CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

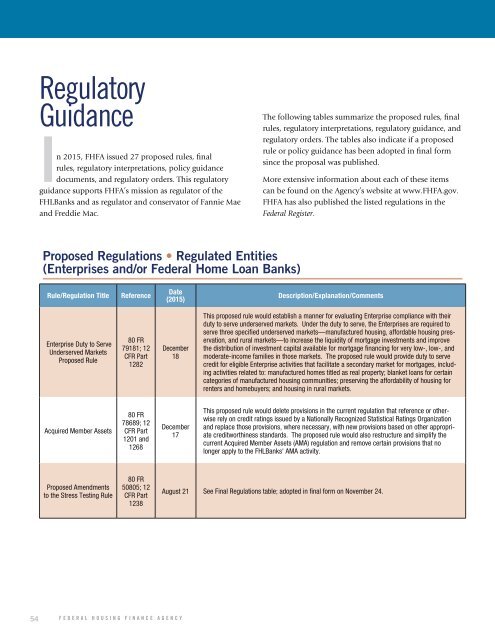

Regulatory<br />

Guidance<br />

In 2015, FHFA issued 27 proposed rules, final<br />

rules, regulatory interpretations, policy guidance<br />

documents, and regulatory orders. This regulatory<br />

guidance supports FHFA’s mission as regulator of the<br />

FHLBanks and as regulator and conservator of Fannie Mae<br />

and Freddie Mac.<br />

The following tables summarize the proposed rules, final<br />

rules, regulatory interpretations, regulatory guidance, and<br />

regulatory orders. The tables also indicate if a proposed<br />

rule or policy guidance has been adopted in final form<br />

since the proposal was published.<br />

More extensive information about each of these items<br />

can be found on the Agency’s website at www.FHFA.gov.<br />

FHFA has also published the listed regulations in the<br />

Federal Register.<br />

Proposed Regulations • Regulated Entities<br />

(Enterprises and/or Federal Home Loan Banks)<br />

Rule/Regulation Title<br />

Reference<br />

Date<br />

(2015)<br />

Description/Explanation/Comments<br />

Enterprise Duty to Serve<br />

Underserved Markets<br />

Proposed Rule<br />

80 FR<br />

79181; 12<br />

CFR Part<br />

1282<br />

December<br />

18<br />

This proposed rule would establish a manner for evaluating Enterprise compliance with their<br />

duty to serve underserved markets. Under the duty to serve, the Enterprises are required to<br />

serve three specified underserved markets—manufactured housing, affordable housing preservation,<br />

and rural markets—to increase the liquidity of mortgage investments and improve<br />

the distribution of investment capital available for mortgage financing for very low-, low-, and<br />

moderate-income families in those markets. The proposed rule would provide duty to serve<br />

credit for eligible Enterprise activities that facilitate a secondary market for mortgages, including<br />

activities related to: manufactured homes titled as real property; blanket loans for certain<br />

categories of manufactured housing communities; preserving the affordability of housing for<br />

renters and homebuyers; and housing in rural markets.<br />

Acquired Member Assets<br />

80 FR<br />

78689; 12<br />

CFR Part<br />

1201 and<br />

1268<br />

December<br />

17<br />

This proposed rule would delete provisions in the current regulation that reference or otherwise<br />

rely on credit ratings issued by a Nationally Recognized Statistical Ratings Organization<br />

and replace those provisions, where necessary, with new provisions based on other appropriate<br />

creditworthiness standards. The proposed rule would also restructure and simplify the<br />

current Acquired Member Assets (AMA) regulation and remove certain provisions that no<br />

longer apply to the FHLBanks' AMA activity.<br />

Proposed Amendments<br />

to the Stress Testing Rule<br />

80 FR<br />

50805; 12<br />

CFR Part<br />

1238<br />

August 21 See Final Regulations table; adopted in final form on November 24.<br />

54 FEDERAL HOUSING FINANCE AGENCY