Emerging Business Models in the Pharmaceutical Industries ...

Emerging Business Models in the Pharmaceutical Industries ...

Emerging Business Models in the Pharmaceutical Industries ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

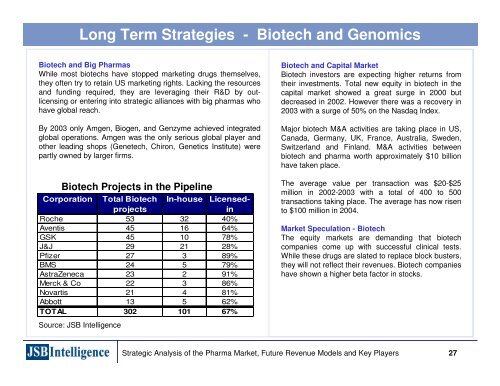

Long Term Strategies - Biotech and Genomics<br />

Biotech and Big Pharmas<br />

While most biotechs have stopped market<strong>in</strong>g drugs <strong>the</strong>mselves,<br />

<strong>the</strong>y often try to reta<strong>in</strong> US market<strong>in</strong>g rights. Lack<strong>in</strong>g <strong>the</strong> resources<br />

and fund<strong>in</strong>g required, <strong>the</strong>y are leverag<strong>in</strong>g <strong>the</strong>ir R&D by outlicens<strong>in</strong>g<br />

or enter<strong>in</strong>g <strong>in</strong>to strategic alliances with big pharmas who<br />

have global reach.<br />

By 2003 only Amgen, Biogen, and Genzyme achieved <strong>in</strong>tegrated<br />

global operations. Amgen was <strong>the</strong> only serious global player and<br />

o<strong>the</strong>r lead<strong>in</strong>g shops (Genetech, Chiron, Genetics Institute) were<br />

partly owned by larger firms.<br />

Biotech Projects <strong>in</strong> <strong>the</strong> Pipel<strong>in</strong>e<br />

Corporation Total Biotech In-house Licensed-<br />

projects<br />

<strong>in</strong><br />

Roche 53 32 40%<br />

Aventis 45 16 64%<br />

GSK 45 10 78%<br />

J&J 29 21 28%<br />

Pfizer 27 3 89%<br />

BMS 24 5 79%<br />

AstraZeneca 23 2 91%<br />

Merck & Co 22 3 86%<br />

Novartis 21 4 81%<br />

Abbott 13 5 62%<br />

TOTAL 302 101 67%<br />

Source: JSB Intelligence<br />

Biotech and Capital Market<br />

Biotech <strong>in</strong>vestors are expect<strong>in</strong>g higher returns from<br />

<strong>the</strong>ir <strong>in</strong>vestments. Total new equity <strong>in</strong> biotech <strong>in</strong> <strong>the</strong><br />

capital market showed a great surge <strong>in</strong> 2000 but<br />

decreased <strong>in</strong> 2002. However <strong>the</strong>re was a recovery <strong>in</strong><br />

2003 with a surge of 50% on <strong>the</strong> Nasdaq Index.<br />

Major biotech M&A activities are tak<strong>in</strong>g place <strong>in</strong> US,<br />

Canada, Germany, UK, France, Australia, Sweden,<br />

Switzerland and F<strong>in</strong>land. M&A activities between<br />

biotech and pharma worth approximately $10 billion<br />

have taken place.<br />

The average value per transaction was $20-$25<br />

million <strong>in</strong> 2002-2003 with a total of 400 to 500<br />

transactions tak<strong>in</strong>g place. The average has now risen<br />

to $100 million <strong>in</strong> 2004.<br />

Market Speculation - Biotech<br />

The equity markets are demand<strong>in</strong>g that biotech<br />

companies come up with successful cl<strong>in</strong>ical tests.<br />

While <strong>the</strong>se drugs are slated to replace block busters,<br />

<strong>the</strong>y will not reflect <strong>the</strong>ir revenues. Biotech companies<br />

have shown a higher beta factor <strong>in</strong> stocks.<br />

Strategic Analysis of <strong>the</strong> Pharma Market, Future Revenue <strong>Models</strong> and Key Players 27