CONGRESS

FHFA_2015_Report-to-Congress

FHFA_2015_Report-to-Congress

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2015 Retained Earnings of the Federal Home Loan Banks<br />

Figure 6 • Retained Earnings of the Federal Home Loan Banks<br />

$16<br />

2.00%<br />

$14<br />

1.75%<br />

$12<br />

1.50%<br />

$ Billions<br />

$10<br />

$8<br />

$6<br />

1.25%<br />

1.00%<br />

0.75%<br />

Percent of Assets<br />

$4<br />

0.50%<br />

$2<br />

0.25%<br />

$0<br />

Q1 2001<br />

Q4 2001<br />

Q4 2002<br />

Q4 2003<br />

Q4 2004<br />

Q3 2005<br />

Q2 2006<br />

Q1 2007<br />

Q3 2008<br />

Q2 2009<br />

Q4 2010<br />

Q4 2011<br />

Q4 2012<br />

Q4 2013<br />

Q4 2014<br />

Q4 2015<br />

0.00%<br />

Retained Earnings (left)<br />

Retained Earnings to Assets (right)<br />

Source: Federal Housing Finance Agency<br />

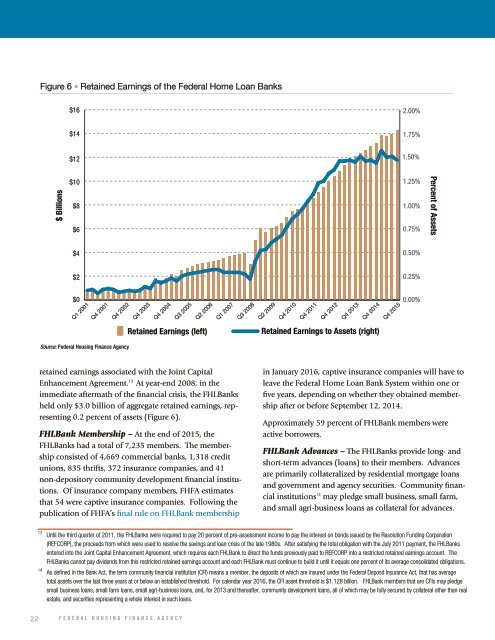

retained earnings associated with the Joint Capital<br />

Enhancement Agreement. 13 At year-end 2008, in the<br />

immediate aftermath of the financial crisis, the FHLBanks<br />

held only $3.0 billion of aggregate retained earnings, representing<br />

0.2 percent of assets (Figure 6).<br />

FHLBank Membership – At the end of 2015, the<br />

FHLBanks had a total of 7,235 members. The membership<br />

consisted of 4,669 commercial banks, 1,318 credit<br />

unions, 835 thrifts, 372 insurance companies, and 41<br />

non-depository community development financial institutions.<br />

Of insurance company members, FHFA estimates<br />

that 54 were captive insurance companies. Following the<br />

publication of FHFA’s final rule on FHLBank membership<br />

in January 2016, captive insurance companies will have to<br />

leave the Federal Home Loan Bank System within one or<br />

five years, depending on whether they obtained membership<br />

after or before September 12, 2014.<br />

Approximately 59 percent of FHLBank members were<br />

active borrowers.<br />

FHLBank Advances – The FHLBanks provide long- and<br />

short-term advances (loans) to their members. Advances<br />

are primarily collateralized by residential mortgage loans<br />

and government and agency securities. Community financial<br />

institutions 14 may pledge small business, small farm,<br />

and small agri-business loans as collateral for advances.<br />

13<br />

14<br />

Until the third quarter of 2011, the FHLBanks were required to pay 20 percent of pre-assessment income to pay the interest on bonds issued by the Resolution Funding Corporation<br />

(REFCORP), the proceeds from which were used to resolve the savings and loan crisis of the late 1980s. After satisfying the total obligation with the July 2011 payment, the FHLBanks<br />

entered into the Joint Capital Enhancement Agreement, which requires each FHLBank to direct the funds previously paid to REFCORP into a restricted retained earnings account. The<br />

FHLBanks cannot pay dividends from this restricted retained earnings account and each FHLBank must continue to build it until it equals one percent of its average consolidated obligations.<br />

As defined in the Bank Act, the term community financial institution (CFI) means a member, the deposits of which are insured under the Federal Deposit Insurance Act, that has average<br />

total assets over the last three years at or below an established threshold. For calendar year 2016, the CFI asset threshold is $1.128 billion. FHLBank members that are CFIs may pledge<br />

small business loans, small farm loans, small agri-business loans, and, for 2013 and thereafter, community development loans, all of which may be fully secured by collateral other than real<br />

estate, and securities representing a whole interest in such loans.<br />

22 FEDERAL HOUSING FINANCE AGENCY