URBANIZATION AND INDUSTRIALIZATION

Economic%20Report%20on%20Africa%202017%20UNECA

Economic%20Report%20on%20Africa%202017%20UNECA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AFRICA’S CURRENT ACCOUNT<br />

DEFICIT REMAINED STABLE<br />

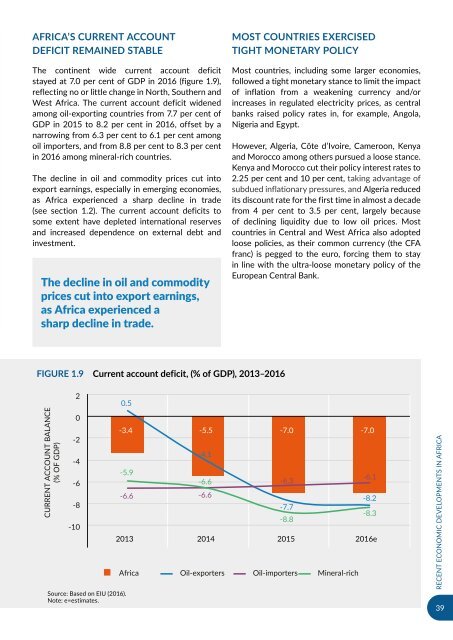

The continent wide current account deficit<br />

stayed at 7.0 per cent of GDP in 2016 (figure 1.9),<br />

reflecting no or little change in North, Southern and<br />

West Africa. The current account deficit widened<br />

among oil-exporting countries from 7.7 per cent of<br />

GDP in 2015 to 8.2 per cent in 2016, offset by a<br />

narrowing from 6.3 per cent to 6.1 per cent among<br />

oil importers, and from 8.8 per cent to 8.3 per cent<br />

in 2016 among mineral-rich countries.<br />

The decline in oil and commodity prices cut into<br />

export earnings, especially in emerging economies,<br />

as Africa experienced a sharp decline in trade<br />

(see section 1.2). The current account deficits to<br />

some extent have depleted international reserves<br />

and increased dependence on external debt and<br />

investment.<br />

The decline in oil and commodity<br />

prices cut into export earnings,<br />

as Africa experienced a<br />

sharp decline in trade.<br />

MOST COUNTRIES EXERCISED<br />

TIGHT MONETARY POLICY<br />

Most countries, including some larger economies,<br />

followed a tight monetary stance to limit the impact<br />

of inflation from a weakening currency and/or<br />

increases in regulated electricity prices, as central<br />

banks raised policy rates in, for example, Angola,<br />

Nigeria and Egypt.<br />

However, Algeria, Côte d’Ivoire, Cameroon, Kenya<br />

and Morocco among others pursued a loose stance.<br />

Kenya and Morocco cut their policy interest rates to<br />

2.25 per cent and 10 per cent, taking advantage of<br />

subdued inflationary pressures, and Algeria reduced<br />

its discount rate for the first time in almost a decade<br />

from 4 per cent to 3.5 per cent, largely because<br />

of declining liquidity due to low oil prices. Most<br />

countries in Central and West Africa also adopted<br />

loose policies, as their common currency (the CFA<br />

franc) is pegged to the euro, forcing them to stay<br />

in line with the ultra-loose monetary policy of the<br />

European Central Bank.<br />

Figure 1.9 Current account deficit, (% of GDP), 2013–2016<br />

CURRENT ACCOUNT BALANCE<br />

(% OF GDP)<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

Source: Based on EIU (2016).<br />

Note: e=estimates.<br />

0.5<br />

-3.4 -5.5 -7.0 -7.0<br />

-5.9<br />

-6.6<br />

-4.1<br />

-6.6 -6.3<br />

-6.6<br />

-7.7<br />

-8.8<br />

-6.1<br />

-8.2<br />

-8.3<br />

2013 2014 2015 2016e<br />

Africa Oil-exporters Oil-importers Mineral-rich<br />

RECENT ECONOMIC DEVELOPMENTS IN AFRICA<br />

39