CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

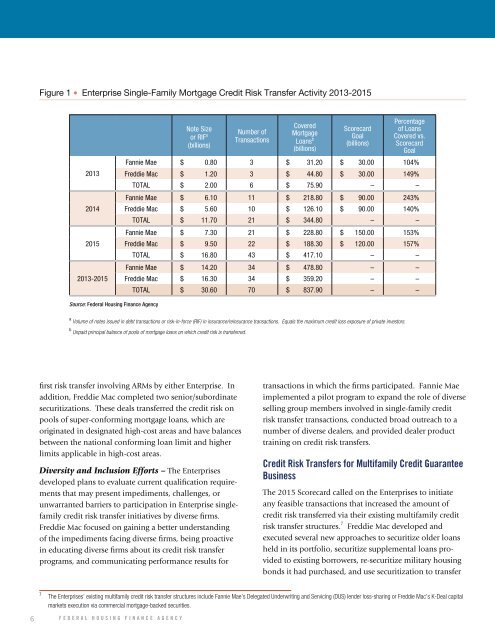

Figure 1 • Enterprise Single-Family Mortgage Credit Risk Transfer Activity 2013-2015<br />

2013<br />

2014<br />

2015<br />

2013-2015<br />

Note Size<br />

or RIF a<br />

(billions)<br />

Number of<br />

Transactions<br />

Covered<br />

Mortgage<br />

Loans b<br />

(billions)<br />

Scorecard<br />

Goal<br />

(billions)<br />

Percentage<br />

of Loans<br />

Covered vs.<br />

Scorecard<br />

Goal<br />

Fannie Mae $ 0.80 3 $ 31.20 $ 30.00 104%<br />

Freddie Mac $ 1.20 3 $ 44.80 $ 30.00 149%<br />

TOTAL $ 2.00 6 $ 75.90 – –<br />

Fannie Mae $ 6.10 11 $ 218.80 $ 90.00 243%<br />

Freddie Mac $ 5.60 10 $ 126.10 $ 90.00 140%<br />

TOTAL $ 11.70 21 $ 344.80 – –<br />

Fannie Mae $ 7.30 21 $ 228.80 $ 150.00 153%<br />

Freddie Mac $ 9.50 22 $ 188.30 $ 120.00 157%<br />

TOTAL $ 16.80 43 $ 417.10 – –<br />

Fannie Mae $ 14.20 34 $ 478.80 – –<br />

Freddie Mac $ 16.30 34 $ 359.20 – –<br />

TOTAL $ 30.60 70 $ 837.90 – –<br />

Source: Federal Housing Finance Agency<br />

a Volume of notes issued in debt transactions or risk-in-force (RIF) in insurance/reinsurance transactions. Equals the maximum credit loss exposure of private investors.<br />

b Unpaid principal balance of pools of mortgage loans on which credit risk is transferred.<br />

first risk transfer involving ARMs by either Enterprise. In<br />

addition, Freddie Mac completed two senior/subordinate<br />

securitizations. These deals transferred the credit risk on<br />

pools of super-conforming mortgage loans, which are<br />

originated in designated high-cost areas and have balances<br />

between the national conforming loan limit and higher<br />

limits applicable in high-cost areas.<br />

Diversity and Inclusion Efforts – The Enterprises<br />

developed plans to evaluate current qualification requirements<br />

that may present impediments, challenges, or<br />

unwarranted barriers to participation in Enterprise singlefamily<br />

credit risk transfer initiatives by diverse firms.<br />

Freddie Mac focused on gaining a better understanding<br />

of the impediments facing diverse firms, being proactive<br />

in educating diverse firms about its credit risk transfer<br />

programs, and communicating performance results for<br />

transactions in which the firms participated. Fannie Mae<br />

implemented a pilot program to expand the role of diverse<br />

selling group members involved in single-family credit<br />

risk transfer transactions, conducted broad outreach to a<br />

number of diverse dealers, and provided dealer product<br />

training on credit risk transfers.<br />

Credit Risk Transfers for Multifamily Credit Guarantee<br />

Business<br />

The 2015 Scorecard called on the Enterprises to initiate<br />

any feasible transactions that increased the amount of<br />

credit risk transferred via their existing multifamily credit<br />

risk transfer structures. 7<br />

Freddie Mac developed and<br />

executed several new approaches to securitize older loans<br />

held in its portfolio, securitize supplemental loans provided<br />

to existing borrowers, re-securitize military housing<br />

bonds it had purchased, and use securitization to transfer<br />

7<br />

The Enterprises’ existing multifamily credit risk transfer structures include Fannie Mae’s Delegated Underwriting and Servicing (DUS) lender loss-sharing or Freddie Mac’s K-Deal capital<br />

markets execution via commercial mortgage-backed securities.<br />

6 FEDERAL HOUSING FINANCE AGENCY