987 2,559 25 0 0 884 3,468<br />

1986 1,530 0 0 0 245 1,775<br />

1985 1,391 0 0 0 75 1,466<br />

1984 1,575 0 0 0 265 1,840<br />

1983 9 0 0 0 227 236<br />

1982 1,799 0 0 0 631 2,430<br />

1981 Not Available Before 1982 Not Available Before 1982 Not Available Before 1982 Not Available Before 1982 Not Available Before 1982 1,047<br />

1980 1,556<br />

1979 843<br />

1978 834<br />

1977 318<br />

1976 245<br />

1975 239<br />

1974 466<br />

1973 227<br />

1972 268<br />

1971 349<br />

Total<br />

($)<br />

Source: Fannie Mae<br />

a Data reflect unpaid principal balance net of unamortized purchase premiums, discounts and<br />

cost-basis adjustments, fair-value adjustments, and impairments on available-for-sale and trading<br />

securities.<br />

b Since 2005, advances to lenders have not been included in the data. Amounts for years before 2005<br />

may include or consist of advances to lenders. Includes tri-party repurchase agreements.<br />

c Includes commercial paper, floating-rate notes, taxable auction notes, corporate bonds, and<br />

auction-rate preferred stock. Starting with 2006, medium-term notes previously reported in “Other”<br />

are included in commercial paper.<br />

d Includes Treasury and agency securities, Yankee Bonds, and domestic certificates of deposit.<br />

92 FEDERAL HOUSING FINANCE AGENCY