Aliging Profit with Purpose - Global Goals Yearbook 2019

What are companies for? The rules for companies have changed. The focus is increasingly on their sustainable, social, and ecological impacts. The strategic orientation toward the so-called corporate purpose is decisive for profitable growth in the future. This currently results in a large number of questions for businesses: How do you find an inspiring and future-oriented corporate purpose, and how can it be aligned in such a way that it brings profitable growth and social responsibility in concert? The new 2019 edition of the Global Goals Yearbook offers answers to these crucial questions thanks to its consistent orientation toward the UN Sustainable Development Goals and a competent editorial board and author pool.

What are companies for? The rules for companies have changed. The focus is increasingly on their sustainable, social, and ecological impacts. The strategic orientation toward the so-called corporate purpose is decisive for profitable growth in the future.

This currently results in a large number of questions for businesses: How do you find an inspiring and future-oriented corporate purpose, and how can it be aligned in such a way that it brings profitable growth and social responsibility in concert? The new 2019 edition of the Global Goals Yearbook offers answers to these crucial questions thanks to its consistent orientation toward the UN Sustainable Development Goals and a competent editorial board and author pool.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

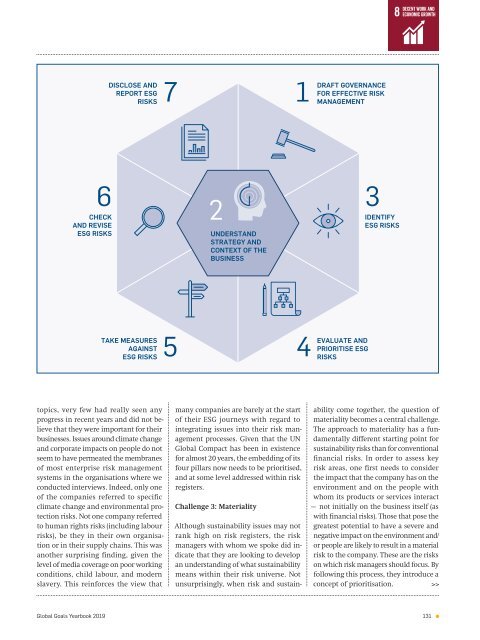

DISCLOSE AND<br />

REPORT ESG<br />

RISKS<br />

7<br />

1<br />

DRAFT GOVERNANCE<br />

FOR EFFECTIVE RISK<br />

MANAGEMENT<br />

6<br />

CHECK<br />

AND REVISE<br />

ESG RISKS<br />

2<br />

UNDERSTAND<br />

STRATEGY AND<br />

CONTEXT OF THE<br />

BUSINESS<br />

3<br />

IDENTIFY<br />

ESG RISKS<br />

TAKE MEASURES<br />

AGAINST<br />

ESG RISKS<br />

5<br />

4<br />

EVALUATE AND<br />

PRIORITISE ESG<br />

RISKS<br />

topics, very few had really seen any<br />

progress in recent years and did not believe<br />

that they were important for their<br />

businesses. Issues around climate change<br />

and corporate impacts on people do not<br />

seem to have permeated the membranes<br />

of most enterprise risk management<br />

systems in the organisations where we<br />

conducted interviews. Indeed, only one<br />

of the companies referred to specific<br />

climate change and environmental protection<br />

risks. Not one company referred<br />

to human rights risks (including labour<br />

risks), be they in their own organisation<br />

or in their supply chains. This was<br />

another surprising finding, given the<br />

level of media coverage on poor working<br />

conditions, child labour, and modern<br />

slavery. This reinforces the view that<br />

many companies are barely at the start<br />

of their ESG journeys <strong>with</strong> regard to<br />

integrating issues into their risk management<br />

processes. Given that the UN<br />

<strong>Global</strong> Compact has been in existence<br />

for almost 20 years, the embedding of its<br />

four pillars now needs to be prioritised,<br />

and at some level addressed <strong>with</strong>in risk<br />

registers.<br />

Challenge 3: Materiality<br />

Although sustainability issues may not<br />

rank high on risk registers, the risk<br />

managers <strong>with</strong> whom we spoke did indicate<br />

that they are looking to develop<br />

an understanding of what sustainability<br />

means <strong>with</strong>in their risk universe. Not<br />

unsurprisingly, when risk and sustainability<br />

come together, the question of<br />

materiality becomes a central challenge.<br />

The approach to materiality has a fundamentally<br />

different starting point for<br />

sustainability risks than for conventional<br />

financial risks. In order to assess key<br />

risk areas, one first needs to consider<br />

the impact that the company has on the<br />

environment and on the people <strong>with</strong><br />

whom its products or services interact<br />

– not initially on the business itself (as<br />

<strong>with</strong> financial risks). Those that pose the<br />

greatest potential to have a severe and<br />

negative impact on the environment and/<br />

or people are likely to result in a material<br />

risk to the company. These are the risks<br />

on which risk managers should focus. By<br />

following this process, they introduce a<br />

concept of prioritisation.<br />

>><br />

<strong>Global</strong> <strong>Goals</strong> <strong>Yearbook</strong> <strong>2019</strong> 131