Aliging Profit with Purpose - Global Goals Yearbook 2019

What are companies for? The rules for companies have changed. The focus is increasingly on their sustainable, social, and ecological impacts. The strategic orientation toward the so-called corporate purpose is decisive for profitable growth in the future. This currently results in a large number of questions for businesses: How do you find an inspiring and future-oriented corporate purpose, and how can it be aligned in such a way that it brings profitable growth and social responsibility in concert? The new 2019 edition of the Global Goals Yearbook offers answers to these crucial questions thanks to its consistent orientation toward the UN Sustainable Development Goals and a competent editorial board and author pool.

What are companies for? The rules for companies have changed. The focus is increasingly on their sustainable, social, and ecological impacts. The strategic orientation toward the so-called corporate purpose is decisive for profitable growth in the future.

This currently results in a large number of questions for businesses: How do you find an inspiring and future-oriented corporate purpose, and how can it be aligned in such a way that it brings profitable growth and social responsibility in concert? The new 2019 edition of the Global Goals Yearbook offers answers to these crucial questions thanks to its consistent orientation toward the UN Sustainable Development Goals and a competent editorial board and author pool.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

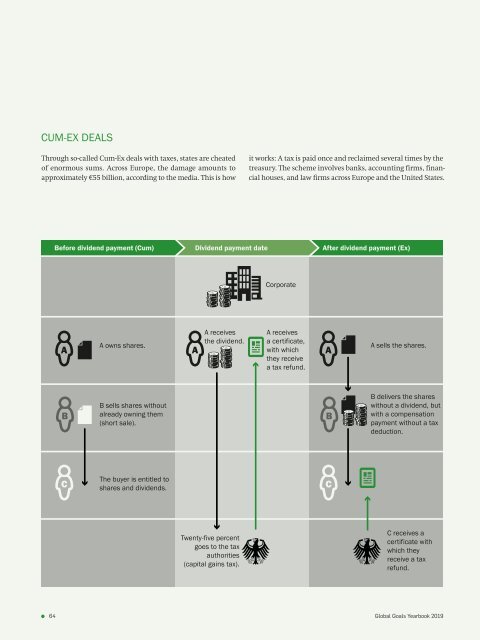

CUM-EX DEALS<br />

Through so-called Cum-Ex deals <strong>with</strong> taxes, states are cheated<br />

of enormous sums. Across Europe, the damage amounts to<br />

approximately €55 billion, according to the media. This is how<br />

it works: A tax is paid once and reclaimed several times by the<br />

treasury. The scheme involves banks, accounting firms, financial<br />

houses, and law firms across Europe and the United States.<br />

Before dividend payment (Cum) Dividend payment date After dividend payment (Ex)<br />

Corporate<br />

A<br />

A owns shares.<br />

A<br />

A receives<br />

the dividend.<br />

A receives<br />

a certificate,<br />

<strong>with</strong> which<br />

they receive<br />

a tax refund.<br />

A<br />

A sells the shares.<br />

B<br />

B sells shares <strong>with</strong>out<br />

already owning them<br />

(short sale).<br />

B<br />

B delivers the shares<br />

<strong>with</strong>out a dividend, but<br />

<strong>with</strong> a compensation<br />

payment <strong>with</strong>out a tax<br />

deduction.<br />

C<br />

The buyer is entitled to<br />

shares and dividends.<br />

C<br />

Twenty-five percent<br />

goes to the tax<br />

authorities<br />

(capital gains tax).<br />

C receives a<br />

certificate <strong>with</strong><br />

which they<br />

receive a tax<br />

refund.<br />

64 <strong>Global</strong> <strong>Goals</strong> <strong>Yearbook</strong> <strong>2019</strong>