URBANIZATION AND INDUSTRIALIZATION

Economic%20Report%20on%20Africa%202017%20UNECA

Economic%20Report%20on%20Africa%202017%20UNECA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

188<br />

ECONOMIC REPORT ON AFRICA 2017<br />

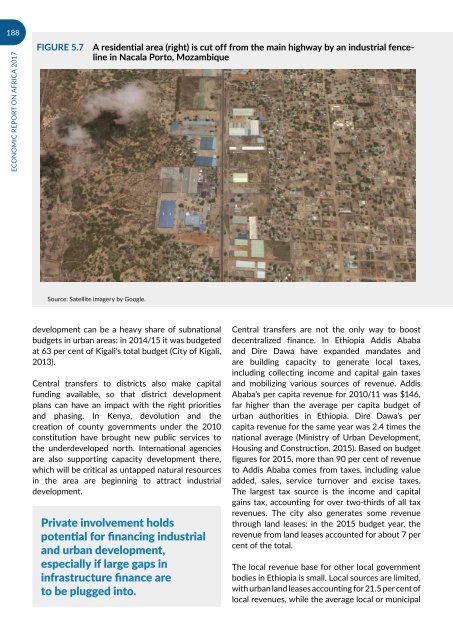

Figure 5.7<br />

A residential area (right) is cut off from the main highway by an industrial fenceline<br />

in Nacala Porto, Mozambique<br />

Source: Satellite imagery by Google.<br />

development can be a heavy share of subnational<br />

budgets in urban areas: in 2014/15 it was budgeted<br />

at 63 per cent of Kigali’s total budget (City of Kigali,<br />

2013).<br />

Central transfers to districts also make capital<br />

funding available, so that district development<br />

plans can have an impact with the right priorities<br />

and phasing. In Kenya, devolution and the<br />

creation of county governments under the 2010<br />

constitution have brought new public services to<br />

the underdeveloped north. International agencies<br />

are also supporting capacity development there,<br />

which will be critical as untapped natural resources<br />

in the area are beginning to attract industrial<br />

development.<br />

Private involvement holds<br />

potential for financing industrial<br />

and urban development,<br />

especially if large gaps in<br />

infrastructure finance are<br />

to be plugged into.<br />

Central transfers are not the only way to boost<br />

decentralized finance. In Ethiopia Addis Ababa<br />

and Dire Dawa have expanded mandates and<br />

are building capacity to generate local taxes,<br />

including collecting income and capital gain taxes<br />

and mobilizing various sources of revenue. Addis<br />

Ababa’s per capita revenue for 2010/11 was $146,<br />

far higher than the average per capita budget of<br />

urban authorities in Ethiopia. Dire Dawa’s per<br />

capita revenue for the same year was 2.4 times the<br />

national average (Ministry of Urban Development,<br />

Housing and Construction, 2015). Based on budget<br />

figures for 2015, more than 90 per cent of revenue<br />

to Addis Ababa comes from taxes, including value<br />

added, sales, service turnover and excise taxes.<br />

The largest tax source is the income and capital<br />

gains tax, accounting for over two-thirds of all tax<br />

revenues. The city also generates some revenue<br />

through land leases: in the 2015 budget year, the<br />

revenue from land leases accounted for about 7 per<br />

cent of the total.<br />

The local revenue base for other local government<br />

bodies in Ethiopia is small. Local sources are limited,<br />

with urban land leases accounting for 21.5 per cent of<br />

local revenues, while the average local or municipal