Emerging Business Models in the Pharmaceutical Industries ...

Emerging Business Models in the Pharmaceutical Industries ...

Emerging Business Models in the Pharmaceutical Industries ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

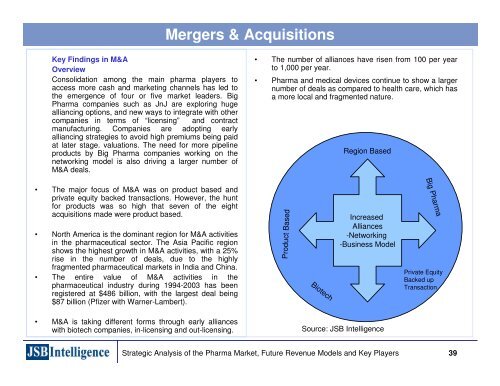

Key F<strong>in</strong>d<strong>in</strong>gs <strong>in</strong> M&A<br />

Overview<br />

Consolidation among <strong>the</strong> ma<strong>in</strong> pharma players to<br />

access more cash and market<strong>in</strong>g channels has led to<br />

<strong>the</strong> emergence of four or five market leaders. Big<br />

Pharma companies such as JnJ are explor<strong>in</strong>g huge<br />

allianc<strong>in</strong>g options, and new ways to <strong>in</strong>tegrate with o<strong>the</strong>r<br />

companies <strong>in</strong> terms of “licens<strong>in</strong>g” and contract<br />

manufactur<strong>in</strong>g. Companies are adopt<strong>in</strong>g early<br />

allianc<strong>in</strong>g strategies to avoid high premiums be<strong>in</strong>g paid<br />

at later stage. valuations. The need for more pipel<strong>in</strong>e<br />

products by Big Pharma companies work<strong>in</strong>g on <strong>the</strong><br />

network<strong>in</strong>g model is also driv<strong>in</strong>g a larger number of<br />

M&A deals.<br />

• The major focus of M&A was on product based and<br />

private equity backed transactions. However, <strong>the</strong> hunt<br />

for products was so high that seven of <strong>the</strong> eight<br />

acquisitions made were product based.<br />

• North America is <strong>the</strong> dom<strong>in</strong>ant region for M&A activities<br />

<strong>in</strong> <strong>the</strong> pharmaceutical sector. The Asia Pacific region<br />

shows <strong>the</strong> highest growth <strong>in</strong> M&A activities, with a 25%<br />

rise <strong>in</strong> <strong>the</strong> number of deals, due to <strong>the</strong> highly<br />

fragmented pharmaceutical markets <strong>in</strong> India and Ch<strong>in</strong>a.<br />

• The entire value of M&A activities <strong>in</strong> <strong>the</strong><br />

pharmaceutical <strong>in</strong>dustry dur<strong>in</strong>g 1994-2003 has been<br />

registered at $486 billion, with <strong>the</strong> largest deal be<strong>in</strong>g<br />

$87 billion (Pfizer with Warner-Lambert).<br />

• M&A is tak<strong>in</strong>g different forms through early alliances<br />

with biotech companies, <strong>in</strong>-licens<strong>in</strong>g and out-licens<strong>in</strong>g.<br />

Mergers & Acquisitions<br />

• The number of alliances have risen from 100 per year<br />

to 1,000 per year.<br />

• Pharma and medical devices cont<strong>in</strong>ue to show a larger<br />

number of deals as compared to health care, which has<br />

a more local and fragmented nature.<br />

Product Based<br />

Biotech<br />

Region Based<br />

Increased<br />

Alliances<br />

M&A<br />

-Network<strong>in</strong>g<br />

-<strong>Bus<strong>in</strong>ess</strong> Model<br />

Source: JSB Intelligence<br />

Strategic Analysis of <strong>the</strong> Pharma Market, Future Revenue <strong>Models</strong> and Key Players 39<br />

Big Pharma<br />

Private Equity<br />

Backed up<br />

Transaction